Just about every merchant understands the need to adopt solutions and technologies to counter fraud.

However, it’s a lot harder for some to answer the essential follow-up question: Do I handle it myself, or outsource it? Especially in the e-commerce sector, how merchants answer that question can make—or break—a business.

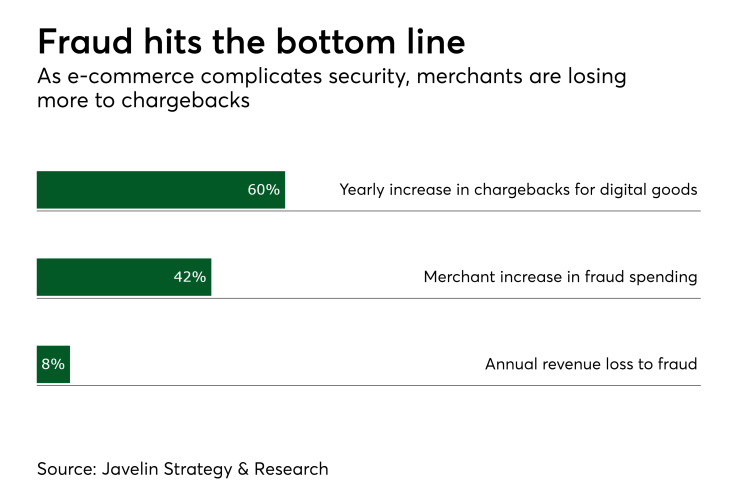

Fraud costs have increased dramatically just within the last few years. Contending with fraud ate up

It’s a kind of perfect storm; e-commerce fraud is evolving faster than merchants and their internal teams can identify and respond to it, while the environment incentivizes fraudsters to move online.

Merchants’ attention is spread across so many potential threats that they can’t manage all of them effectively. Compared to businesses focused explicitly on addressing e-commerce fraud, most merchants’ internal teams suffer from a lack of expertise and comprehensiveness. As a result, merchants deploy ineffective solutions that increase false positives and customer friction without substantially improving fraud prevention.

This leads to the question: Is it better to build—or buy—a fraud solution? There are benefits to both approaches; in-house teams possess an in-depth knowledge of products and business operations, while outsourced solutions are much more agile and resource-efficient. The real question comes down to ROI, but even then, accurately gauging ROI is extremely difficult.

Each merchant's needs are different. For example, it’s standard to anticipate that about 20% of the average merchant’s chargebacks are the result of merchant error, but that’s not the case for every merchant. For some, deliberate friendly fraud is overwhelmingly the problem, while for others, a policy or procedural misstep is the culprit.

Obviously, merchants who seek out the right expertise can expect higher ROI. But getting the most detailed picture will call for a multilayered approach that leverages the most effective elements of in-house and outsourced solutions.

I think it’s about time we stopped thinking about the question in terms of “build versus buy” when developing a fraud solution. Instead, e-commerce merchants should ask themselves, “How can I get the most effective use of my in-house and third-party solutions?”

Merchants need to play to the strengths of each strategy. An in-house fraud and loss prevention department can examine data firsthand, and can understand the organization on an intimate level. Combining that with an outsourced solution allows merchants to also benefit from the expertise and agile placement of dedicated fraud services who are up to date on policy changes and new threats.

There’s no need to fight between in-house and outsourced fraud prevention. Instead, start thinking about building the best fraud solution, and adopt the tools and professional assistance that will help make it possible.