Seasoned payments industry observers predicted it would take time for mobile wallets to catch on, but few thought adoption would reverse course so soon.

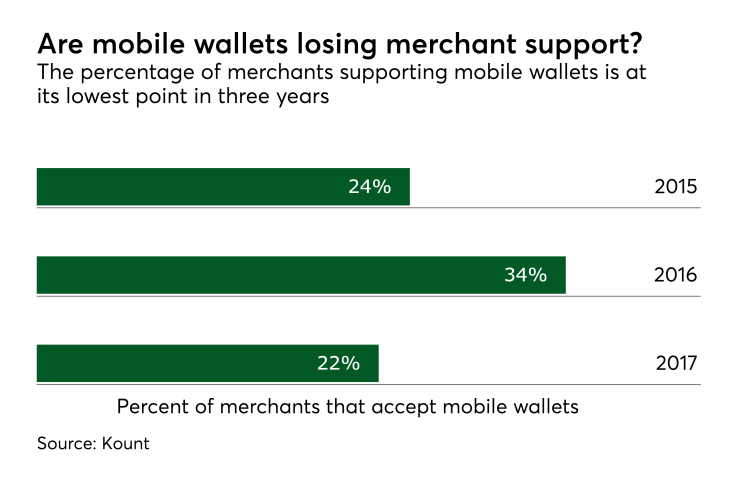

The Boise, Idaho-based fraud-management firm Kount found a notable drop this year in the overall percentage of "merchants that accept mobile wallets," to 22% from 34% in 2016. The latest figure dips below 2015 figures, when 24% of merchants Kount surveyed said they supported mobile wallets.

“Even with the influx of new mobile wallet options, our survey found that merchants have been slow to adopt these payment options,” said Don Bush, Kount’s vice president of marketing. Kount surveyed 800 merchants from April to June 2017.

A closer look at Kount’s data suggests several possibilities, including the fact that while merchants as a whole still plan to adopt mobile wallets, there’s a split between larger and smaller merchants that may be skewing results.

This year about 40% of higher-revenue merchants—those with $250 million in annual revenue—said they support mobile wallets, compared with only 19% of merchants with less than $25 million in annual revenues who said so, and 11% of merchants with less than $5 million in revenue.

Bush said merchants are bullish overall on the future of mobile wallet growth, and 70% of all merchants surveyed said they expect widespread adoption of mobile wallets is two to five years away, Kount said.

One drag on mobile wallet adoption could be the choppy rollouts by the major third-party wallets, creating uncertainty for merchants who had expected to support them earlier.

Apple launched Apple Pay in October 2015, several months ahead of Android Pay and Samsung Pay. Canadian merchants didn’t get access to Android Pay until

“As with any emerging technology, we first see a proliferation, where more and more brands introduce mobile payment options to the market, followed by a collapse,” Bush said. “We are still in the expansion stage of mobile wallets and we’ll see swings in adoption, in part because many wallets didn’t show up on our first survey (in 2015) and the definition of wallet has also changed, as increased education in the market has also influenced merchants changing their perceptions about wallets.”

Experts say several factors could account for the ups and downs in merchant adoption of mobile wallets.

“Mobile wallets are evolving very fast, a lot of experimentation is going on around what makes for a good user experience, and a lot of mistakes are being made,” said Aaron McPherson, an independent payments analyst. “Some merchants have had rocky rollouts and some consumers who tried using a mobile wallet had a bad experience and didn’t try it again, which could lead to some disillusionment.”

Measuring merchants’ usage of mobile wallets also is becoming trickier, as the options now include third-party wallets, QR code-based merchant wallets and digital wallets embedded in checkout pages, McPherson said.

“Merchants are rapidly getting savvier about mobile wallets, but there’s a lot of overlap in different wallet descriptions that may be confusing them, so the results we’re seeing from surveys now may not be stable,” McPherson said.

The takeaway from Kount’s survey is that merchants currently are operating in an uneven landscape with mobile wallets, according to Patricia Hewitt, CEO of PG Research & Advisory Services in Savannah, Ga.

“It’s clear that the merchants that drive the most volume are all participating as acceptance points for at least the major (third-party) wallet providers,” Hewitt said. “What we see here is that the market remains uneven between acceptance and adoption, but a new-technology adoption window of two to five years, in an infrastructure-heavy market like North America, is well within the boundaries of normal development curves.”