There are few scenarios more frustrating for consumers ̶ and, of course, every single one of us falls into that category ̶ than our payment card being lost, stolen or compromised.

People who have essentials to buy, bills to pay and generally busy lives to lead cannot afford to wait days for financial institutions to mail them out a new card. In fact, in this fast-paced, technology-enabled world of ours, they simply will not tolerate such a delay either.

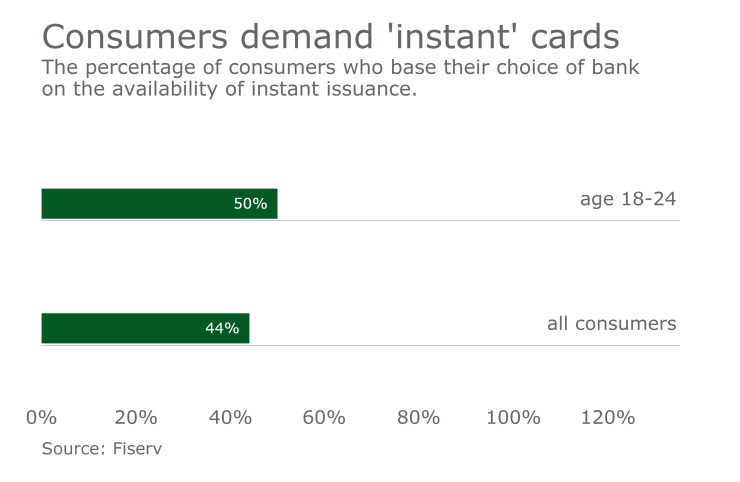

Unscheduled card reissuances are often unavoidable, particularly at a time when data breaches and data theft make security of paramount concern. Financial institutions are increasingly meeting consumer expectations in this “I want it now” world, and in an era of increased competition, by using technology to hand over replacement cards in a matter of minutes ̶ either temporary cards to tide the consumer over until the permanent replacement is received via mail, or a straight replacement permanent card. In research undertaken by Fiserv, 44% of respondents reported that the option of receiving instant issuance of a card at the branch would influence where they choose to bank ̶ and that number jumps to 50% for 18- to 24-year-olds.

Instant issuance is gaining ground as the fastest way to get new cards into the hands of consumers ̶ enabling them to walk out of their bank branch with an activated ATM, debit or credit card. In addition, financial institutions are turning to instant issuance to stay ahead of the demand caused by the ongoing migration to EMV technology (by upgrading instant issue equipment to support EMV cards or by having temporary debit EMV cards available). Cards instantly issued in-branch gives consumers immediate access to their funds and at the same time, the security capabilities of EMV.

This is an area ripe with opportunity for banks and credit unions, as it creates a positive experience for consumers ̶ saving time and avoiding a waiting period of up to 10 days for delivery of their card in the mail. Instant issue also provides staff with the chance to more effectively explain card features and benefits, a personalized EMV tutorial and encourages immediate and frequent usage and cross-selling other products and services that are in step with the way people live and work today, including online banking. In addition, instant issue can become a competitive advantage as it gains loyalty and increases the likelihood that a financial institution’s card will achieve top-of-wallet status.

Instant issue cards can issued as a permanent card or temporary while the consumer awaits their permanent card to be delivered by mail. More often than not consumers are now receiving permanent cards at their branch ̶ our research showed, that among millennials, 22% received their most recent card in-branch. 51% of all debit card users agree it’s important to receive a debit card in-branch.

Of course, with technology evolving at such a rapid clip, financial institutions cannot ignore the opportunities that exist in the mobile payments space. Consumers have become very comfortable using their smartphones for all manner of financial transactions, and the “mobile wallet” ̶ functionality that allows consumers to tap their phones to make in-store, in-app or in-browser purchases, offers an extra layer of security via tokenization, removing sensitive card account information from the payments process.

As mobile payment technology becomes more accessible and convenient, consumer adoption will accelerate, and those financial institutions that can stay ahead of these trends will differentiate themselves from competitors, ensuring their payment cards remain top-of-wallet and, increasingly, front-of-phone.

While physical cards will not disappear any time in the foreseeable future, they will be complemented by mobile innovations, thus helping a financial institution have its payment product included in a mobile payment app and prevent non-financial institution companies, who are becoming key competitors as they deliver solutions that consumers want in the way they want, from intruding on that part of their business.

Financial institutions can find incremental value and meet consumer expectations by offering in-branch instant issuance of cards, giving consumers immediate access to the enhanced technology capabilities of EMV, and can lead to increased revenue opportunities and cross-selling additional products and services. The mobile commerce landscape, and the role of financial institutions within that landscape, also continues to evolve. Financial institutions are ideally positioned to help consumers maximize the way they use their smartphones to make payments and purchases.

Ultimately, today’s sophisticated consumer seeks a real-time, personalized, convenient experience that fits seamlessly into the rhythm of their lives, and those financial institutions that can stay one step ahead of consumer expectations will be in a position to leverage the trust consumers already have in them as providers of secure payment services, and remain competitive as the landscape continues to evolve.