The vast majority of companies providing consumer loans at the e-commerce point of sale have done so after the 2008 recession, setting them up for a major test when the inevitable downturn in the economy occurs.

If some of those companies disappeared, it would be a difficult pill to swallow for businesses and consumers who have grown accustomed to the option during an online or mobile transaction to decide at the "moment of purchase" whether to make installment payments on a higher-priced item.

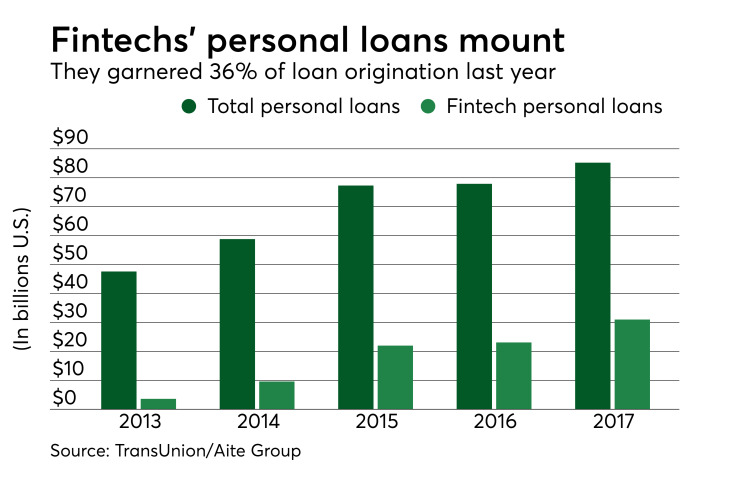

But the onset of artificial intelligence and machine learning could serve as the safety net some companies need, providing a different and more thorough twist on traditional underwriting and credit checks, new research from Aite Group suggests.

That process allows online lending during an e-commerce purchase to develop its own ecosystem that capitalizes on mobile commerce because of instantaneous decisions and rapid funding to consumer accounts, the report said.

"We know downturns happen, and when they do, unsecured lending is the first thing that takes a hit," said Thad Peterson, senior analyst with Boston-based Aite Group and author of the report regarding mobile opportunities in online lending. "A lot of these companies don't know what is going to happen when there is a downturn, and some certainly will not make it. But some companies are starting to use very different evaluative tools to determine credit score, using AI to learn not just what your salary is and how long you have worked at a company, but looking at factors not normally used to determine a credit score."

The factors include an applicant's company address and level of education, two data points that companies using AI consider prime predictors of default potential. The report also cited companies like Enova and Upstart as those providing real-time analytics for person-to-person lending marketplaces.

With that type of support, it has allowed companies to shift the focus from simply providing subprime loans to consumers who might not otherwise be able to obtain one, to that of being confident in the underwriting process and focusing more on making the experience very convenient for merchants and consumers, Peterson added. After all, he said, online-mobile commerce is "a slave to purchase friction."

PayPal Credit represents the longest-standing online lending product at the point of purchase, the result of acquiring the point of sale lender Bill Me Later in 2008. Bill Me Later was the first of its kind in 2000, and it was rebranded as PayPal Credit in 2014.

While a longtime player in the consumer lending field and a proponent of establishing frictionless payments and other services,

In addition, the Consumer Financial Protection Bureau slapped PayPal's hand in 2015, saying the company was

Those hiccups aside, there has been "tremendous demand" for the PayPal Credit option on e-commerce sites, and merchants are using it to help optimize their sites and track conversion of sales, said Dana Warren, senior director of global credit for PayPal.

"Today there is a clear desire for consumers to have POS-specific financing," Warren said. "The proliferation of providers is a great example of the demand on the consumer side and an understanding of the value on the merchant side."

The company clearly remains in a better position than most of its competitors, in part because of its reported 225 million customer database. PayPal's research also has found that midsize merchants adding the PayPal Credit button to their sites, on average, will benefit from an incremental sales lift of 9%, Warren added. In addition, more than 50% of PayPal Credit users say they wouldn't have completed their online transactions without the loan option.

Currently, 19.5 million merchants accept PayPal payments, and consumers can opt for PayPal Credit with all of those merchants.

Others notice that sort of acceptance rate and sales numbers, and it has translated into a significant increase in online lending providers since Bill Me Later took its maiden journey 18 years ago.

Other "moment of purchase" lenders include PayPal co-founder Max Levchin's

Just this week, American Express announced a partnership with the point of sale lender

The convenience of online lending "drives straight into the millennial intersect," which is an important market for payments companies, Aite's Peterson said.

"The thing about PayPal and some others, that if you are enrolled in their service, they already have a wealth of information about you and it only takes two or three clicks to obtain the loan and get back to making the payment," Peterson added.

Consumers can use their own PayPal Wallet or the PayPal Credit button on a merchant site to apply for the lending option. After applying, it becomes part of the user's PayPal credentials in the sense that they have the ability to borrow at any site accepting PayPal and offering the Credit button.

"They are bringing that line of credit to a million merchants," Warren said. "And if you are new to the process, we go to painstaking lengths to ensure consumer transparency for what they are applying for."