Despite the breakneck speed of technological advances, however, the United States has been slow to evolve its security practices compared with other countries, many of which began adopting EMV more than a decade ago.

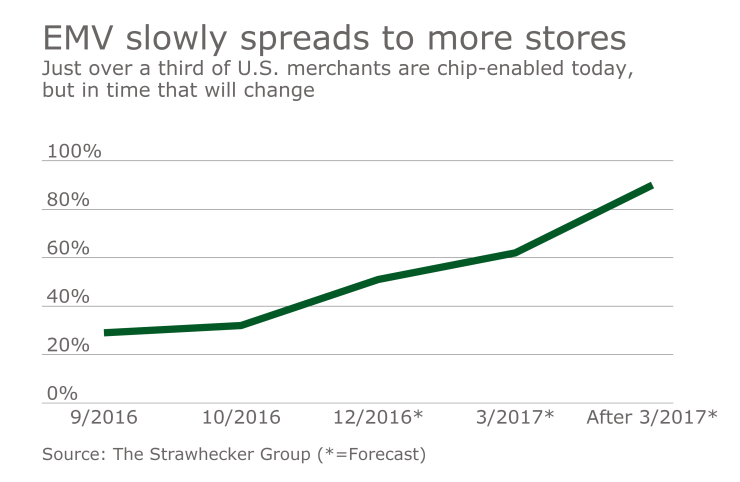

Last year’s liability shift for the majority of businesses in the United States created financial impacts and a risk of longer queues – both delayed adoption of EMV at the point of sale. The U.S. implementation has been inconsistent, and some small businesses struggle to afford new EMV technology acceptance devices and to complete EMV certification.

Still, EMV adoption will drastically reduce fraud at the point of sale and is one of the many ways we can thwart criminals. But EMV isn’t the only answer to securing payments. Even as more businesses adopt the technology, card not present (CNP) and pay-at-the-pump still pose security risks and an increase of fraud.

Market research firm Aite Group reports that CNP fraud costs rose more than 33 percent in the U.S. between 2011 and 2013, and will hit $6.4 billion by 2018 – a rate that is much faster than the growth in e-commerce in our country.

We must stay ever-vigilant in our industry to stay one step ahead of fraudsters, and ensure our products and services are compliant with the latest Payment Card Industry Security Data Standards. Educating both merchants and consumers about security best practices in all variations of payment processing is a critical component of that process.

As an industry we have a responsibility to keep card information safe – whether it’s at the cardholder or merchant level. Advanced technologies mean added convenience for consumers, but increased vulnerabilities.

Obviously, much has changed when it comes to processing transactions and keeping data secure since the first cards were introduced in the 1950s. Imagine authorizing card transactions via stacks of phone-book-sized ledgers detailing, literally, every card on file versus a few seconds to scan your mobile phone or dip your card into an EMV reader. Innovation, consumer adoption and technology advancements continually shape our industry, with increasing demand to balance convenience, security and privacy with consumer preferences.