Sole proprietors who are African-American or Hispanic are less likely than their white counterparts to have their funding needs met and are more likely to be discouraged from applying for credit, according to a new report by the Federal Reserve Bank of New York.

The report, issued on Wednesday, suggests this is yet one more example of the wealth gap among racial groups in the United States. It also suggests that banks and other lenders have an opportunity to reach this segment of the market with alternative financial products, especially those that focus on building credit.

The Small Business Credit Survey on Nonemployer Firms zeroes in on those businesses that employ no other staff than the owner. That group can include freelancers and contractors earning 1099 income, gig-economy workers or businesses that intend to eventually hire more employees but simply have not yet.

While the group defies neat categorization, the report’s authors point out that nonemployer firms make up 81% of all small businesses in the country. The smallest of small businesses also face greater challenges, like a heavier reliance on personal collateral and guarantees, and those challenges are often tougher for nonwhite owners.

“A majority of these firms struggle with making a profit, facing both rising costs and limits in passing on those costs to consumers,” Claire Kramer Mills, assistant vice president at the New York Fed, said in a press release that accompanied the report. “The data also underscore financing challenges for nonwhite business owners, echoing similar findings for employer firms.”

Sixty-two percent of nonemployer firms said they have had financial challenges in the prior 12 months, but 76% of black-owned firms reported financial difficulties. The same statement was made by 70% of Hispanic-owned firms and 59% of white-owned firms.

Thirty-nine percent of all nonemployer firms said they had all their funding needs met, but just 17% of black-owned and 25% of Hispanic-owned businesses said as much.

Among those that applied for financing, 38% of all nonemployer firms said they received none. This was true for 36% of white-owned firms compared with 54% of black-owned firms and 45% of Hispanic-owned firms.

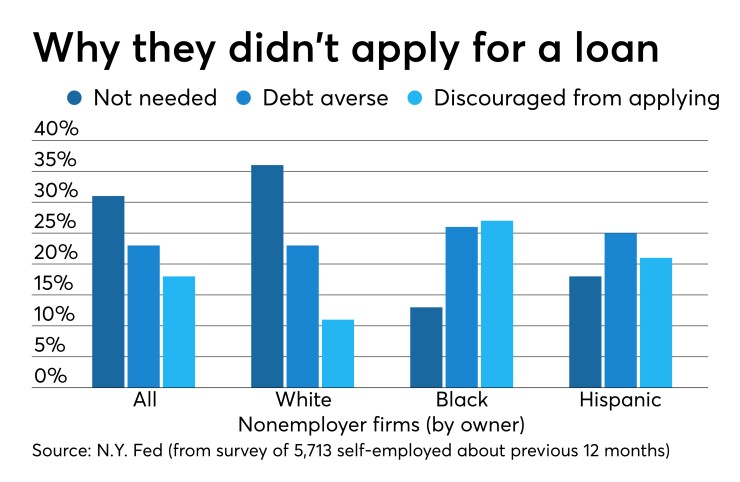

Among the firms that did not apply for financing, 36% said it was because they were either debt averse or discouraged from applying. Black- and Hispanic-owned firms were likelier to say they did not apply because they were discouraged or debt averse, while white-owned firms were likeliest to say that they already had enough financing.

On some level, it may be rational for business owners operating close to the margins to be wary of debt. On the other hand, the firms who said they were “discouraged” did not apply because they believed they would be turned down. That could be because they have previously been turned down for financing or because they know others who have been.

A third of nonemployer firms with debt have unsecured debt, indicating they may not qualify for debt that requires collateral.

Nonemployer firms also often end up using the owner’s personal credit score or personal assets to obtain financing. Because black and Hispanic families accumulate

Fifty-eight percent of all nonemployer firms said their firm was a low credit risk, but 70% of black-owned firms and 56% of Hispanic-owned firms described their business as medium or high credit risk.

For lenders, the findings suggest there could be demand for alternative types of small-business financing, like small-business loans underwritten using a firm’s payment history,

After all, most of these very small firms want their businesses to grow. Of all those business owners who applied for financing, the majority said they wanted to expand their business or explore a new opportunity.