When Chris Winship, partner of FTV Capital, paid $35 million in private equity funds for a slice of the digital gift card player Tango Card in May 2018, he did so with the expectation that he would quickly find a buyer.

It’s the equivalent of buying the Boardwalk property in the Monopoly board game when another player already owns the pairing property, Park Place, just to make money off their need to buy you out so they can start building hotels.

While Tango Card serves employers in the rewards and incentives industry, it is a purely digital gift card player that has a direct connection to the consumer so it can thrive in an increasingly mobile world. This is exactly the technology that Winship predicted that a physical gift card distribution giant would need to adapt to a growing market for digital gifting.

It echoes the strategy that prompted FTV and other investors to sell the digital gift card company CashStar to

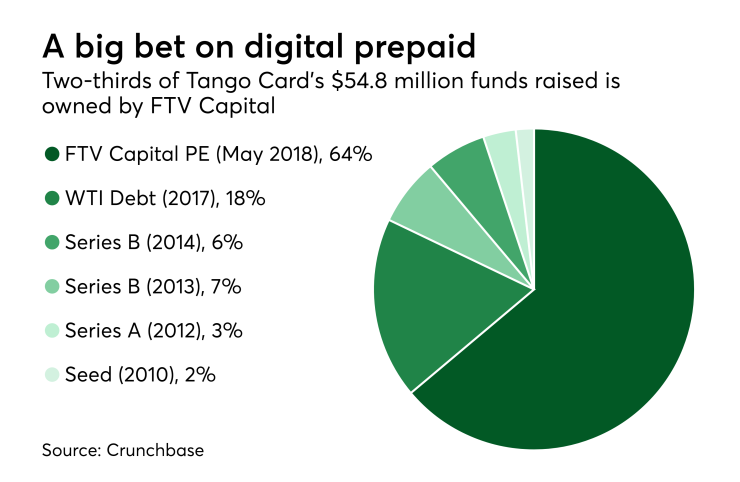

“We know who the next generation of winners will be and are willing to invest in those emerging companies,” Winship said. While FTV Capital is not the first investor to purchase equity or place debt into Tango Card, it is the most recent and it has placed the majority funds raised by Tango. According to

The FTV Capital funding isn’t a straightforward $35 million equity investment. According to the

Tango Card reported $17 million in revenues for 2017 to

FTV Capital has notched up several wins using the “buy what someone else needs" strategy. The companies which FTV invests in tend to fill technology holes or product gaps that larger organizations are unable to plug or slow to recognize how the industry is changing until it’s almost too late.

After CashStar, other examples include

“Chris has the Midas Touch for the financial institutions that have entrusted him with their money,” said Richard Crone, principal of Crone Consulting.

The other major company in the prepaid gift card industry is Blackhawk's rival

InComm, which is owned by Warburg Pincus, recently announced that its president, Phil Graves, is retiring at the end of the year.

It would make sense for InComm to buy Tango Card to add its digital capabilities. When asked if InComm plans to make a bid for Tango Card, an InComm spokesperson said the company does not comment on corporate strategy.

The consumer gift market has experienced significant disruption in the last few years as it has been beset by two major trends. First is the challenge the industry has faced a

So Tango has set its sights on a different audience. It pursues the employer rewards and incentive market, which it views as more lucrative than the consumer market, where people buy gift cards only for annual events such as birthdays and holidays. Corporate clients instead disburse funds on a monthly or quarterly basis, with those purchases built into annual HR salary budgets.

"In an enterprise, these rewards are earned, they are not gifts," said David Leeds, founder and CEO of Tango Card.

This means the right gift card platform should be digital and integrated with HR platforms. “Integrating with employee engagement platforms is critical to building us into the enterprise,” Leeds said. Tango Card has integrations with

And even in the consumer market, there is a trend to digital gifting over physical cards.

This is when the gift card is sent digitally so it can be spent through a phone or online via a computer. This digital transition over the last three to five years has caused the major gift card players to go on shopping spree to fill technology gaps and even consolidate. For example, First Data acquired digital players