Many consumers have become accustomed to tapping their phones at checkout, but scanning their palm or paying with their face is still more of a novelty in the U.S.

Yet, with Amazon, PopID and others rolling out in-store

While still in its infancy, Goode Intelligence

Consumers are interested in biometric payments

Notably, 68% of consumers polled said they had used biometrics for any reason, according to the Javelin 2024 North American Payment Insights Emerging Payments survey. Nearly half, 47%, said they are likely or very likely to use biometric authentication at a store using a terminal provided by a merchant.

What's more, banks are trusted by 41% of consumers to store their biometric data ahead of tech companies like Apple and Google or government agencies, Javelin data show.

The PopID model

PopID, a majority-owned subsidiary of the investment company Cali Group, allows consumers to use biometric checkout at more than 380 locations of quick-serve restaurants and retailers across the country. Last summer, the company announced an expanded relationship with

One of those merchants is the restaurant chain Whataburger, which said in a

The Amazon One solution

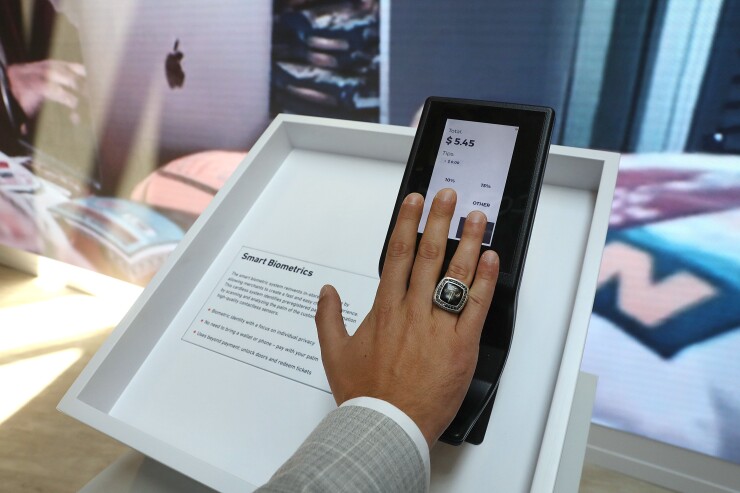

Amazon One uses palm-vein recognition, which relies on the veins in an individual's palm below the surface of the skin, for payments. By holding one's palm over the Amazon One device, the technology evaluates multiple aspects of it to identify the individual. Cameras in the hardware capture surface-area details like lines and ridges, as well as subcutaneous features such as vein patterns, according to a description on Amazon's website.

The technology is available at the point of sale at more than 500 Whole Foods Market locations, and select other locations across the U.S., including Amazon Go, Amazon Fresh, stadiums, airports, fitness centers and convenience stores.

Examples outside the U.S.

Several pilots are underway outside the U.S., with examples in South America and across Asia and Europe.

In 2022, Mastercard

Read more about biometrics.

In November, Tencent

In May, NEC said it would

Challenges persist

In the U.S., adoption of face or palm biometrics has been a work in progress for several years, but Miller predicts these types of payments will become more popular over time for multiple reasons, including ease of use.

Still, there are challenges. The fraud rate is low for many existing payment methods, including tap-to-pay POS transactions, and it's pretty fast, so it might be hard to convince people — at least initially — that paying by face or with their palm is so much better, Miller told American Banker. "The immediate trigger that would drive substantial uptake right away, just isn't there," he added.

Still, some consumers might find paying with their palm or face more compelling if there are ancillary benefits. This could include entrance to a sports arena, payment for beverages, access to a club area and more, all with your face. There are systems in development that can continuously recognize you, so re-authorization wouldn't be necessary, Miller said.