But beyond the initial coin offerings (

However, like all investments, some are more likely to succeed that others. At the top end of the scale, Filecoin and Tezos raised over $200 million with their ICOs. At the bottom end, some raised little to nothing.

Over a third of ICOs were based around infrastructure projects and while payments, trading/investing and finance all ranked highly, other categories included health care, gaming, gambling, advertising and identity/reputation management. If there is a purpose for blockchain-based coin offerings, it can’t be nailed down to one specific vertical.

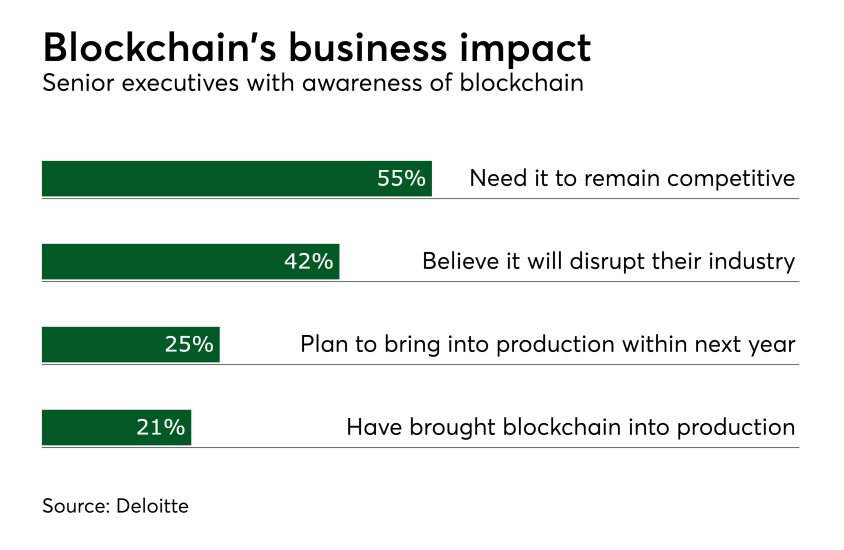

In a 2016 Deloitte survey of over 300 senior executives at U.S. companies with $500 million in revenue or more, 60% stated they had some knowledge of blockchain and its capabilities. Of this group, 55% said that they needed to invest in blockchain initiatives to remain competitive and 42% predicted that it would disrupt their industry.

The responses given were not just hypothetical — 21% of these executives stated that their organization had brought blockchain projects into production, with a further 25% stating that they planned to launch blockchain initiatives within the next year.

It is also worth emphasizing that the development of blockchain projects was far broader than just financial services. Fifty-eight percent of blockchain projects were in consumer goods or manufacturing, 52% were in life sciences or health care, and 48% were in tech, media or telecommunications. Just 36% were in financial services.

In 2017 IBM surveyed nearly 3,000 C-suite executives from 80 countries and 20 industries. This survey placed executives in three categories depending on their level of interest and activity in blockchain — “Explorers,” those actively participating in blockchain projects; “Investigators,” those who are considering blockchain projects but haven’t committed yet; and “Passives,” those with no blockchain plans. “Explorers” and “Investigators” represented a third of executives polled.

“Explorers” and “Investigators” had numerous reasons for developing blockchain initiatives. At the top of the list were requirements for increased data quality and increased transactional trust, reliability, security and transparency. Other motivators were transaction cost reduction, increased transactional speed (particularly in settlement) and a simplification and/or automation of business processes, often by removing the requirement for a third party.

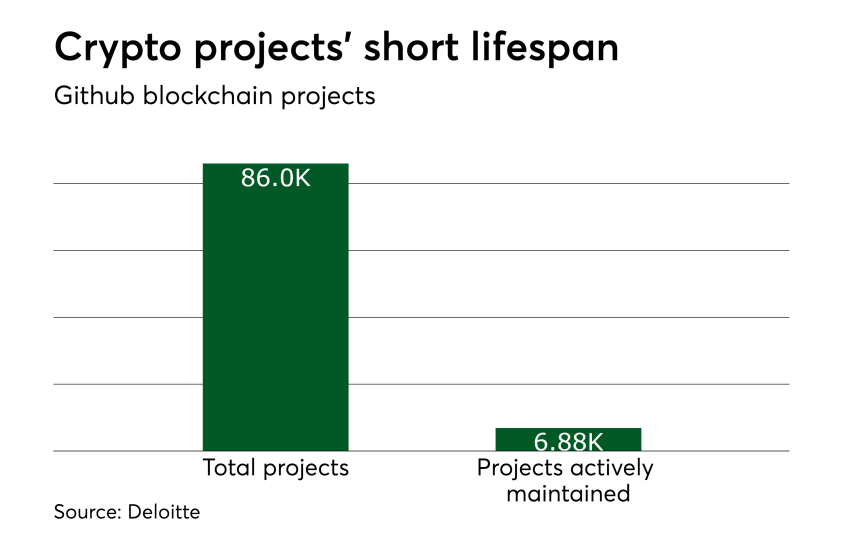

However, there was a notable difference in projects initiated by individuals compared to those developed by organizations. Some 9,300 projects were orchestrated by companies, research institutions and startups and these registered a 20% faster adoption rate than individual-led projects and had a higher survival rate.

In a recent survey by Turner Little and YouGov, nearly a third of Americans said they thought that cryptocurrencies were for purchasing illegal goods or services. Seventeen percent thought that they were for online purchases and 7% for savings.