The use cases for faster payments are typically considered to be somewhat niche: payments to the gig economy, immediate insurance disbursements, disaster relief, etc. But if any payment can be made in real time, why should full-time employees wait two weeks for every paycheck?

As more employees learn of the proliferation of faster payment options, either through their own use of P2P systems like Zelle or by chatting up their Uber drivers, they will start to expect similar treatment with their own payments.

It's the same pattern that is being seen in business payments automation — employees see certain payment innovations in their personal lives and expect the same at work.

"Consumers and businesses would rather get paid instantly," said Drew Edwards, CEO of digital payment platform Ingo Money. "We have the point of view that we have this end-to-end platform that allows a bank or business to offer the consumer the same kind of experience when being paid that they are used to when they go buy something and have a choice of the way to pay."

The desire to get paid instantly will advance beyond the gig economy, Edwards said. Ingo has long tried to help banks and businesses move into a

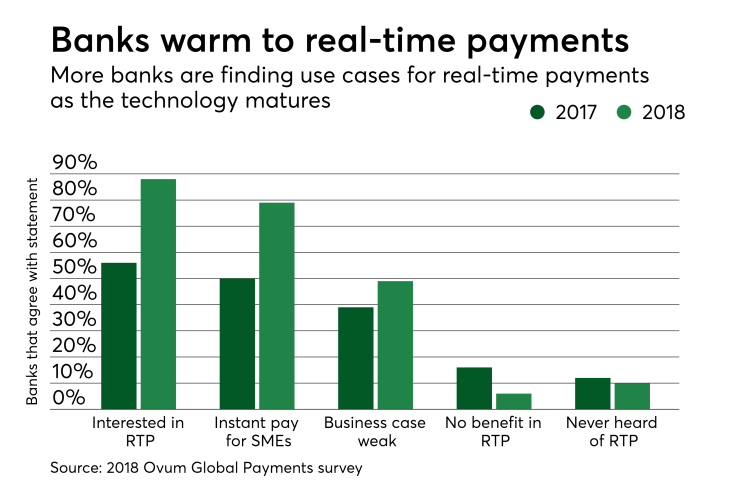

There's plenty of momentum to support that prediction. It's a growing industry featuring end-to-end platform providers, P2P options like Zelle, Venmo and Apple Cash and major network gateway providers moving to faster payments as a way to serve all consumers and businesses.

Ultimately, those providers see faster payments as a way to boost the overall economy and well-being of consumers and businesses. Workers would get paid sooner and have the money placed in any account they would like, with the ability to choose the destination with each payment. And businesses could break the cycle of sending an invoice, getting a paper check two weeks later and then waiting another week for the bank to clear the check.

"The argument for doing this is that turnover is expensive and employee satisfaction is important, just as important for a business as customer satisfaction," Edwards said.

The hurdles, Edwards said, include traditional payroll systems, time-card systems, time-tracking devices, and the process of validating all of those checkpoints every two weeks.

"Change is hard at big companies because there is some risk management and data flow issues," Edwards said. Many companies already make loans available to employees based on their payment history and, over time, that concept will move over to real-time payment and time-card tracking, Edwards added.

If these providers can solve the puzzle of real-time authorization through artificial intelligence and other tools, it is "inevitable that this change is going to happen," said Maria Arminio, president of Avenue B Consulting Inc., a Redondo Beach, Calif.-based payments management consulting firm.

In participating on the Secure Payments Task Force for the Federal Reserve faster payments initiative, Arminio said the key issue being debated was making sure the sender of a payment had confidence that the person or company receiving the check was who they claimed to be.

"Still, it is ridiculous to have someone issue a paper check and wait for almost a two-week cycle before that transaction is completed," Arminio said. "The whole intention of faster payments was to change that dynamic."

Ingo Money has worked with Visa for the past six years, basically converting paper checks to digital money to become push payments to cards. It reinforced that concept and partnership recently through an agreement with

Many other players are placing stakes in the ground as digital money movers and faster payments or loan providers: OnDeck, Kabbage, Instant Payments, Even, Activehours, and PayForward. Plus, prepaid card providers

Most recently, Square launched a

In their own way, the major payments players like Visa, Mastercard and PayPal have variations of faster payment options. And then there are the major initiatives of same-day ACH, the Real Time Payments rails of The Clearing House and Mastercard's Vocalink in the U.K.

"At Mastercard, we believe that business is complex; payments shouldn't be," said Mastercard spokesperson Chaiti Sen.

With Vocalink technology, Mastercard moves "data with the dollars" to make reconciliation easier and thus making the payments real-time, Sen added.

Mastercard serves the gig economy, insurance and health-care industries with Mastercard Send instant digital payments. It also launched

"The popularity of digital marketplaces has allowed anyone with a smartphone to become a gig worker, but a payment that arrives even a few days later can have an impact on a gig worker's life," said Jess Turner, executive vice president of digital payments and labs in North America for Mastercard. "With Mastercard Send companies employing gig workers can pay almost anyone, anywhere through a secure process, blending stability and flexibility."

The concept of moving funds into a consumer or business account in real-time has a growing appeal among younger workers and the millions of Americans who live paycheck to paycheck, Ingo's Edwards said.

"The 'just in time population' or gig economy is what this is built for, but traditional hourly workers operate under the same scenario, so faster payments has to make its way to traditional payments," Edwards said.