-

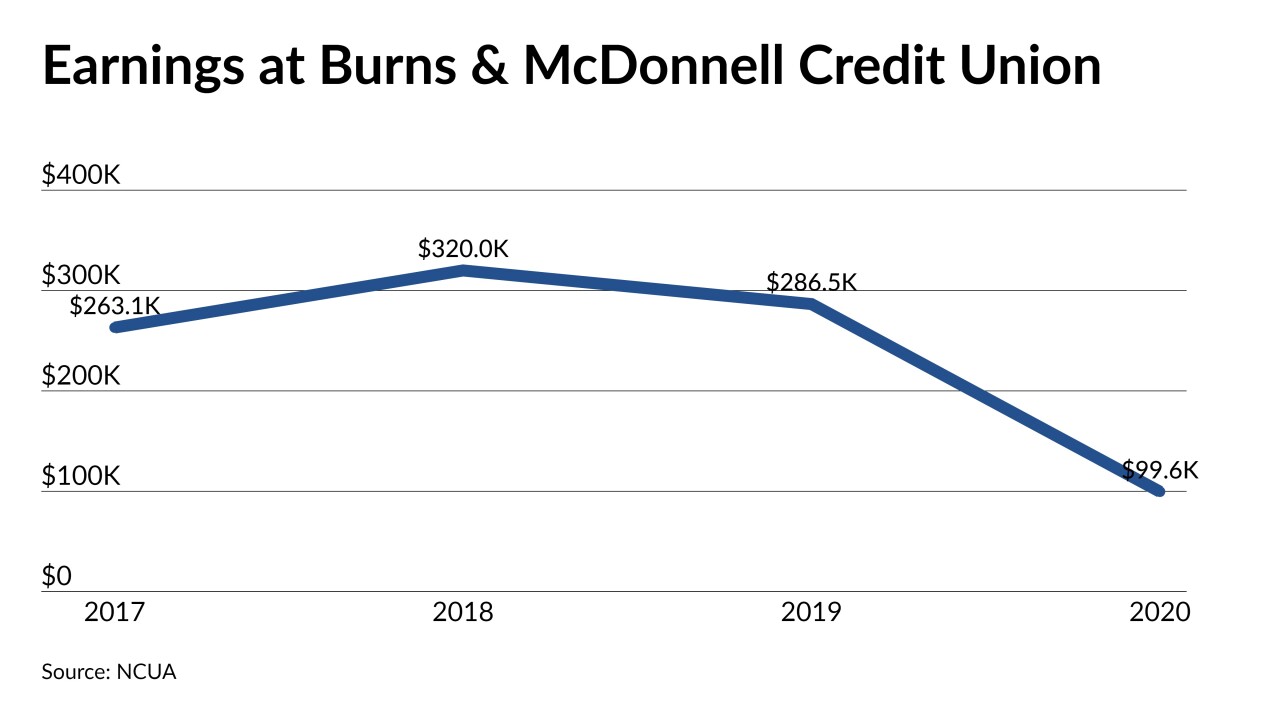

Burns & McDonnell Credit Union holds just $27 million of assets and is seeking approval to merge into CommunityAmerica, which serves the KC metro region and is the largest credit union in Kansas and Missouri.

April 21 -

Rhonda Diefenderfer, who has led the Billings, Mont., credit unon for 20 years, will retire in May and be succeeded by the credit unions busines vice president of business lending.

April 20 -

Climate First Bank has raised $29 million in initial capital, surpassing the $17 million target set by the Federal Deposit Insurance Corp.

April 20 -

The Methuen, Mass.-based institution's newest CEO was born in the same town and has more than a decade of experience in the credit union industry.

April 19 -

Calvin Philips led the credit union – which today operates as Neighborhood CU – from 1958 until he retired in 1988, and remained active on its board long after his retirement.

April 19 -

The retirement of the chief executive at Cincinnatio Ohio Police FCU has resulted in a new hire there and at nearby TruPartner Credit Union.

April 15 -

Janet Sanders has retired after 13 years at the helm of the $142 million-asset credit union. She is succeeded by the credit union's longtime executive vice president, Shelley Sanders. The two are not related.

April 15 -

The South Carolina credit union has pivoted to an open-concept model that allows for social distancing, along with a walk-up window to serve members outside the branch if lobby access is restricted for any reason.

April 13 -

The Michigan-based institution has positioned itself for additional growth by making it easier to qualify for membership.

April 13 -

The Louisiana credit union holds just $3.5 million of assets and could not find a successor for its retiring chief executive.

April 12