According to data, they do, and more now than ever.

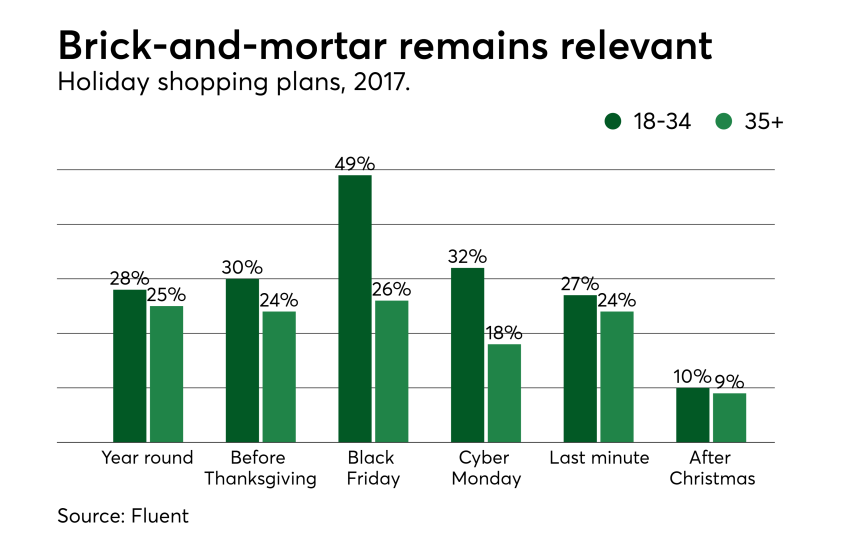

According to research by Fluent, 49% of 18- to 34-year-olds plan to shop on Black Friday this year, as well as 26% of 35-plus-year-olds. The youthful exuberance for Black Friday markedly contrasts with older generations for whom the novelty of scooping up bargains in busy retail stores is less appealing. Nonetheless, it still outpaces Cyber Monday by a considerable margin when 32% of 18- to 34-year-olds and 18% of 35-plus-year-olds intend to shop.

Thirty-one percent of 18- to 34-year-olds also stated that they intend to spend more on holiday shopping this year, with 43% stating that they would spend about the same as last year and 26% stated they would spend less. Among older shoppers, just 16% stated they intend to spend more this year, with the majority (60%) stating that they expect to spend about the same and 24% expecting to spend less.

In 2015, just over a quarter of online holiday purchases were made on a smartphone or tablet. By 2016 this had grown to 31%, and the NRF anticipates that this will reach 33% this year.

In monetary terms, a sizable $3.8 billion dollars was forecast to be spent on Cyber Monday, more than the $3.5 billion forecast for Black Friday. This is due to online purchases often being for higher ticket and bulkier items such as electronics rather than smaller, lighter "stocking stuffers" that are more frequently bought in person.

According to Vantiv, two-thirds of digital holiday shoppers go online because of the convenience. However the advantage of physical stores having no delivery costs is being negated and is therefore a major factor in persuading shoppers to go online — 53% shop online due to free delivery options. Further, the ability to compare prices across multiple retailers allows consumers to find the best prices without the legwork — nearly half (48%) of online shoppers do so because of lower pricing availability.

Wallethub’s recent publication of 570 U.S. cities' anticipated spend over the season provides a marked breakdown of the nation’s wealth. At the top end of the scale, households in Naperville, Ill., expect to spend $2,380 this holiday. Of major cities, San Francisco residents expect to spend $1,580 this holiday season, more than double that of New York and Chicago. At a sobering bottom end of the scale, inhabitants of Flint, Mich., expect that they will spend an average of just $69 on the upcoming holiday season.

Singles Day on Nov. 11, a fairly recent invention of China’s retail giant Alibaba, has become the largest single day of global retail spend. Singles Day debuted in 2009 and by 2012, total sales reached $US 3 billion. This year, the money spent has grown to a staggering $25.3 billion single shopping day, up 42% from 2016. That is nearly five times greater than Black Friday and Cyber Monday combined.

The event marks a massive windfall for Alibaba — not only in retail sales, but in transaction fees. According to ATLAS, 90% of Singles Day transactions are made through Alipay, the payments affiliate of Alibaba.

Neither is it just a Chinese phenomenon. According to Ingenico, Russian consumers, for instance, completed more than 10 times as many transactions on Singles Day as on an average day. In Latin America, growth was most pronounced in Chile, where the number of transactions processed by Ingenico was almost nine times the normal number. By comparison, growth in the region’s bigger e-commerce markets was more modest, with Mexican consumers completing 91% more transactions and growth in Brazil at 30% — although both numbers are based on much bigger volumes.

Even activity domestically was pronounced; in the U.S., the number of transactions on Singles Day jumped 22% from the daily average.