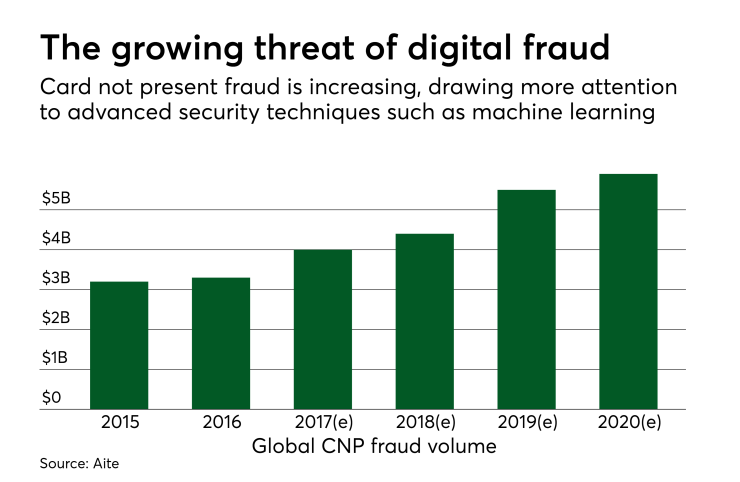

Card not present fraud is on the rise, and so is the sense of impunity that fraudsters seem to feel about their activities.

Fraud against e-commerce merchants is growing faster than the rate of e-commerce sales, and Juniper Research projects that

Why is CNP fraud growing so fast? It’s no longer a matter of post-EMV migration from POS to online fraud. What we’re seeing now is brazen, organized cybercriminals leveraging technology and traditional business strategies to commit more fraud faster.

Today’s CNP criminals network online, and not only in the far recesses of the dark web. RSA recently reported that

Telegram isn’t the only social tool crooks are using to organize their fraud schemes. Any social network or messaging tool has the potential to be abused by fraudsters looking to share information and make sales. For example, in April 2018, security blogger Brian Krebs tipped off Facebook to the existence of

As fraudsters take more technologically complex approaches to fraud, they’re also, ironically, making it easier for just about anyone to become a CNP fraudster. Card brands are keeping an eye on the growing trend of fraud-as-a-service that is growing on the dark web and beyond. Visa Chief Risk Officer Ellen Richey recently wrote that “the

In addition to the scams-for-hire available through messaging sites and social media, scammers also offer

As fraudsters get more sophisticated, better funded and increasingly connected, it’s clear that the fight against fraud will be ongoing, not a battle with a clear end. None of these trends mean that fraud-fighting is hopeless. In fact, you could argue that the lengths criminals now go to show that it’s getting harder for them to commit fraud. But these trends do show that going it alone, relying on last year’s fraud detection tactics and hoping for the best are no longer enough. It’s up to everyone in the e-commerce ecosystem to keep up with fraud trends, follow current fraud detection and prevention best practices, and share information to counteract the networking practices that fraudsters have learned to leverage.