More than two years after Apple Pay made its debut, less than 20% of U.S. shoppers are routinely using their smartphones for

In the last six months, only 19.4% of smartphone owners used Near Field Communication-based wallets like Apple Pay, Android Pay or Samsung Pay or QR code-based mobile payment apps from

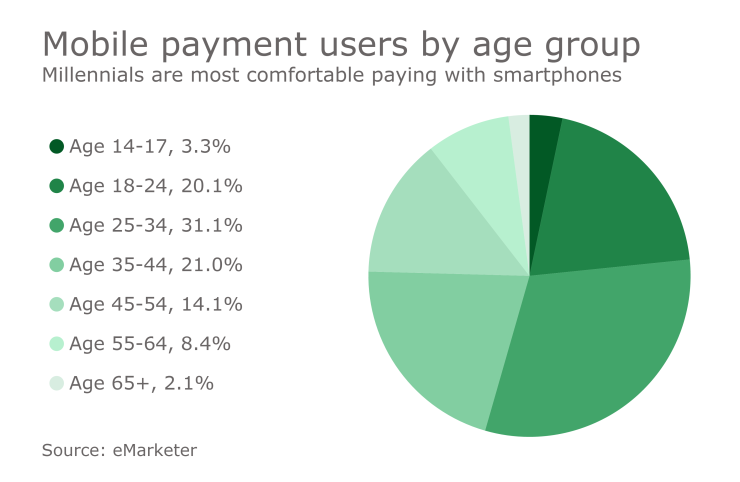

As the most tech-savvy group of adult consumers, millennials are most comfortable with mobile payments. Among U.S. consumers 25 to 34 years old, 31.1% said they used their smartphone to make an in-store purchase in the last half-year, eMarketer said. More are on track to join the fray. By next year, 55% of all U.S. mobile payment users will be under the age of 35, eMarketer forecasts.

U.S. consumers as a whole will continue to move slowly in adopting mobile payments, weighed down by concerns about security, a lack of widespread merchant acceptance and no compelling reason to switch payment methods, according to eMarketer. By 2020, only 33.1% of all smartphone users will routinely make mobile payments, the firm's data suggests.

But retailers should take note that mobile payments volume is poised to rise sharply. This year in-store mobile payments transaction volume will reach $27.67 billion, but if present trends continue, by 2020 that number will soar to $314 billion, the research firm predicts.

“Increasing acceptance of proximity payments at a wider array of merchants is pushing average spend via such methods higher, which helps explain why transaction value is growing far faster than the number of users,” said Bryan Yeager, an eMarketer analyst, in the release.