With the Canadian federal government looking to disburse welfare payments to prepaid cards, the nation's prepaid card market will likely experience growth similar to that seen in the U.S. due to federal and state government prepaid load programs.

A key difference today between the Canadian and U.S. prepaid card markets is that, unlike the U.S., Canadian federal government agencies don’t disburse welfare payments, pensions and tax refunds to prepaid cards. Instead, government payments are deposited directly to recipients’ bank accounts or mailed as checks.

“The Canadian federal government wants to make its disbursements more efficient, and wants to include prepaid cards as part of its government payments toolkit,” said Jennifer Tramontana, president of the Canadian Prepaid Providers Organization (CPPO). “Every year there is CA$400 million in uncashed government checks as well as government check fraud. Because they are more efficient, we’ll see a lot more use of prepaid cards for Canadian government disbursements. I expect there to be a tipping point for government payouts to prepaid cards.”

If Canada follows the example set by the U.S. for disbursements, it could supercharge the overall market for prepaid cards.

“The fact that the U.S. government provided COVID stimulus money on prepaid cards put prepaid card volumes in the U.S. into the stratosphere over the last year,” said Amy Dunckelmann, Mercator Advisory Group’s vice president, research operations.

The prepaid card market is typically divided between open-loop cards, which can be used at any merchant that accepts mainstream debit cards, and closed-loop products like transit fare cards, which are limited to a specific use.

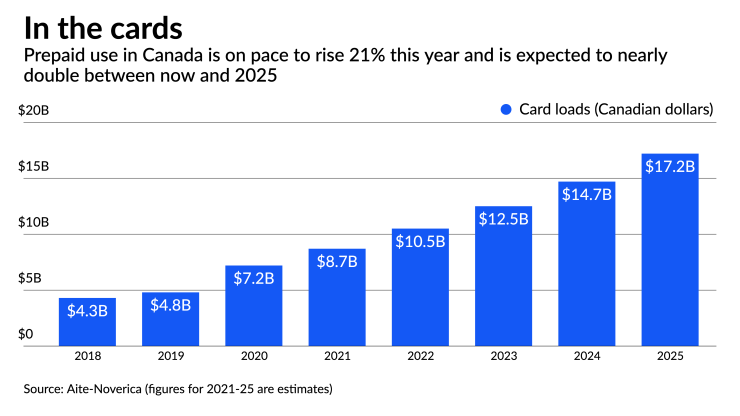

According to Aite-Novarica and the CPPO, Canadian open-loop prepaid card loads will grow to CA$8.7 billion in 2021 from CA$7.2 billion in 2020 and CA$4.8 billion in 2019. At the end of 2020, there were 46 million open-loop prepaid card accounts in Canada, with gift cards representing the largest category. General-purpose reloadable prepaid card loads rose to CA$3.6 billion in 2020 from CA$2.8 billion in 2019, while gift card loads rose to CA$2.1 billion from CA$1.4 billion during the same period.

With the Canadian government expected to disburse welfare and other payouts to prepaid cards, there will be a significant opportunity for U.S. and Canadian prepaid program managers, said Francisco Javier Alvarez-Evangelista, advisor at Aite-Novarica.

“Other untapped areas where I see opportunities for prepaid card providers are buy now/pay later and early wage access,” he said. “All the big U.S. prepaid providers have operations in Canada, but there are a lot of upcoming U.S. niche prepaid program managers who should look at Canada. The Canadian open-loop prepaid card market is growing so fast due to innovative use cases that there is space for multiple providers. Canada is relatively welcoming to new entrants from the U.S.”

Going digital

In the U.S. and Canada, the sale of prepaid and gift cards has largely moved online because COVID is slowing down in-store traffic.

“Eight years ago, the Canadian prepaid card market largely involved physical cards,” said Alvarez-Evangelista. “Now most prepaid card programs have moved to online acquisition channels offering both virtual and physical cards.”

Canada is a mature market for the U.S. gift card giant Blackhawk Network, but there’s still plenty of opportunity, said Chris Jones, Blackhawk Canada’s vice president of digital services and incentives.

