Want unlimited access to top ideas and insights?

Bitcoin and other decentralized,

Fueled by various governmental and corporate pronouncements, the court of popular sentiment has tried and convicted a whole new generation of cyber criminals who use these currencies as facilitators of crime and illicit trade.

However, despite the attention that Bitcoin is getting as the number one facilitator of online crime, it’s become much easier to launder money and pay for illegal goods online by abusing the existing payments ecosystem with the help of

While the use of cryptocurrencies requires a certain level of technological savviness and skill-there is an acknowledgment of the illegitimate transaction being executed. Transaction laundering, however, utilizes legitimate, known, and well-accepted payment methods such as credit cards, wires and other electronic payment methods, exposing the sales of illegal goods on the open web to the mom and pop shops of the world that may not even be aware of the illegality of their acts. This makes transaction laundering, from a fraud standpoint, a far more worrying phenomenon than cryptocurrency-based crime.

Transaction laundering occurs when unknown businesses use an approved merchant’s payment credentials to process payments. By using a registered merchant account for undisclosed transactions, unknown or hidden entities gain a gateway into the legitimate payments ecosystem. Since transaction laundering completely circumvents MSP risk and fraud mitigation procedures, it is extremely difficult to detect. This creates serious regulatory and compliance issues for the entire payments industry, especially given that transaction laundering often hides funds originating from illegal activities like drugs, weapons, extreme pornography, counterfeit goods, and more.

Given the sheer volume of online commerce, and the fact that transaction laundering abuses an existing, established payments system. It’s likely that the dollar-value of transaction laundering by far outstrips Bitcoin and other cryptocurrency-based crime.

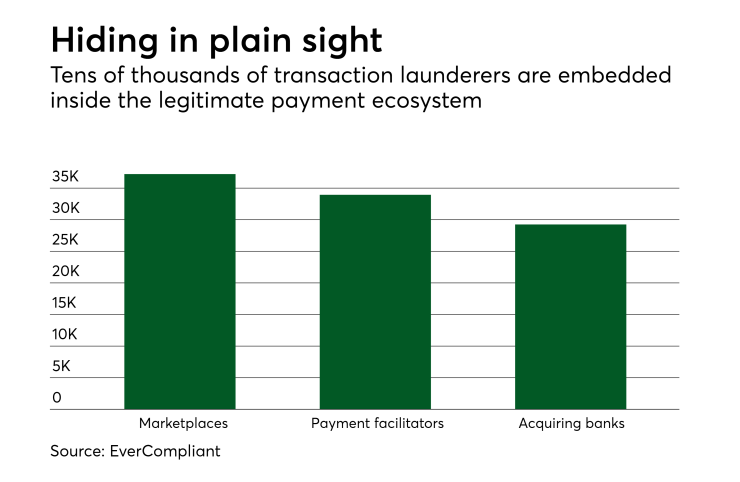

The extent of the transaction laundering problem is staggering. It’s been found that on average, the size of the unknown merchant portfolio is 6% to 10% of the known client base. That means that for every 10,000 merchants registered with an MSP, some 600 to 1000 hidden entities are transacting through legitimate payment networks without being detected- most of which originate in illegal, illicit or otherwise unwanted activities.

By removing the limitations proscribing traditional currencies, it’s easy to understand why Bitcoin and other cryptocurrencies are perceived as the financial Wild West. However, times have changed, and Bitcoin is not the criminals’ safe haven it used to be. Only as recently as 3 years ago, it seemed that anyone could buy or sell anything with Bitcoin and never be tracked. However recent years have seen multiple

While it is possible to send and receive Bitcoins without giving any personally identifying information, achieving the perfect

Add this to the fact that there is a growing body of regulations governing virtual currencies. For example, the

With law-enforcement paying close attention to Bitcoin, the inherent traceability of Bitcoin transactions in the blockchain and the relative complexity of Bitcoin payments, criminals flock to other methods. As evidenced by a series of

This is not to say that Bitcoin is not

The prime differentiator between cryptocurrency-based crime and transaction laundering is the radius of the circle of damage. Transaction laundering is far- reaching, allowing for illegal trades, such as drug cartels, to abuse legitimate payment ecosystems. However, paying for legal as opposed to illegal goods, does not differ at all--at least from the user experience standpoint-- from a legitimate online payment. You enter your credit card details on a payment page of a legitimate merchant, and there you have it.

On the other hand, people who wish to purchase using Bitcoin, need to be in-the-know, be technically adept and tech savvy. Essentially Bitcoin users need to put in an extra effort to make the transaction that they do not wish to be associated with, for one reason or the other.

Cryptocurrency crime, on the other hand, can be heinous and far-reaching, yet its victims are generally affected immediately. With transaction laundering, in addition to the direct victims of a given instance of illicit activity, MSPs (acquiring banks, payment facilitators, and online marketplaces) can also suffer devastating losses, and even be held criminally liable. For this reason, financial institutions and regulatory bodies worldwide are placing greater emphasis on effective KYC programs. merchant service providers should be vigilant in protecting themselves from involvement with transaction laundering, or risk regulatory fines, brand damage and legal action.