PayThink is focused on the rapidly changing, inter-connected markets of debit, credit, mobile, prepaid and digital payments. As the payments industry strives for faster innovation to launch new products ahead of competitors, PayThink provides insight from market participants and innovators leading the way. PayThink is designed for executives looking to stay relevant in the ever-changing payments ecosystem by finding and honing their competitive edge.

-

Madhu Nadig is the co-founder and CTO of

Flagright , a provider of transaction monitoring and AML compliance software.December 26 -

Bank merger and acquisition activity rebounded this year, led by Fifth Third's $10.9 billion proposed purchase of Comerica. Huntington, PNC and Columbia were involved in some of the other biggest deals announced in 2025.

December 26 -

Articles about stablecoins, scams, fintechs, premium credit cards and open banking were just some of the topics that struck a chord with American Banker subscribers in 2025.

December 26 -

From credit bureaus to software providers, 2025 saw attackers bypass bank defenses by targeting the supply chain and using social engineering.

December 26 -

Banks are beginning to engage with decentralized financial infrastructure. But until lawmakers create a foundation for allowing legally recognized entities like LLCs and nonprofits to govern these networks, compliance burdens will hinder full adoption.

December 26

-

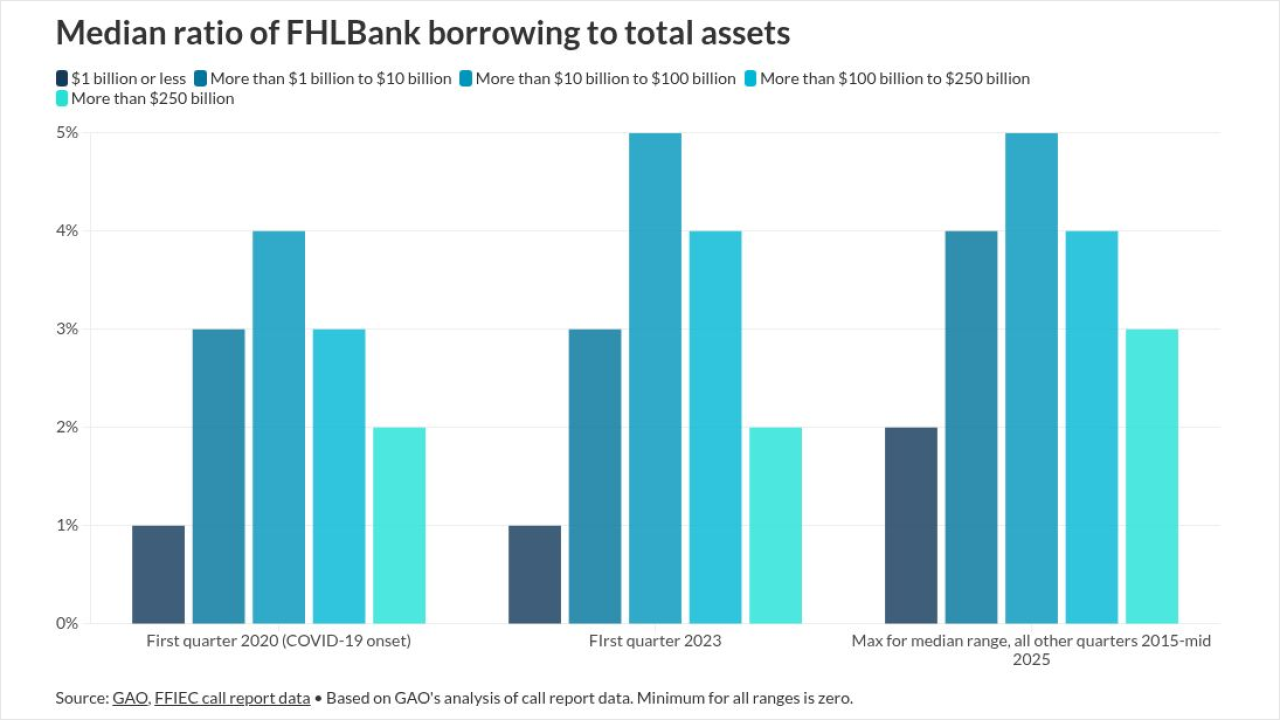

Fewer than 1% of members reported surges relative to total assets outside the normal range, making Silvergate's experience unusual, according to the GAO.

December 26 -

Banks typically prefer to steer clear of politics. But in 2025, politics would not steer clear of banks

December 25 -

CodeBoxx Academy is filling a void for banks and other companies that desperately need AI experts. Peret's time behind bars uniquely informed how he runs the school, he says.

December 25 -

The Consumer Financial Protection Bureau will face an existential crisis in 2026 between the Trump administration's efforts to shut down the agency and the employee union and consumer advocates who want to stop them.

December 25 -