Blackhawk has seen a slowdown in Canadian in-store sales of closed- and open-loop gift cards but sees opportunities in online sales, Jones said. “The growth area for us is in digital channels where consumers can buy virtual prepaid cards as well as physical gift cards that are couriered to recipients,” he said.

According to a July 2021 survey by the Canadian core payment systems operator Payments Canada, 42% of respondents said the pandemic had changed their payments preferences to digital and contactless for the long term. The survey, which covered multiple payment methods, found that 50% of respondents use e-commerce more often than previously and that 33% report using food delivery services such as Uber Eats more often. Cyrielle Chiron, Payments Canada’s chief strategy officer, said that people won’t abandon online shopping habits formed during the pandemic.

“Growth in Canadian open-loop prepaid card usage for everyday spending accelerated during the pandemic and is here to stay,” said Maria Riesenberg, Mastercard Canada’s director of business development. “Cardholders now use prepaid cards online and in-store for everyday purchases such as groceries and dining as well as niche spend categories.”

Other opportunities for prepaid

COVID accelerated the use of prepaid card programs for early wage access (EWA) in Canada and the U.S., enabling gig economy workers such as delivery drivers to gain fast access to their earnings. Prepaid cards will also likely benefit from the spread of buy now/pay later loans.

“There’s a lot of opportunity to use BNPL to buy gift cards,” said Alvarez-Evangelista. “There will always be people who want to pay for their gift cards in four installments.”

Blackhawk Canada plans to offer buy now/pay later for purchasing gift cards on its digital channels through a partnership with a BNPL provider, Jones said.

“We have some partners who want to use BNPL so consumers can buy these firms’ gift or prepaid cards and finance the purchase over four installments,” he said.

BNPL is an emerging use case, enabling consumers to pay for gift card purchases in installments. In October 2021, Blackhawk partnered with the BNPL platform Zip to enable consumers to use Zip’s Pay in 4 program to buy gift cards. So far the partnership is live only in the U.S.

Prepaid incentive cards are a growth area for Blackhawk Canada, with retailers using them as rewards for purchases to attract consumers back into stores.

“During COVID, prepaid emerged as a go-to product for the incentive market,” said Jones. “In the last few months as people have resumed shopping in stores, we’ve really seen an increase in prepaid incentive card issuance. We’re also seeing prepaid cards being used by employers to thank staff for their increased workload over the 18 months while working from home.”

Open-loop prepaid cards are used by younger consumers for managing spending and improving their financial literacy, Riesenberg said.

The RBC subsidiary RBC Ventures has created Mydoh, a money management app and prepaid card that helps 10- to 15-year-olds make earning and spending decisions. Customers of any Canadian financial institution can create and fund the prepaid Mydoh account for their children, said Gaurav Kapoor, Mydoh’s CEO.

Mydoh accounts provide virtual and plastic Visa cards and provide parents with visibility into their children’s spending.

“As things open up, we’re seeing volumes pick up on our plastic cards,” said Kapoor. “Games are one of our top merchant categories, and we’re seeing teenagers using our cards at stores such as Walmart and at fast food chains. They also use Mydoh cards for ordering food deliveries from Uber Eats.”

Prepaid cards are also helping delivery and ride-share drivers manage their cash flow, by letting them gain earlier access to their wages to cover fuel and other expenses.

“Delivery drivers can’t wait until the end of the week to get paid,” said Marco Margiotta, CEO of the Toronto-based EWA provider Payfare. Ninety percent of Payfare's business stems from the U.S.

Because these drivers use Payfare's cards to cover necessary expenses such as fuel and meals, “this leads to higher spending on our cards than for other types of prepaid card programs," Margiotta said.

Payfare plans to use its EWA platform to offer loan products such as mini lines of credit and installment loans.

“You can get very creative in adjudicating and underwriting loans when you have a complete view of a borrower,” said Margiotta. “We can see how our users make their money, what the source of their money is and what their spending habits are. We can lower their risk profile and pass the savings on interest charges to them so they can avoid predatory payday lenders.”

Since Payfare’s users are mostly immigrants, the company has partnered with Wise for low-cost remittances. “We’ll be rolling out our partnership with Wise in 2022,” Margiotta said.