-

Even as Jamie Dimon touts the female leadership at his company, it lags in one key area. But JPMorgan women are making strides in particular with blockchain initiatives, and Amber Baldet finally shares what she is working on. Plus, heels or flats?

May 18

-

Bank of America on where its AI hopes (and worries) lie; Zelle founder Paul Finch announces his leave from the payments network; the one area where banks and fintechs want more regulation; and more from this week's most-read stories.

May 18 -

While working with new fintechs carries some risk, it can also provide community banks with an affordable way to upgrade products and technology.

May 18 -

Blockchain's potential for revolutionizing the world’s payment systems has captured the imagination in recent years, and last month Santander became the U.K.'s first bank to use the technology to create a new international payments service.

May 18 -

Bank executives say artificial intelligence will create jobs, while analysts say the opposite. Employees are anxious but willing to try to work with it. All agree AI is already making an impact.

May 18 -

Fintechs attending Consensus 2018, the annual cryptocurrency event, said they found promise for a market still trying to find a path to unified operations and wider acceptance within financial services.

May 17 -

Envestnet's aggregator rolls out PFM features meant to appeal to younger clients — and links to Alexa.

May 17 -

JPMorgan and Santander show off their uses for the technology; commercial and industrial loans outstanding are rising.

May 17 -

Mark Begor said Wednesday that banks and other customers will receive regular updates on the credit reporting agency’s efforts to improve its cybersecurity in the wake of last year’s massive data breach.

May 16 -

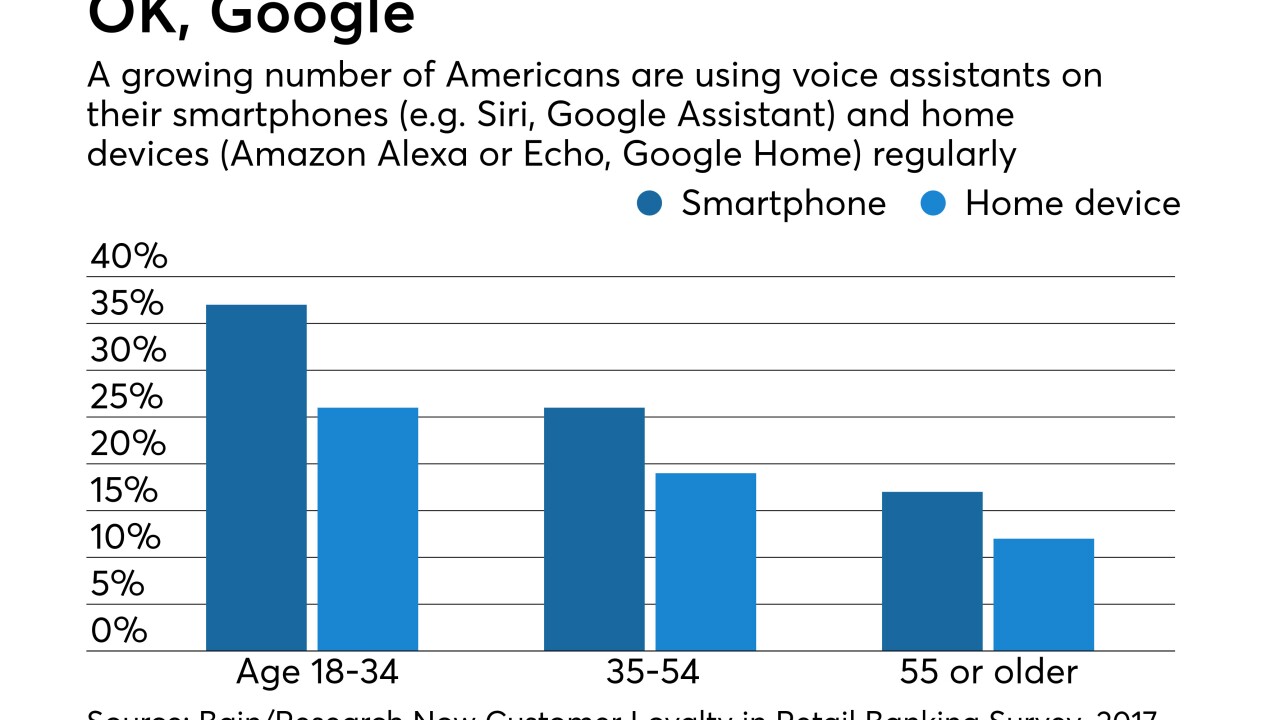

Google's new voice assistant technology may be the best right now at imitating human speech. That makes it a potentially powerful tool for bankers — and for cybercrooks.

May 16