With big companies frequently set in their ways for how they make cross-border payments, most innovation is targeted toward smaller shops that make fewer payments to foreign suppliers.

But that isn't always the case.

Big companies also suffer from the sluggishness of legacy systems, and may be receptive to change if the right business case comes along, according to Jason Kolbeneyer, managing director of the Bonita Springs, Fla.-based CSI globalVCard.

"B-to-B does lag behind consumers when it comes to payment innovation, but it's a harder market," said Kolbenheyer. "You can't just send a few bucks to your buddy across the office like Venmo."

CSI has generally processed B-to-B payments in the U.S., but plans to have a presence in most of the world by the end of the year, an effort that started with an office in London that opened in March. CSI is collaborating with Edenred, a company that's 30% owned by Mastercard, to issue and process virtual cards and wire transfers.

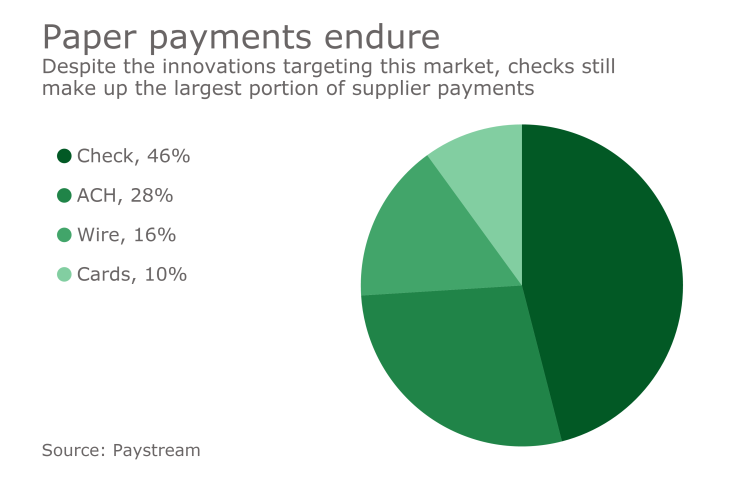

CSI is hoping to capture business from clients who wish to execute B-to-B payments in the local currencies of each party. The market is sizable: Paystream Advisor's 2017

While CSI serves businesses of all sizes, it has a particular interest in using its new London office to reach larger corporates. Paystream estimates organizations with more than $2 billion in revenue make a substantial amount of payments to foreign suppliers. And across all business segments, checks are still the largest mode of payment.

"There's still lots of room for growth here," said Kolbenheyer. "Things are just getting started."

CSI hopes these larger businesses will be a distinct niche. Cross-border payments has become a popular market for financial technology companies over the past couple of years.

But the market has skewed small. Vendors are using

"The structure changes in different markets. Interchange is different and the common forms of payment are different," Kolbenheyer said.

CSI is instead relying on its relationships with clients and partners to remove paper and manual processes for larger companies that make billions in payments annually.

"I love blockchain, but we sit on top of the existing rails, so there's no structural change needed on the buyer or seller side," Kolbenheyer said, adding the steps of billing, paying, processing and reporting financial information to a company's enterprise resource planning system can be reduced. "There's a lot of technology already out there for small payments and micropayments."

Despite the popularity of mobile devices among consumers and the abundance of new technology, there are still cultural factors that could continue to hold back automation in supply chains. Businesses are aware of new technology, likely more than consumers, so there has to be another reason for the continued dominance of paper processing.

Business payments are, along with rent payments and government disbursements, the three major holdouts that are keeping checks alive, said Michael Moeser, director of payments at Javelin Strategy & Research.

"I think the issue at hand is when business will stop user paper checks, as I believe consumers continue to reduce the amount of checks they are using every single year," Moeser said.

It's possible the longer processing and mailing time for checks may still be valuable to some businesses as a cash flow tool.

"We see that businesses want to get paid as quickly as possible, but when it comes to paying their suppliers they are still such in check writing mode," Moeser said.