Cybercrime organizations are more sophisticated and organized, keeping networks designed to stop them busier than ever.

After thwarting 144 million cyberattacks and 300 million bot attacks during the second quarter of this year, ThreatMetrix confirms the

Cyberattacks are confirmed attempts to steal money, payment or personal data, while bot attacks tend to be probing devices similar to sending a scout ahead of time to determine the weak points of a target. Or a bot can masquerade as a real customer to see how easy it might be to open a fake account.

But the prevention toolbox is always expanding.

"We now look at shared intelligence and are able to get intelligence data from the banks that points to certain accounts being used by a fraudster," said Vanita Pandey, vice president of product marketing at ThreatMetrix.

It is becoming common for the fraud prevention researcher to halt a bot attack on a mobile wallet provider, a retailer and a bank, and realize they all came from the same source, Pandey said.

ThreatMetrix revealed its 2017 second-quarter cybercrime report on Monday, citing Europe as a hotbed for cybercrime, with 70% more attacks coming from Europe compared with North America.

Cybercrime in Europe doesn't always have to start behind closed doors or on the dark web.

"You have young people there standing outside of schools and offering young students $200 to sell bank account information to them," Pandey said. "Once they have access to that data and the accounts, they can attack in Europe or the U.S."

At the same time, South America is the global hot spot for new account creation, with more than 45% of all new account creation coming from Brazil with stolen credentials. Primarily, payments is the largest use case in South America, with those fraudsters picking soft targets like digital goods that are easily consumed, the report noted.

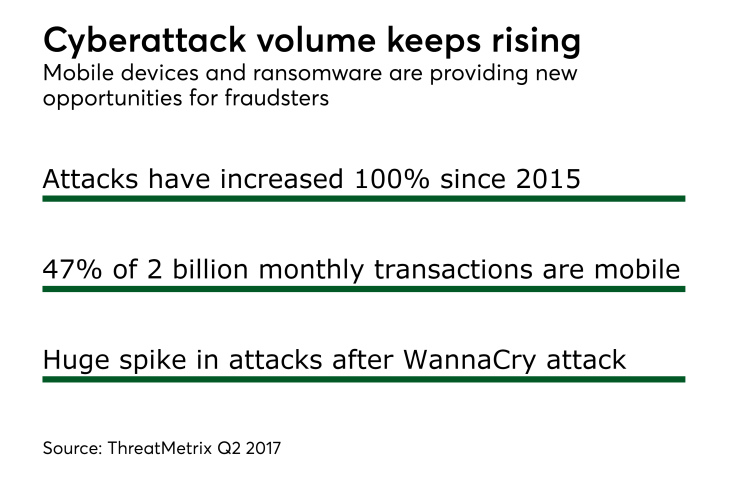

Securing card payment data or personal account credentials has become riskier every quarter, Pandey added. The 144 million attacks in this year's second quarter topped the previous quarter's 130 million attacks.

Companies across the globe involved in content sharing or social media are seeing fraudsters try to create new accounts for their sites with fake credentials through bot attacks, then selling those account credentials at discount rates on the web. That type of activity can lead to fake financial accounts being opened with the same credentials.

"Fraudulent account origination, using either synthetic or stolen identities, is a rising concern across the financial ecosystem," said Julie Conroy, research director and fraud expert with Boston-based Aite Group. "We’re seeing a huge spike in this type of fraud, thanks in part to all of the identity data available in the dark web as a result of the breaches."

Such a scenario can be particularly painful for consumers when these identities are used to initiate new lines of credit, Conroy said. "The consumer generally will not know about it until they get a collections letter for money the fraudster stole," she added.

In that regard, it is the type of crime that consumers have no way of knowing about until it is way too late.

"If someone tries to log into my bank account, I would be notified of that by the bank," Pandey said. "But if someone is trying to open a new credit card account under my name, I would never know."

A lot of consumers with long credit card histories continue to go through this scenario, Pandey added.

Top attack vectors remained device spoofing, followed by identity spoofing and bots. Internet protocol spoofing actually decreased from 2.4% of total transactions recognized as attacks last year to 2% this year, possibly signaling more movement to fraud against mobile sectors.

It is becoming increasingly difficult for global online companies or financial institutions to manage fraud because of how fraud trends can vary in other countries, based on local customs and regulations, Conroy said.

But an increase in the proportion of transactions that are coming from mobile devices, at 47% of all transactions (payments, logins, account creations), provides potential relief.

"The good news there is that there are often more robust ways to secure the mobile app, so hopefully that's one point in favor of the good guys," Conroy said.