While German consumers prefer using cash in stores and are accustomed to paying for products after delivery, the global nature of e-commerce is sparking a change in payment habits.

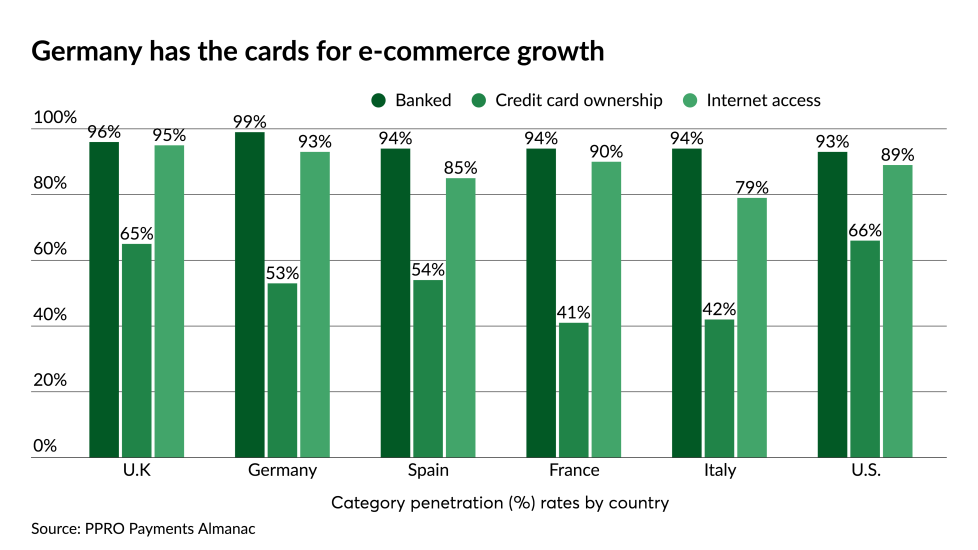

This trend creates opportunities to convert more payments to card or digital options, as bank ownership and internet penetration are high while card adoption is on par or above many other European nations.

In a country with over 83 million consumers and the world’s fourth-largest economy based on