Alibaba is investing billions into mobile ordering technology in China — but what is more fundamentally American than spending large amounts of money on food?

And this is only the beginning.

The survival of grocery and restaurant businesses doesn't hinge on the next hot menu item, but on harnessing mobile technology to make sure customers have a faster experience and a bigger bill at the end. Mobile ordering apps are the ride-sharing startups of the food industry.

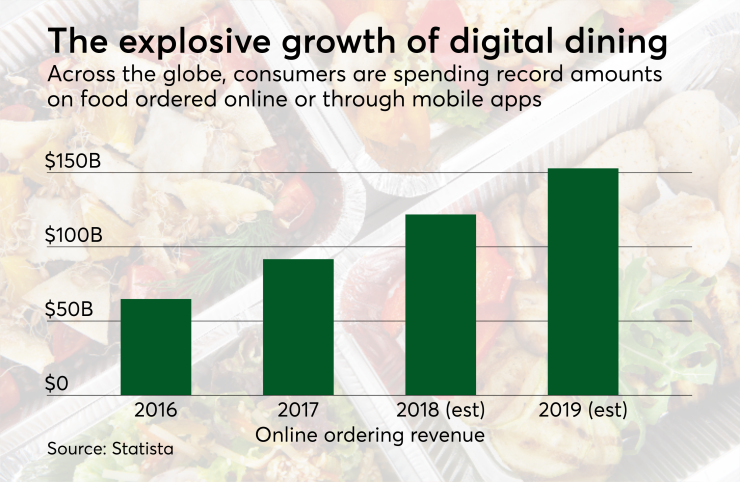

Billions spent on food fintech

Ele.me has seen its value jump to $9.5 billion from $5.5 billion a year ago, and a quick look at Monday's stock market shows that it wasn't the only company affected by Alibaba's investment.

Most apps are spiking.

sharing service in many cities, totaling about $3 billion in sales in 2017.

Amazon famously has a multi-pronged strategy for this market. In addition to experimental concepts like the cashierless Amazon Go store and the drive-through AmazonFresh grocery experience, Amazon took ownership of

Square was ahead of the game with its $90 million all-stock purchase of food delivery company

And Starbucks, having reached an apparent limit of

The great wall opens up

All of this activity comes up against the possibility that these companies will soon be competing more directly with Alibaba and its payments affiliate, Ant Financial, as China loosens restrictions on foreign companies operating within its borders. Last month, the

'You gotta eat'

These investments are a potentially expensive proposition for merchant service providers, corporate acquirers looking for deals or integration partnerships, but it's an unavoidable part of retail strategy given the close tie between point of sale and ordering in the digital age.

"You gotta eat," said Richard Crone, a payment consultant. "Order ahead is a 'plus one' feature for a payment application. You have a registered known user. You have to have a payment platform and if you can add 'order ahead' to it, it makes it more attractive for a merchant acquirer or a payment platform. That's why GrubHub has been so highly valued."

For restaurants, the bigger opportunity is to pair mobile ordering with delivery. "We've found small restaurants can boost their sales by 30% with a mobile delivery option," Crone said.

In China, this option has allowed the restaurant industry itself to expand, since almost "any kitchen" can become a restaurant, he said.

Payment companies could be potential acquirers as they diversify beyond payments, but are currently focused more on fraud detection and e-commerce facilitation in their M&A strategy, according to Ray Pucci, an associate director at Mercator Advisory Services. "The more probable buyers of delivery services and apps are merchants, plus the likes of Amazon and Walmart," he said.

Mobile delivery also has a future beyond restaurants, Pucci said.

"Merchants across verticals are getting into the act, especially in the grocery category, although other merchants such as Macy's and Best Buy have added delivery to their mobile app strategy," Pucci said. "Same-day delivery has now become table stakes in large metro areas, but the costs are steep for providers and already there is some shakeout occurring. But on-demand, mobile delivery is here to stay."