It's been a chaotic week for the U.S.-based international payments establishment, facing the turmoil of being exploited in President Trump's clash with Mexico on one side, and the competitive bombshell of Alibaba's Ant Financial deal to buy MoneyGram on the other.

Ant, which is run by Chinese billionaire Jack Ma, has substantial scale. By tying its company to MoneyGram's base, partners and brand,

"This is a change of a different order of magnitude from previous forays of large Asian players into Western markets that were largely focused on serving their own consumers via acceptance and marketing deals," said Zil Bareisis, a senior analyst at Celent.

The U.S.-to-China payments corridor is one of the biggest in the world, according to the most recent World Bank data. It is dwarfed only by the U.S.-to-Mexico corridor, which the Trump campaign targeted as part of its border wall plan.

The MoneyGram acquisition is expected to close in the second half of 2017, but regulatory hurdles are not out of the question.

It's unclear if remittances will remain a part of Trump's plan to pressure Mexico, but Trump's rivalry with China could impact the Ant deal in a different way. Bloomberg reports The Treasury Department will likely scrutinize the deal, which run afoul of

"The political environment could have helped to keep the price for MoneyGram down," said Sarah Grotta, director of the debit advisory service at Mercator. "With the uncertainty around taxes (on) U.S. to Mexico remittances — or the potential to have remittance stopped altogether — doesn't help the near term outlook."

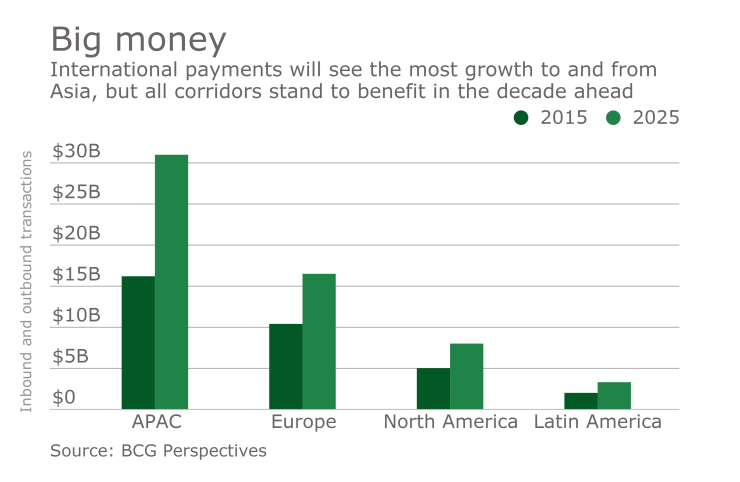

There are some potential positives around marketshare, according to Grotta. "The U.S. market for remittances is dominated by MoneyGram and Western Union, but I have estimated that combined, they still have less than 30% of the market. Ant could help expand the Asia corridors for MoneyGram."

Ant Financial's

Ant did not make an executive available for an interview. In an email from an external public relations team, a spokesperson said "MoneyGram is important for a whole number of reasons, both promoting inclusive finance globally and creating opportunities for growth in MoneyGram’s main ‘send’ markets. Obviously it's a bit early for detailed announcements, but ... the U.S. is a key market for the business."

Western Union and PayPal, two of the companies that would be most affected by the combination of Alipay and MoneyGram, did not return requests for comment by deadline.

"This does change the landscape in the money transfer business and cross-border payments. For example, for remittances the key is ensuring reach and efficiency in specific corridors between countries," Bareisis said. "The deal with Ant gives Moneygram access to large markets such as China and other Asian countries."

For Western Union, a company that predates the

"I think this move does probably give Western Union a little run for its money," said Talie Baker, an analyst with Aite Group. "There is intense competition and a lot of disruption in the remittance space these days and Western Union has always been the dominant player."

MoneyGram, which will retain its brand after the acquisition closes, will also have more heft to battle in the suddenly dynamic cross-border transfer market with Ant's backing.

"It certainly positions MoneyGram to have money to invest in innovation to ward off competition from startups like Xoom, Remitly, WorldRemit, etc.," Baker said.

The transaction was applauded by Ismail Ahmed, CEO and founder of WorldRemit.

"This deal is a recognition of the importance of remittances as a powerful driver of economic change, at both the individual and international level," Ahmed said in an email, adding a convergence of key technological and regulatory trends is driving M&A activity such as

"Remittances is one of the only industries that keeps even the poorest segments of society connected financially over long distances," Ahmed said. "It’s a $600 billion dollar industry today and growing, which is why we expect to see more deals of this type in future."