Buy now/pay later lending has sparked worries about mounting consumer credit risk, and part of the issue is the lack of data available to other lenders.

Beginning in the next few weeks, Equifax will add a business industry code for BNPL to classify data such as payment history, a move that will make BNPL loans visible on credit reports. Equifax says this will provide clients and scoring partners the ability to decide how to include BNPL payments into their own decision making for new financial services. At the same time, TransUnion is working on its own BNPL credit reporting service.

"There's a huge opportunity to better understand what's going on in this market," said Mark Luber, chief product officer at Equifax U.S. Information Solutions in Atlanta. "Everyone is responsible for responsible lending … to make loans that can be paid back. This credit reporting will help with that."

The bureaus' moves come as BNPL lending continues to expand, with

"Traditional lenders will be able to benchmark usage and identify lending opportunities. Regulators interested in understanding lending quality will not have to look further than anonymized bureau data," Riley said. "And merchants will benefit through the mainstreaming of BNPL lending."

BNPL loans, also called installment loans, are typically offered online or at the physical point of sale as a "pay in four" option for a single purchase. Some banks also present the option to pay for individual credit card purchases in installments after the fact, though most providers offer BNPL loans separate from any specific card account.

Equifax internal research, conducted with FICO, found that on-time payments for BNPL lending can boost credit scores. Consumers who paid BNPL installments on time had an average FICO score increase of 13 points, according to Equifax's study. The study also showed that consumers with a thin credit file (two or fewer trendlines) or a young file (less than 24 months old) had an average FICO score boost of 21 points by adding on-time BNPL payments. Equifax did not answer questions on how missed BNPL payments specifically change FICO scores, though it did say there is an adverse impact.

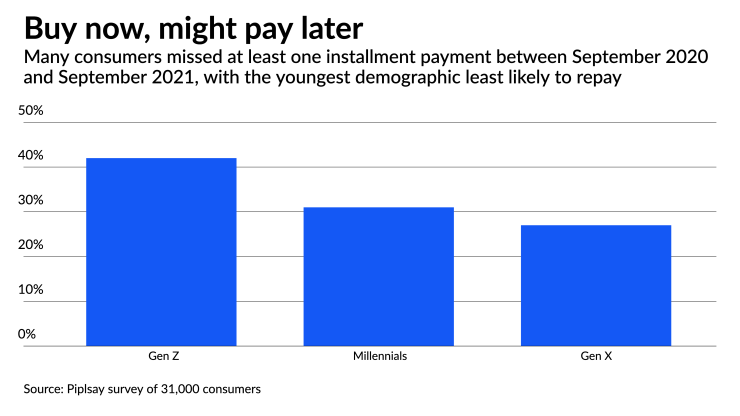

Studies from sources as varied as the

Additionally, 39% reported using BNPL because they did not want to make the full payment for the product (generally $500 or less) all at once, 37% said the product was over their budget and 24% said they did not have enough money to pay. Piplsay also found 34% of consumers have used BNPL once or twice in the past year, 26% three or four times, 21% five to seven times, and 19% more than seven times.

"Folks are using BNPL to buy stuff they can't afford rather than the luxury of paying for it later," said Ted Pulsifer, an executive vice president at the Schlesinger Group, an Iselin, New Jersey-based market research firm. "The data is demonstrating that there's an awareness of the risk that needs to take place."

Data from credit reporting can provide regulators with visibility into BNPL's impact on consumers, according to Riley, who added it can also help the consumers who do pay their BNPL loans successfully build their own credit profiles for much larger purchases.

"Credit reporting on BNPL loans is an important facet of the product's maturation," Riley said. "Although these are relatively low-ticket financial products, they do offer insight into how the borrower repays. For the many people with thin or invisible credit files, BNPL can offer a way to help them into the mainstream of credit."

In an email, TransUnion spokesperson Liz Pagel said: "BNPL and POS installments are net new types of credit obligations that the existing credit ecosystem in the U.S. is not ready to support."

Pagel added that it's important that TransUnion's reporting to reflect the total indebtedness of the consumer, and "we are well on our way to bringing a solution to market that will make this data available without having an undue impact on existing scoring models."

TransUnion also has partnered with the buy now/pay later lender Sezzle to allow consumers to build credit using their repayment history with Sezzle.

"By turning BNPL into a credit-building tool, BNPL providers benefit by improving their value proposition to their users, Equifax expands its utility as a bureau and at the same time banks benefit by gaining more insight into and increasing the size of the targetable base of creditworthy borrowers," said Rick Oglesby, president of AZ Payments Group in Phoenix.