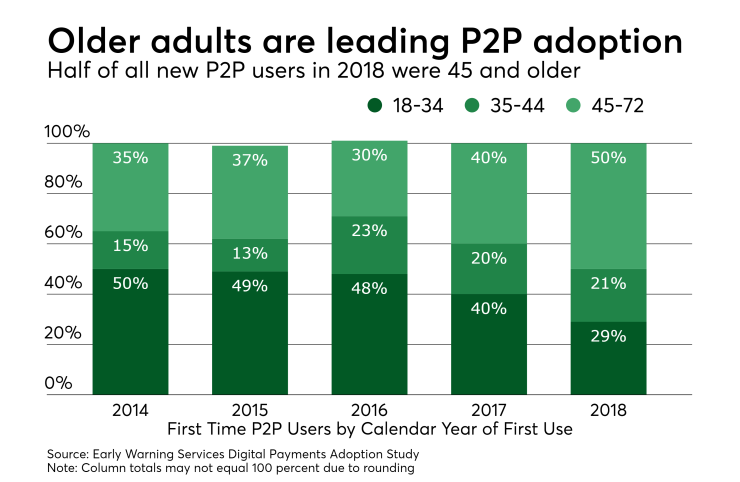

The bank-run Zelle P2P network was designed without the social media-esque touches that made Venmo a hit among millennials. And as one might expect, half of all new P2P users are 45 and older.

Zelle's design treats P2P as an added service of mobile banking, rather than a standalone service that requires a separate app and enrollment (though it does have an app for users at non-Zelle banks). This design philosophy held more appeal to older adults; although Zelle users accounted for only 26 percent of the survey group, they made up 45 percent of respondents who were at least 45 years old.

“Services such as Zelle are now integrated into their banking app, so it’s there when they are paying bills or moving money ... it’s being offered by a trusted source,” stated Ravi Loganathan, chief data officer at Early Warning Services LLC, which operates the Zelle network.

Early Warning surveyed 1,500 U.S. consumers between October and early December 2018. Twenty-nine percent of new P2P users were between the ages of 55-72 and 21 percent were between the ages of 45-54. Meanwhile only 11 percent of new P2P users were between 18-24 and 18 percent were between 25-34. In the study Early Warning defines users as people who have conducted a transaction in the last 30 days.

The first-time usage of P2P by consumers 45 and older is up significantly from years past; in 2017 the age group accounted for only 40 percent of new P2P users. This should be no surprise since

“Zelle’s goal was to make digital P2P mainstream and they seem to be achieving it,” said Talie Baker, senior analyst with Aite Group’s Retail Banking & Payments practice

The Early Warning study also looked at cumulative adoption over time for P2P services as well as other digital payment options such as wallet apps and cryptocurrencies. The study found that over 80 percent of U.S. online consumers have tried P2P services and 43 percent have used digital wallets.

While Zelle is currently live at over 60 financial institutions, it continues to maintain a standalone app for consumers whose financial institution has not yet integrated Zelle or is still considering its adoption. Even for users of the standalone Zelle app, one person in the transaction must be a customer of a Zelle bank, for risk management purposes.

Early Warning found that there is a subset of users who use both the standalone app and their mobile banking app that’s been integrated with Zelle to make Zelle P2P payments.

“They will use the standalone app in a public setting such as a bar when you don’t want to open up your banking app. It allows you to quickly send the transaction,” said Loganathan.

This could be to deter shoulder-surfing so that sending a payment to split a lunch bill doesn't mean exposing your bank balance to your friends or coworkers.

While it could be expected that as more banks integrate Zelle into their mobile banking apps that the need for a standalone app could diminish, Baker said that's not the case.

“I think they will have to continue to offer a standalone app until all banks get on the Zelle network so we won’t see this going away anytime soon," Baker said. "It’s the only way a person can receive a Zelle payment if their bank is not connected to Zelle.”