Want unlimited access to top ideas and insights?

The U.S. economy is looming at the peak of another cycle, which could negatively impact financial institutions’ credit card portfolio margins.

Consumer bank debit and credit card portfolio managers should act now to stay ahead of the rapidly changing market conditions. Payment industry specific trends are emerging simultaneously that will affect both debit and credit card profitability.

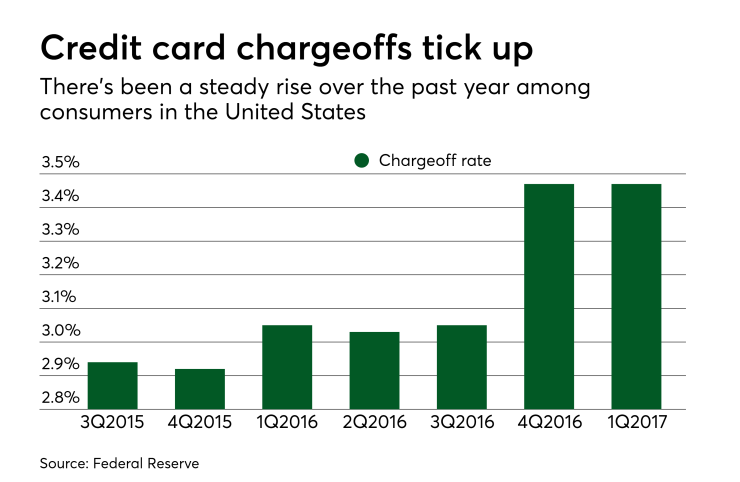

These trends include deregulation, shrinking brick and mortar point of sale purchasing, tightening employment markets, and credit card usage and average outstanding balances up for the fifth consecutive year. Revolving credit card debit hits nine-year highs and consumer habits are mirroring the pre-2008 market crash. In lockstep with rising debt are higher delinquencies and chargeoff rates. Delinquency and chargeoff rates started ticking up in 2015 and are continuing to rise.

Coinciding market trends have significant implications for both credit and debit card portfolio managers. Three implications to watch for are credit card delinquency and chargeoff rates; higher debit card rates, which pressure financial institutions to reduce fraud-driven portfolio churn; and thinner credit card margins.

Portfolio managers should now start looking for portfolio expense savings now by curbing fraud losses and expenses. Here are three prudent measures:

Understand the total cost of fraud, not just the dollars that get charged off. The total cost of fraud includes the downstream implications of card replacement costs, reduced use on replacement cards and account attrition. Understanding the total cost of fraud will open up opportunities for a longer average account life and uninterrupted card use.

Layer fraud prevention tools and don’t be reliant on detection solutions alone. Detection solutions come with the consequences of false-positive declined transactions that jeopardize cardholder relationships. Growing evidence demonstrates consumers will abandon a card account or close an account after experiencing a declined transaction that should not have occurred.

Deputize the consumer with new fraud prevention security methods. Tools that empower the consumer help allay consumer fears about fraud. Specifically security tools that work the same way across purchasing channels and devices can engage cardholders and provide an opportunity for new product positioning around the safety and security of the card.