-

Attackers stole over $340,000 in stablecoin from the Venezuela-focused app. The incident adds to recent troubles including frozen accounts at JPMorganChase.

January 6 -

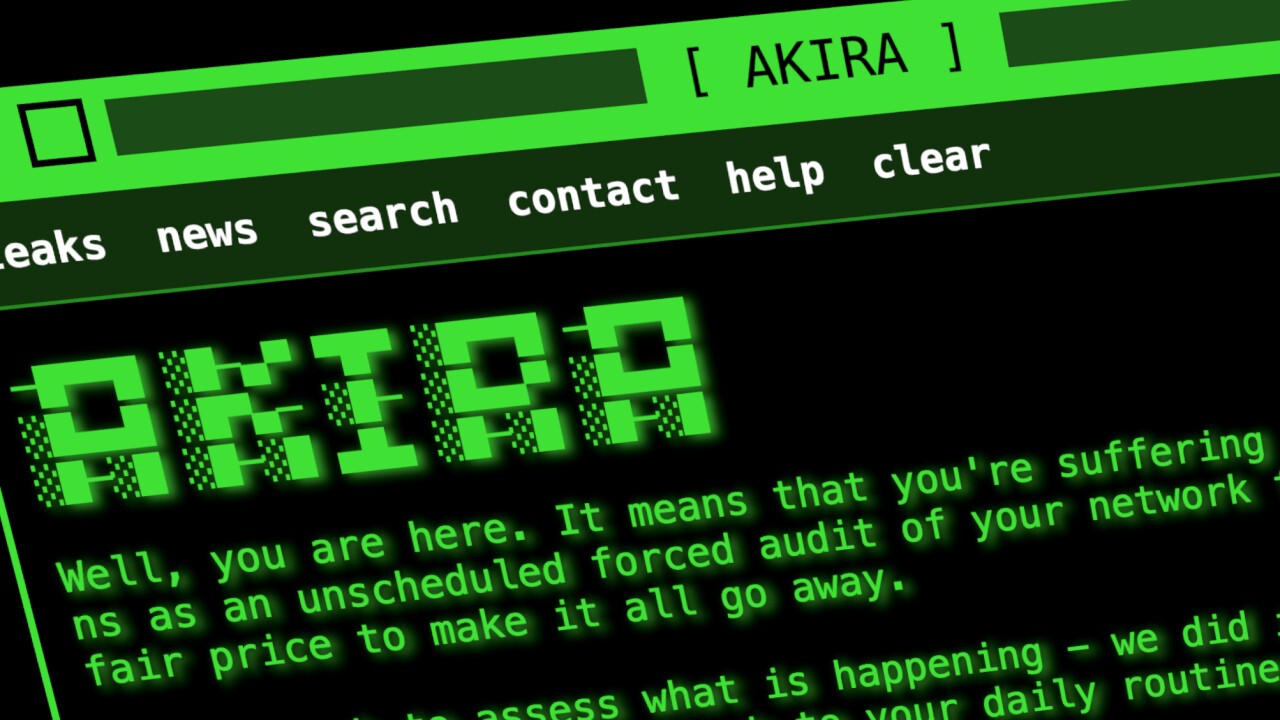

New disclosures show the ransomware attack on the marketing vendor affected far more community banks and credit unions than initially estimated.

January 5 -

There is a narrow window of opportunity for banks to position tokenized deposits as an alternative to stablecoins for customers seeking the convenience of cheap, blockchain-enabled payments.

December 30

-

Stories about data breaches, fraud and one neobank were reader favorites this year.

December 29 -

From credit bureaus to software providers, 2025 saw attackers bypass bank defenses by targeting the supply chain and using social engineering.

December 26 -

Fifty-four individuals tied to the Tren de Aragua gang face charges for using Ploutus malware to drain millions from community banks and credit unions.

December 23 -

ServiceNow, with its largest-yet M&A deal, will fold Armis' threat prevention services into its larger cybersecurity suite.

December 23 -

An American Banker survey found that bankers think the industry isn't prepared for growth in artificial intelligence and digital assets.

December 23 -

The National Institute of Standards and Technology's preliminary draft helps banks integrate artificial intelligence into their existing security strategies.

December 17 -

New research from American Banker explores how bankers predict stablecoins, subprime credit, cyber security and other factors will shape the industry at large.

December 17