-

The Michigan-based institution has positioned itself for additional growth by making it easier to qualify for membership.

April 13 -

Gap and Synchrony Financial are parting ways after they couldn’t reach an agreement to renew their longstanding card partnership.

April 13 -

Invoiced is working with with the Mastercard Track Business Payment Service, the open-loop network that supports a vast network and business directory of buyers and suppliers.

April 13 -

While U.S. regulators pressure Visa and Mastercard, there's ample choice, particularly when compared to the national debit rails that exist in most of the world, says Intrepid Ventures' Eric Grover.

April 13

-

The Wisconsin company is paying $248 million for Mackinac, which has $1.5 billion of assets and $1.3 billion of deposits.

April 12 -

The Mississippi company has never done a deal this large. But buying Houston-based Cadence would take it into high-growth markets and reduce both companies' concentrations in sectors such as energy, dining and hospitality.

April 12 -

Katz Investment agreed to buy Camp Grove Bancorp in March 2019. The Federal Reserve approved the buyer's application to form a bank holding company earlier this year.

April 12 -

Bank of Montreal agreed to sell its Europe, Middle East and Africa asset management unit to Ameriprise Financial for 615 million pounds ($847 million), marking CEO Darryl White’s biggest move yet to trim the bank’s portfolio of noncore businesses.

April 12 -

BancorpSouth would have $44 billion of assets after it buys Houston-based Cadence. The company will be rebranded, while the bank will retain the Cadence name.

April 12 -

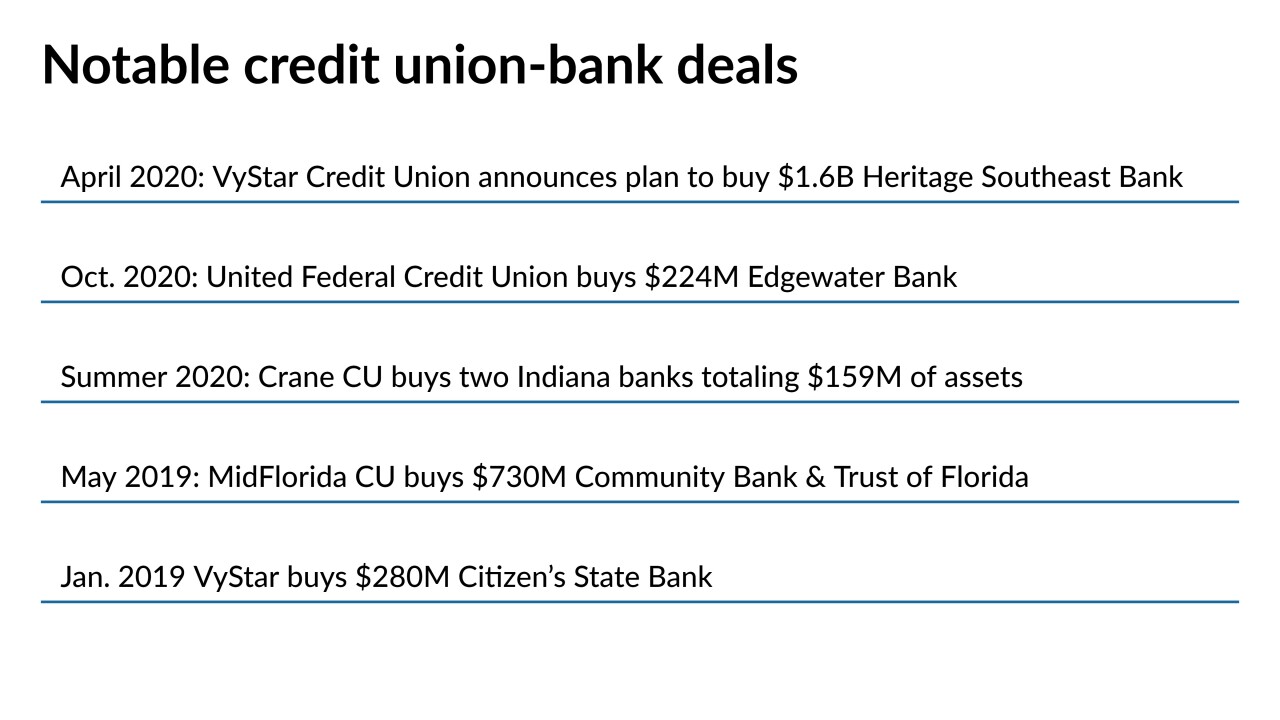

Banking trade groups have called for congressional hearings following the Jacksonville, Fla.-based credit union's agreement to purchase the $1.6 billion-asset Heritage Southeast Bank, the largest deal of its kind to date.

April 12