Fill a room with 100 financial services CEOs. It's likely that only one of them is a woman, even in 2016.

"The percentage of women is increasing but is still not significant," said Diane Vogt Faro, CEO of JetPay and co-founder of the Women's Network in Electronic Transactions (Wnet), a not-for-profit women's professional organization serving the credit card, electronic payment, mobile technology and virtual currency markets.

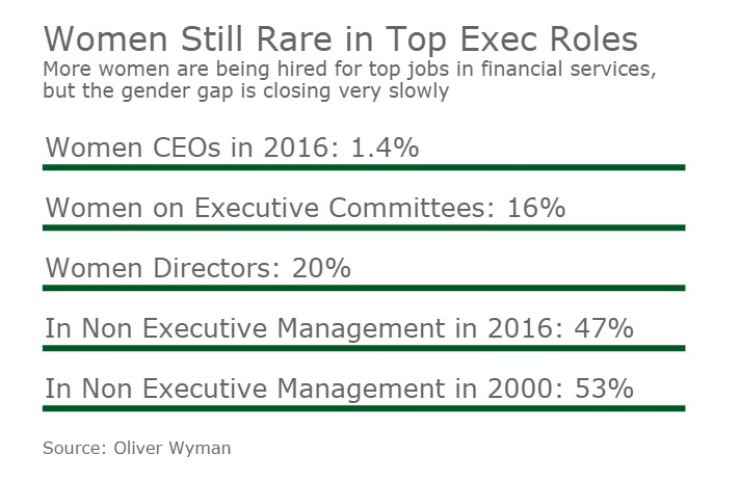

It's a slow improvement over past years—in 2003, 12% of board members of financial institutions and 11% of executive committee members were women. Oliver Wyman's report did not break out the percentage of women in payment-specific companies or payment-specific executive committee jobs in detail, but a spokesperson for the research firm said 22% of executive committee spots at the payment-focused companies in the company's research group are occupied by women.

This places the U.S. is in the middle of the pack when compared to the rest of the world. Scandinavian countries such as Norway and Sweden have a much higher 33% and 32% of women board members; while Asian countries such as South Korea and Japan are much lower, at 4% and 2%. At the current rate of growth, which remains slow, women on executive committees will not reach 30% globally until 2048, Oliver Wyman reports.

Additionally, Oliver Wyman reports the percentage of women in general management and professional positions outside of the executive board committee in financial services is decreasing—to about 47% in 2016 from 53% in 2000. And only 1.4% of financial services CEOs are women, according to the report.

There's also a pay gap for women in "elite" jobs across all industries, according to

A big difference between now and the past, Faro said, is the networking and community among women executives, which she said did not exist when her career began in the 1970s. Faro founded Wnet in 2005, along with payments industry veterans

"Mentoring was nearly non-existent when I started," Faro said, adding the challenges women face as executives can be isolating without communication within a community of peers. "I guess maybe I have thick skin and I didn't involve myself with people that I knew would not be supportive earlier in my career."

Community implies a place of support, information sharing, mentorship and sponsorship, and for women in financial services, it's critical because women have traditionally been excluded from career information sharing, said Ghela Boskovich, director of global business development for Zafin, a Vancouver-based bank software developer; and founder of FemTechGlobal, an organization aiming to reduce the gender gap in financial technology.

"What we can't forget is that the community women to try to bridge the gender gap cannot and should not be exclusively comprised of only women," Boskovich said. "Men are part of the community and need to be welcomed into it. More inclusivity of women in executive ranks requires men in executive suites to advocate for equality."

There is also communication among women in industries outside of payments and financial services, Faro said, adding the percentages of women in top executive roles are relatively similar, and relatively low, for most industries.

"The whole idea is to get women speaking to each other, that they are not alone and there are other women who have the same challenges," Faro said.

Beyond the low percentage, workplace attitudes toward women in executive positions are still a challenge, Faro said.

"Those types of things still exist today, though not as significantly as in the past," Faro said. "And there are programs today that help women deal with it."

Financial services and payments companies rely more on technology companies as partners, or are technology companies, a sector of the overall economy in which women executives have faced

"There are so many problems, from rampant harassment, to blatant discrimination in acceptance of coding, to family unfriendly work hours to perpetuating myths that boys are better than girls at maths and sciences," Boskovich said. "Again, this is systemic, but its root cause is related to unconscious bias and privilege. Start with correcting perception biases, and we'll be better able to correct the systemic imbalance."