Behavioral data about Hispanics’ use of digital payments is scarce, but the sector as a whole spends more than $1.4 trillion annually and its population growth rate significantly outpaces the mainstream, based on U.S. Census Bureau data. According to Univision, younger Hispanics are highly mobile-centric and more likely to have a credit card than their non-Hispanics peers.

Many Hispanics speak both Spanish and English, and about 25% of all U.S. Hispanics speak only English at home. Payments providers are listening more closely to Hispanics’ preferences when designing products and services. One example is Western Union, which launched a Spanish language version of its mobile payments app early this year.

What follows are vital data points for payments companies targeting U.S. Hispanics.

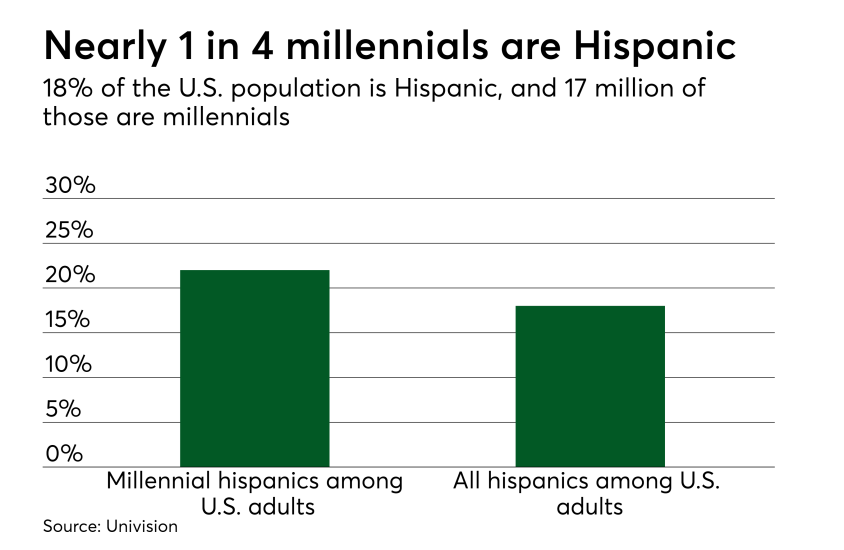

Among all Hispanic adults in the U.S., about 17 million are millennials between 18 and 34, which means at least 22% of the U.S. population is a Hispanic millennial. This group is driving higher-than-average population growth over the next decade, with a longer projected median lifespan than mainstream audiences, based on U.S. Census data.

“Roughly one in every four millennials is Hispanic, and this is an increasingly affluent group that consists of heavy users of payments and financial services,” said Jack Randall, executive vice president of new business development at Univision, speaking at SourceMedia’s Card Forum this month in Miami.

In a separate study MSL Group released last year, Hispanics were found to visit nearly four different retail stores per week, often switching their destinations based on available deals discovered via smartphones. Food—dining out and cooking at home—is a top spending category, and word of mouth is a key influencer. For dining, 46% of Hispanic consumers rely on recommendations from friends and family versus 29% of the general population, MSL said.

The gap between these demographics expands when comparing other products, with 58% of Hispanics claiming a checking/savings account versus 73% of non-Hispanics; and 45% of Hispanics (18 million) owning a credit card versus 60% of non-Hispanics. A similar pattern plays out in home loans, with 33% of Hispanics owning a mortgage versus 48% of non-Hispanics.

Hispanics’ credit card behavior is close to that of non-Hispanics’. Hispanics with a credit account have an average of 2.7 cards per household, compared with 2.9 for non-Hispanics. The average monthly card expenditure for all Hispanic credit card users is $555, versus $664 for non-Hispanics, Univision said. If present trends continue, Hispanic millennials will likely surpass non-Hispanics’ credit card spending soon — if they haven’t already — and other digital payment types are ripe for growth.