Seattle-based Remitly launched in 2011 with the goal of building a fully digital approach for beaming funds around the world, but while senders prefer mobile devices, recipients remain stubbornly attached to receiving cash.

Migrating more users to mobile devices for a range of transactions remains a top goal, and Remitly hopes to achieve that with $220 million it received this month from investors, according to Matt Oppenheimer, Remitly’s co-founder and CEO. The influx brings its total outside investments to about $420 million.

“With the global popularity of mobile devices, people might think cash is becoming less relevant, but that’s not the case — the customers we serve still rely heavily on cash payouts,” Oppenheimer said. “We’re expanding to new markets, speeding up cash delivery so it's closer to real time, and we’re going to develop new financial services to engage more users with digital products."

Remitly has ramped up immediacy with its network of 150,000 walk-up centers, including banks and shops directly integrated with its platform, where recipients can pick up cash minutes after it’s sent. In many markets, Remitly now promises on-the-hour home-delivery of cash.

In the last 18 months, Remitly also boosted its overall geographic reach by more than 30%, so senders in the U.S. and 15 other markets can transmit funds to 44 global markets. It has plans to add more locations over the next year in key markets in Latin America, Africa and Asia, according to Oppenheimer.

By honing its cash-delivery services for recipients regularly receiving funds, Remitly will try to gradually woo those users to try other products that might lessen their reliance on cash, Oppenheimer suggested.

Examples include insurance, loans for consumers with no credit history and digital bank accounts available with little documentation, he said.

“We aren’t ready to talk about specifics yet, but we plan to develop other financial services beyond remittances for our customer base,” Oppenheimer said.

Remitly will use another portion of its recent funding influx — $85 million in debt financing — to directly fund remittances as its volume accelerates with geographic expansion.

Other payments industry players are using a similar approach with digital apps and related services to cut into the market share of dominant legacy remittance providers like Western Union and MoneyGram.

Remitly rival

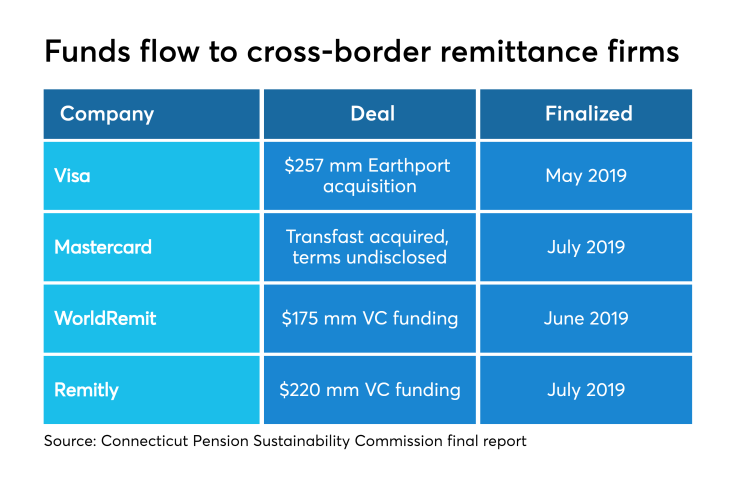

Major card networks also are wading deeper into cross-border remittances by working with startups — Remitly partnered with Visa last year to add a quick direct-debit funding option to its services — and developing their own global remittance power.

“Fintech has not yet solved the challenges in cross-border payments in the same way it has for domestic payments, so there’s a lot of opportunity for companies like Remitly and WorldRemit that are establishing their own global payment networks and it's attractive to the card networks,” said Talie Baker, a senior analyst at Aite Group.

But remittance recipients in emerging markets will be slow to let go of cash, Baker predicts.

“As mobile money continues to proliferate in less-developed countries, I think we’ll see digital become more important on the receive side of remittances, but it’s a little ways out,” she said.

For both Remitly and WorldRemit, the longer-term challenge will be showing consistent profits in an increasingly competitive arena.

“It’s insanely expensive to operate a money-transfer operation and it takes a ton of capital, so the ability to manage the business and turn a profit is the number one challenge for these companies,” she said.