Mastercard has spent more than $4 billion on investments so far in 2019 to thread a needle between several must-haves in the digital payments market.

The card brand has agreed to buy a majority of Denmark-based Nets' corporate services business for about $3.19 billion, Mastercard's largest acquisition in this or any year. The price tag is justified in part by the risk that would come if Mastercard tried to compete for a more affordable firm — Mastercard tried to instigate a bidding war for a different company, Earthport, this year only to see it stick to its original suitor,

From Nets, Mastercard will get technology to support clearing, e-billing and instant payment services when the deal closes in the first half of 2020.

"The global adoption of real-time payments is moving quickly," said Paul Stoddart, president of new payment platforms for Mastercard in London. "More markets are coming out of implementation and looking at different use cases and lots of other markets are in the process of implementing it."

The Nets deal follows several relatively smaller Mastercard investments and is taking place alongside a scramble from governments, fintechs and financial firms to conquer the intersection of real-time processing, cross-border payments, account-to-account transfers and B2B transactions.

These capabilities are all necessary for issuers, merchants and acquirers to thrive in an Amazon-influenced market that demands borderless retail, supply chains and instant access to funds. The market's largest payment processors have already shelled out

"Mastercard sees an insane market opportunity," said Erika Bauman, a senior research analyst for Aite Group. "The commerce of tomorrow means solving cross-border and account to account settlement. No one has really figured out how to do this at scale."

Nets gives Mastercard a heavier bat to swing at open banking, bill pay, data analytics and real-time payments. Nets' corporate service business adds scale to Mastercard Send and Transfast, and gives Mastercard greater account-to-account reach in continental Europe to match the card brand's A2A heft in the U.K., Asia, Africa, the Middle East and the Americas.

"The acquisition of Vocalink was a first step in offering ACH and real time payments, this is about further accelerating and doubling down," said Stoddart, who was the CEO of Vocalink before Mastercard purchased it. "The [Nets] deal will help us in Europe and provide technology that can be extended to other markets."

Nets was traditionally a Nordic payments technology power, though a fast series of private equity deals over the past three years has allowed

The Nets deal will immediately catalyze other faster payments initiatives because Mastercard is not operating in a vacuum.

Visa has made its own faster payment plays, including a collaboration with Western Union and the acquisition of

"This catches the attention of anyone who doesn't have a real-time payments plan, or are doing a wait-and-see," Bauman said. "With Visa, Mastercard and now the Fed, making faster payments a part of overall payments strategy is vital."

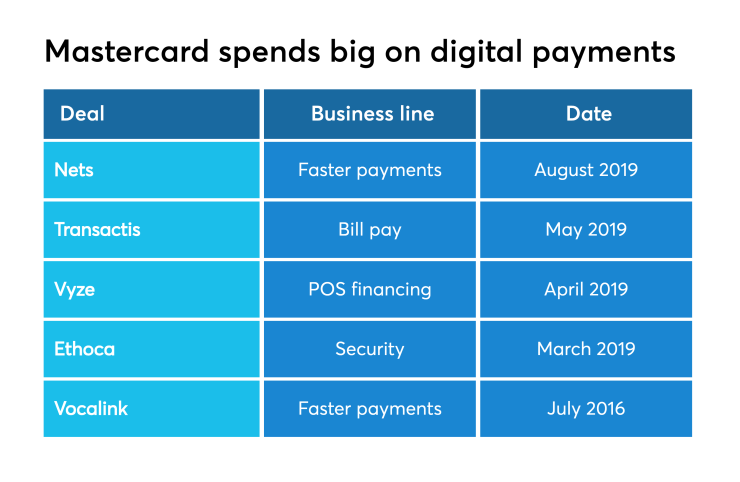

Mastercard's tying its Nets deal to other acquisitions that fill needs in cross-border, faster processing and B2B payments. Mastercard acquired

The card brand also made two deals earlier in 2019, acquiring

Mastercard left open the possibility of even more deals as it attempts to create a one-stop for B2B, A2A and faster payments across borders. In its most recent earnings call,

Nets will provide bill payment and opening banking technology with added speed and scale, along with data analytics and more fraud protection, Mastercard contends. This is designed to bolster the earlier acquisitions, such as Transactis' bill payment. The added fraud protection also addresses PSD2 regulations, making it easier for fintechs and banks to collaborate on digital payment and e-commerce development and push faster payments.

"I cannot build and implement technology quickly enough," Stoddart said, and the time and recruitment needed to organically build the technology is prohibitive, he said. "We're implementing in six or seven markets in parallel."