Google is moving to corral its various mobile wallet concepts under a new umbrella—Google Pay—but it won’t be an overnight cure for the confusion many consumers and merchants are likely to experience as the new “G Pay” logo starts to appear.

The move mends a deliberate split in Google's branding — its Android Pay mobile wallet and its Google Wallet P-to-P service — under a single brand that also encompasses in-app payments, Google said in a Monday

Consumer adoption of mobile payments over the last few years has been tepid at best, and Google has done plenty to muddy the waters by calling its first concept Google Wallet in 2011, only to downgrade it a few years later to function merely as a P-to-P payments tool. Google introduced Android Pay in 2015 and spent millions promoting that name as its wallet for in-store purchases.

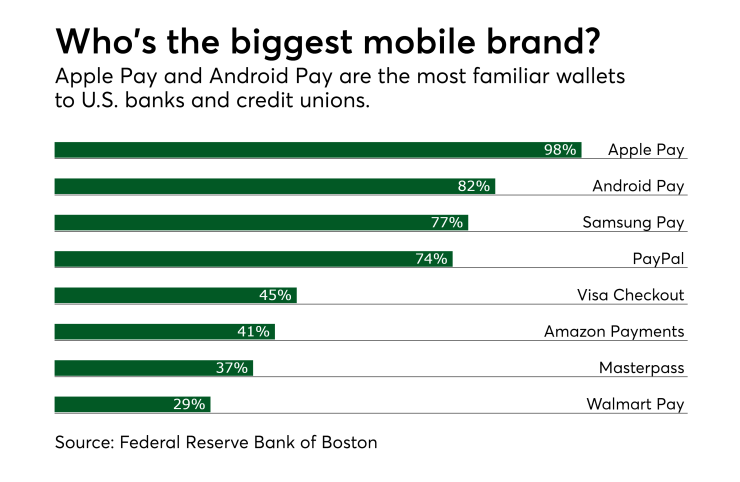

Apple Pay, which launched several months ahead of Android Pay, has the greatest familiarity among U.S. banks and credit unions, but Android Pay is close behind, according to a study by the Federal Reserve Bank of Boston.

The branding move makes sense, given the growing momentum of other wallet brands that use “Pay” in their names, experts say. But Google’s erratic path to launch Google Pay hasn’t made it easier for consumers or merchants struggling to get on board with mobile payments.

“Google’s branding of its payment products has grown increasingly confusing over the years. The lack of unity and consistent messaging has created challenges for consumers in understanding which Google payment product to use, not to mention how and where to use it,” said Jordan McKee, principal analyst for payments with 451 Research.

The launch of Google Pay is an attempt to create some brand cohesion, but there’s no clarity on how long that might take, he said.

“It remains to be seen if the Google Pay brand will enhance consumer understanding and therefore adoption of Google’s payment services, or if it will only add another layer of confusion,” McKee said.

But there was no benefit in waiting for Google to finally capitalize on its most powerful branding tool—its name—with Google Pay after its odyssey of trial and error with other ideas, analysts agree.

“With Google Wallet, Google was trying to find its wings in navigating between the point of sale, in-app and online payments, and they’ve reached the point now where ‘Pay’ has become the noun used by Apple, Samsung, Walmart, Kohl’s and others — and there’s no point in going another direction,” said Richard Crone, a principal with Crone Consulting LLC.

One catalyst for Google’s decision to launch Google Pay may have been the need to consolidate P-to-P payments under a "Pay" brand while keeping it distinct from Google Wallet. This move comes on the heels of the launch of Apple Pay Cash, a P-to-P system that operates within Apple's iMessage platform, and PayPal's expansion of Venmo into e-commerce, Crone noted.

“The timing is important because Google Pay wants to capture and build momentum around mobile payments before competition gets any more intense. PayPal is pushing hard with its one-touch payments approach and the early signs of consumers take-up with Pay with Venmo are very good,” Crone said.

There's still plenty of time for Google to make its mark with Google Pay, said Raymond Pucci, an associate director of research at Mercator Advisory Services.

"Some consumers may think this is a totally new payment platform, but in-store mobile payment usage is low anyway, so the largest potential impact will be with online sales, and that's where Google is trying to compete against Amazon, PayPal and the card networks," Pucci said.

Google's move also enables the e-commerce giant to integrate consumers' account credentials currently stored separately in Chrome to Google Pay, noted Rick Oglesby, president of AZ Payments Group. "That will expand utility and provide a more consistent and secure experience," he said.

The Google Pay brand will start to appear online in the coming weeks, and Google has no plans to phase out the Android Pay or Google Wallet brands, a spokesperson said.