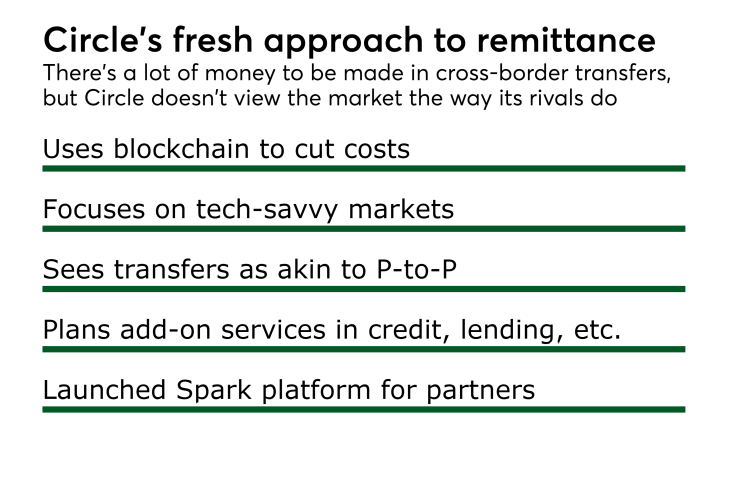

Circle customers in the U.S., U.K. and Europe now have the ability to send and receive money instantly across borders with no fees and no markup on foreign exchange rates. It's a move that leaves a lot of money on the table, but it also stems from a fundamentally different approach to cross-border payments.

The commoditization of remittance using blockchain technology, as Circle is doing, is akin to the disruption to fixed line telephony that occurred with the advent of Voice over IP (VoIP). However, as with service providers such as Vonage in the telco space, Circle will have a long way to go to displace the incumbent remittance networks, which perhaps explains why its business today is still focused on the easier targets.

The staggering size of the cross-border payments market

It's worth looking at just how much money there is to be made under traditional business models for cross-border payments.

According to an

The increasingly nomadic global population means that the demand for remittance services is rising, as are their expectations for fast, secure and inexpensive (preferably free) providers. These consumers also increasingly expect to be able to make these payments via mobile devices.

The remittance landscape has traditionally been serviced by proprietary networks operated by companies such as Western Union and MoneyGram, but with the growth of digital payments, newcomers have come to the scene such as Xoom (a unit of PayPal) and Remitly. However, the revenue model for the newer digital providers is still based on markup of foreign exchange rates and transaction fees, typically between USD$2.99 and $4.99 depending on the size of the transaction.

"Circle is the only service to enable instant, fee-free cross-currency money transfers without a markup on foreign exchange rates," said According to Josh Hawkins, VP Marketing at Circle. "Both legacy players and fintech startups either charge a fee or markup the currency exchange rate, or do both. Circle does neither.”

Circular reasoning

The obvious next question is: How does Circle intend to generate revenue?

According to Hawkins, it isn't just about remittances. “Now that we're achieving significant consumer adoption in multiple markets, we're in a position to begin offering new value-added services to consumers that will provide Circle with monetization opportunities,” he said.

This explains Circle's limited reach to date. Circle currently operates in the U.S., U.K., Spain and Ireland, and is also available in early access release in 15 other markets (Germany, France, Italy, Netherlands, Finland, Slovenia, Slovakia, Estonia, Austria, Portugal, Poland, Luxembourg, Czech Republic, Croatia and Liechtenstein).

“Circle doesn’t play so much in the remittance space as they do in the P-to-P space because they are not focused on serving traditional migrant corridors — like the U.S. to Mexico or the Philippines," said Talie Baker, analyst at Aite Group.

Although Circle isn't targeting the biggest remittance corridors, its areas of coverage are more likely to be conducive to a technology-based offering.

A piece of Circle's expanded strategy has already fallen into place. In December 2016, Circle launched Spark, an open source project that enables consumer digital wallets to be interoperable over the internet.

As Circle's customer base has grown and as more partners leverage Spark for cross-currency payments, the company has expanded trading activity across crypto-assets, such as bitcoin and ether. Similar to other trading desks, Circle generates revenue from the spread traded between buyers and sellers for these assets.

Circle is also actively developing consumer facing products in credit, lending, investment and savings.

Coming full circle

Whether Circle can add sufficient value from layering additional services onto its money transfer platform remains to be seen, and incumbents shouldn’t necessarily be worried yet.

Circle's future growth may be dependent on developing hooks into more traditional remittance corridors, and it can start by following the migration habits of its existing user base.

"Some of the countries they serve in Europe do have larger migrant populations within Europe," Baker said. "The former Eastern Europe communist countries — those countries nationals will migrate to another country in Europe for work.”

Should Circle desire to expand services to more traditional remittance corridors, it will face a requirement for more analog cash in/cash out locations to service less technologically advanced markets. It remains to be seen whether Circle’s revenue generation plans outside of traditional transaction fees will be sufficient to meet these costs.

What do you think? Senior Analyst Nick Holland welcomes your feedback in the comments below or at