-

Readers react to states investigating payroll advance companies and the GOP's weak response to cannabis banking, heed a warning that nonbanks are prepared for CECL and more.

August 15 -

Four advocacy groups questioned why the consumer bureau did not ask a judge to lift a stay of the rule's payment provisions.

August 12 -

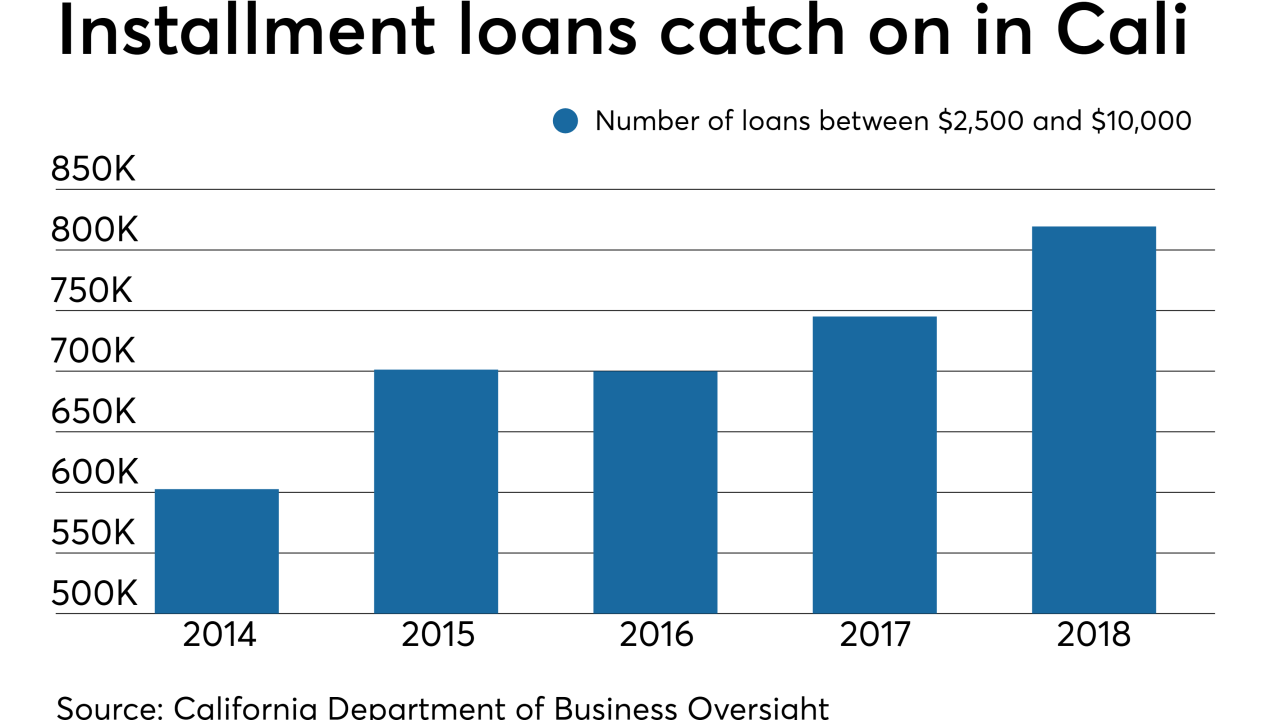

New data from the state shows that payday loans fell to a 12-year low in 2018. But the trend does not necessarily mean that consumers are paying less to borrow.

August 8 -

New York and 10 other states are looking into whether companies in the fast-growing sector are violating payday lending laws.

August 7 -

The legislation, which passed a key test in the state Senate on Wednesday, is the product of a compromise between consumer advocates and some lenders.

June 27 -

Companies that offer early access to earned wages want a regulatory framework for their fast-growing industry. But the bill under consideration in Sacramento is exposing big divisions in the sector.

June 24 -

Readers respond to BB&T-SunTrust's rebranding, consider the future of home equity loans, debate the number of credit unions buying up community banks and more.

June 13 -

The CFPB issued a final rule late Thursday to delay the compliance date for mandatory underwriting provisions of the 2017 payday lending rule.

June 7 -

Critics have knocked the product, which provides workers access to their wages before payday, as another form of predatory lending. But California has a new bill that would create a legal framework for this short-term lending alternative, and policymakers elsewhere should follow the state's lead.

June 3 Nevcaut Ventures

Nevcaut Ventures -

Banks and credit unions “push back” against an FCC proposal to limit calls; Miami gets the next assistant the bank says is not intended to replace humans.

May 30 -

Currently, the maximum a federal credit union can charge on most loans is 18%. But a proposal from Sen. Bernie Sanders and Rep. Alexandria Ocasio-Cortez to lower that to 15% on consumer credit could reduce access, experts said.

May 29 -

Kathy Kraninger, the bureau's director, is in a standoff with Democrats about her claim that the agency cannot supervise institutions under the Military Lending Act.

May 27 -

As part of the deal, the agency summarized its policy on account terminations and issued a letter acknowledging that some employees “acted in a manner inconsistent with FDIC policies with respect to payday lenders.”

May 22 -

A year after trying to save faltering payday lender Wonga, Balderton Capital is investing in the other side of the model by leading a $19 million Series A funding round in Wagestream, a U.K. startup that provides flexible payroll technology to avoid payday loans.

May 20 -

The AGs say the agency's plan to rescind ability-to-repay requirements for payday loans would undermine states' ability to enforce their own laws.

May 17 -

The official told lawmakers Thursday that the research underlying the bureau's 2017 payday rule proposal did not support strict underwriting requirements of small-dollar loans.

May 16 -

Recent letters from NAFCU and CUNA called on the Consumer Financial Protection Bureau to provide a carve out in its payday lending rule for loans made by credit unions.

May 16 -

A bill that would have capped payday loan rates at 36% failed to get through committee, but credit unions have pledged to continue to fight for the legislation.

May 16 -

The bank plans rollout of a global cash management business; the lead Democrat on the Senate Banking Committee “not optimistic” about privatization.

May 14 -

Readers respond to JPMorgan's Twitter gaffe, weigh the role banks should play on issues like climate change, consider the impact of artificial intelligence on fair lending and more.

May 2