Pine Labs has raised $285 million in its latest funding round, including participation from Singapore’s sovereign fund Temasek, to continue its geographic and product expansion.

The New Delhi-based startup raised funds from eight different firms as it expands its global investor base. The new investors included Baron Capital Group, Duro Capital, Marshall Wace, Moore Strategic Ventures and Ward Ferry Management. Three existing investors also participated in the round to bolster Pine Labs’ capital base:

“We are very excited to be a part of the technological transformation that Pine Labs is driving on the ground in payments and the multiple interlinkages and efficiencies it is able to create by providing faster, cost effective consumer access to a broader range of financial products such as BNPL, where it is driving a pioneering effort on behalf of the financial system,” Amit Rajpal, CEO and portfolio manager of Marshall Wace Asia, said in a press release. “We are also excited about an Indian business being able to drive regional and potentially global adoption of its intellectual property and this represents significant optionality for the future.”

In March,

Pine Labs serves more than 150,000 clients with its online and offline merchant acquiring solutions. In April, the company acquired

Pine Labs has raised over $423 million, over eight rounds since 2009 from a total of 15 different investors based on data from

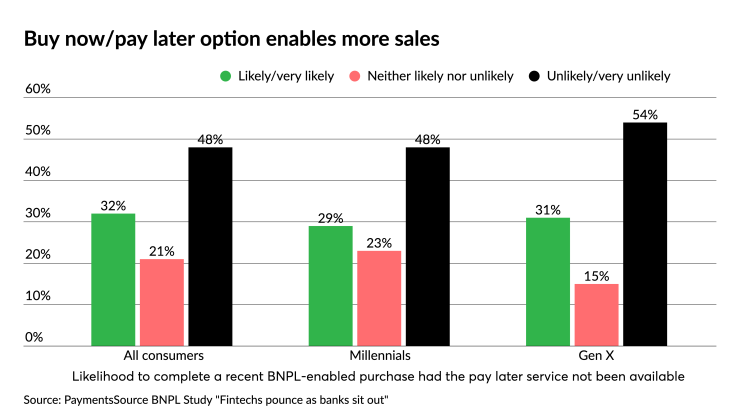

Buy now/pay later services have become increasingly common across global markets as an important financial tool to enable sales, often to people who lack the necessary credit. A PaymentsSource study released in March, titled

“Pine Labs has rapidly transformed from a single product company offering retail acceptance of payments to a broader payments platform,” Shailendra Singh, managing director at Sequoia Capital, said in the release. “The company now serves hundreds of thousands of merchants for payments through cards and UPI, processing tens of billions of payment volume. In addition, their market leading Pay Later product sees $3 billion in annualized EMI transactions. Through the acquisitions of QwikCilver and Fave, Pine Labs is now the number one prepaid-issuing platform as well as the top consumer loyalty product in this market.”