For the first time, physical goods are the most purchased items on mobile devices, according to a recent report from Javelin Strategy and Research. But the bigger takeaway is what this means for bringing mobile payments into other channels.

Previously, the most common purchases made from a phone were products that were downloaded directly to the handset, such as ringtones and apps. This is why many argued that Apple was already the dominant player in mobile payments years before the introduction of Apple Pay.

But today, "smartphone screen sizes are large, 4G is prevalent, merchant support for mobile browsers is strong, buy buttons and one-click [are] exploding, and device-specific features are being leveraged through native apps to cut down on the pain of adding new cards to checkout, like mobile imaging," said Javelin Research Specialist Daniel Van Dyke. "Put shortly, all the necessary conditions for retail commerce are met."

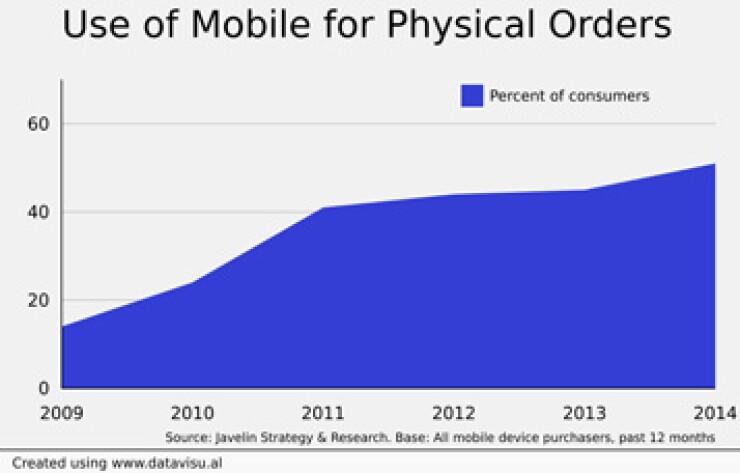

Javelin reported that 51% of all mobile purchases are now physical, compared with games (38%), music (38%), apps (37%) and ringtones (18%). But that slim majority for physical mobile purchases has been creeping up for years. Back in 2009, Javelin placed mobile purchases of physical goods at just 14%, growing to 24% in 2010 (the year the first iPad was introduced) before shooting up to 41% in 2011. Since then, it has increased gradually until finally hitting 51% last year, according to the report released this month.

The fact that physical goods are now commanding the top tier of mobile purchases wouldn't be that significant if mobile sales weren't growing on their own. But Javelin's figures demonstrate sharp increases, with $75.8 billion tracked from last year's mobile purchases, up about 15% from the $65.7 billion recorded in 2013. Javelin found that mobile purchases more than tripled from 2012 to 2014 and is projecting a 23% compounded annual growth rate for the next few years. That leads to the firm's projection of $93.6 billion by the end of this year and $217.4 billion in mobile commerce sales by 2019.

Unlike desktop e-commerce purchases, though, mobile covers a bit more territory. A mobile payment can simply be a purchase on a mobile website, but it can also be a contactless NFC or Bluetooth beacon-based payment in a store. It could even be a purchase made from a retailer's website while the shopper is in one of its physical stores. Those activities have perhaps the greatest potential for rewriting how retail is done over the next several years; the report found only $4 billion in mobile wallet purchases last year, but Apple Pay didn't come about until October.

In-store payments, Javelin notes, are still dwarfed by the rest of mobile commerce. "For every dollar spent through mobile proximity payments, $19 is spent through mobile browsers and apps," the report said.

The report also looked at the mobile payments between iOS and Android and found that Apple's advantage has thinned out. Javelin found that 76% of iPhone users and 77% of iPad users made mobile payments. This is only a slight lead over the 73% of Android phone users, 72% of Android tablet users and 74% of Amazon Fire device users (Amazon's Fire phones and tablets are based on Android).

The biggest practical difference between device-based m-commerce and desktop-based e-commerce is that mobile allows 2-way communication. The devices can use Bluetooth to announce themselves upon entering a store, can

"The metrics for effective sales are changing at the same rate consumers are changing the ways they interact with technology," Van Dyke said. "Retailers need tremendous agility to hop to every new platform consumers turn to for shopping, as consumer technology adoption cycles continue to accelerate with each new device type introduced: smartphones, tablets, now wearables."

As shoppers become more comfortable with mobileand larger screen sizes, as much as anything else, are doing thatthat is going to force retailers to make even more rapid changes to accommodate and to stay ahead of mobile purchase interactions.

"As soon as (shoppers) feel the desireat home or on the goits a matter of a rapidly shrinking number of taps to have their desired item packed and shipped their way. It seems like the only good reason to turn to a laptop over a large-screened smartphone or tablet for online shopping is habit," Van Dyke said. "Providers that leverage the device specific capabilities of mobile to enhance the shopping experience, like Amazon, will enjoy an increasingly disproportionate share of all online commerce in the coming years."

Van Dyke also wondered how much industry disruptionmostly in terms of startups undercutting major chainswould occur based on mobile technology. Unlike earlier e-commerce market battles, though, he predicts the established players may fare better with mobile as long as they don't ignore the need to stay competitive.

"I could envision a scenario years down the line that leaders today have such distinct advantages with regard to one- or two-day shipping, one-click, and superior selection that they could risk becoming complacent and still maintain their lead for the short term," he said. "In such a scenario, conditions would be ripe for disruption by a start-up. However, most successful startups in online retail today will likely focus on perfecting one aspect of the checkout or browsing experience and aim for an acquisition."