Some of this stemmed from riskier practices PayPal engaged in prior to joining eBay. Other times, eBay had to use its resources to gain ground that PayPal lost in the market.

But even when there were calls to split the companies, eBay saw value in its prized payments subsidiary.

This listicle is compiled from reporting by PaymentsSource writers including John Adams, Nick Holland and Daniel Wolfe. Click the links in each item to read more.

In the beginning: Billpoint loses its edge

One of the major points of contention in the early days of online payments was fees. Banks, merchants and payment companies were still experimenting with how to profit from online payments, even as it seemed inevitable that such services would increasingly become free to the end user.

In 2001, eBay and Billpoint thought that PayPal had made a fatal error: PayPal started charging fees to its longtime users. Billpoint told American Banker that it started getting "floods of email" from angry PayPal users, but PayPal said its defections amounted to only 1% of its userbase.

Part of Billpoint's frustration was that its audience was limited to eBay sellers, whereas PayPal was free to serve the wider internet. And even with the home-field advantage, Billpoint was used by just 15% of eBay sellers compared to PayPal's 60% back in 2001.

Cleaning up PayPal's casino ties

Specifically, it saw

"Under the current legal and regulatory environment, we just thought this was the best decision for eBay," an eBay spokesman told American Banker at the time.

Just one day after eBay received antitrust clearance to proceed with its acquisition, PayPal

As a privately held company, PayPal was able to assume risks that the publicly traded eBay could not (PayPal went public earlier in 2002 but had previously operated privately since its inception in 1998). This included working with gambling sites but also operating internationally — and under eBay, that latter strategy continued its momentum.

eBay gives up on PayPal's instant credit offering

That admission cost eBay about $820 million in cash plus $125 million of outstanding options to purchase the rival instant credit company.

Bill Me Later was also getting good pickup with non-eBay merchants, an area where PayPal was working hard to expand its own reach. That said, Bill Me Later didn't have the same resources eBay and PayPal did, so its ability to continue that expansion as an independent company would have been limited.

Another admission of failure, this time with developers

"Just go back a bit in time, toward the end of 2012 and early 2013, we were losing touch with developers," said Lunn, then the senior director of developer relations worldwide. PayPal was making its pitch to startups much too late in the companies' lifecycle, and that PayPal's application programming interface was "poor" only added to the challenge, he says.

In the year since, PayPal worked hard to catch up by hosting hackathons and engaging in outreach programs. But even this wasn't enough — a rival company called

The goal of all of these efforts is to get PayPal in front of developers substantially faster, Lunn said.

"Startups go from zero to hero in about eight months. We have to talk to them early, to make sure they are using our products in a way that will appeal to consumers," Lunn said.

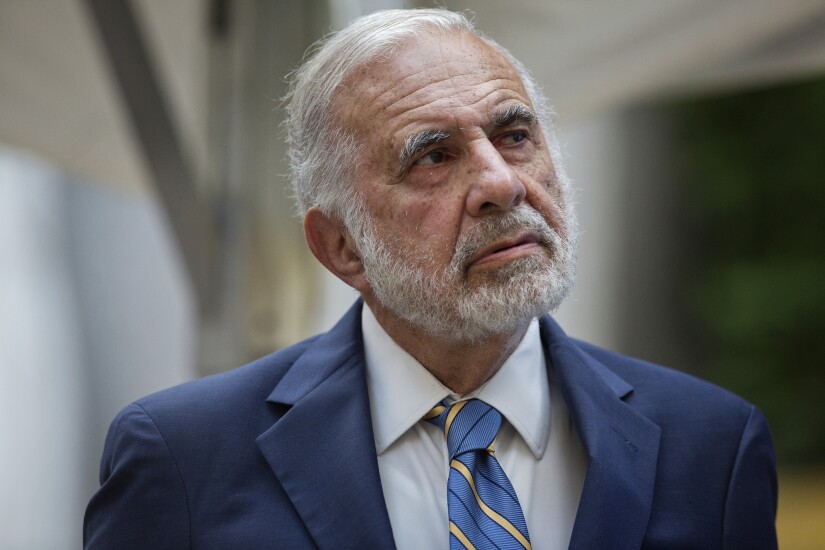

eBay gets defensive against Carl Icahn

In recent years, PayPal had aggressively pushed beyond its roots as the darling of eBay marketplace sellers, and was an increasingly a common sight on the checkout pages of mainstream e-commerce brands.

Its ties to eBay had started to become an hindrance, Icahn argued.

"We expect that an IPO of PayPal, thereby creating two focused entities, each with clear prospects and strategies for investors and analysts to consider, would enable both companies to attract a more natural shareholder base,"

Though eBay would eventually agree to spin off PayPal, it took some convincing.

"PayPal is thriving as part of eBay Inc.," eBay said in a press release at the time. "Being part of eBay Inc. for more than a decade has enabled PayPal's strong growth and global leadership position in digital payments. PayPal has not been held back by eBay Inc."

Finalizing the divorce: eBay chooses Adyen

The transition to full payments intermediation will be a multiyear journey, and eBay will move as quickly as possible to complete this process within the parameters of the Operating Agreement with PayPal, which remains in place through mid-2020.

Though the decision may seem abrupt, it is a recognition of the market realities that both eBay and PayPal have had to confront in recent years.

PayPal, a longtime eBay partner, will remain a payments option at checkout for eBay buyers — but it will no longer get the star treatment it has long enjoyed. There has been a certain inevitability to this announcement.

“At first glance, this feels like the Costco and American Express divorce,” said Michael Moeser, director of payments at Javelin. “We all knew the relationship had an expiry date. Renewing it didn’t make sense for anyone.”

PayPal was similarly prepared for this day to come.

“We’ve been accounting for it from the very beginning,” said Amanda Miller, corporate communications director at PayPal.