It has now been two years since the EMV fraud liability shift took effect in the U.S. for most companies. This is enough time to evaluate the EMV migration's effect on fraud, and whether it can be blamed for anything happening in digital channels.

“Criminals aren’t moving that quickly from POS to CNP, but they don’t necessarily have to,” says Al Pascual, SVP, research director at Javelin. “Online fraud can occur much more frequently than in person (consider the impact of bots) — so there is a force multiplier effect when fraudsters go online. I suspect the curve will become even steeper.”

According to forecast data from Aite Group, CNP fraud will grow from $4 billion in 2017 to nearly $6 billion in 2020. This will be in tandem with similar growth rates seen in application fraud and account takeover fraud. Bear in mind that this forecast was made prior to the Equifax data breach — the fraud curve could be much steeper now that a fresh crop of Social Security numbers is on the market.

“CNP fraud will grow because of the rapid rate of growth of e-commerce in general, but in a number of countries we’re seeing CNP fraud growing faster than the rate of e-commerce itself,” says Julie Conroy, research director at Aite. “As the U.S. EMV migration picks up pace, we’re not going to see the organized crime rings content to take a $4B hit to their P&L. We’re already seeing the migration impact application fraud and [account takeover], and my discussions with e-commerce merchants indicate that we’re seeing losses rising there as well.”

But is the U.S. experiencing CNP fraud at levels that are greater than other countries?

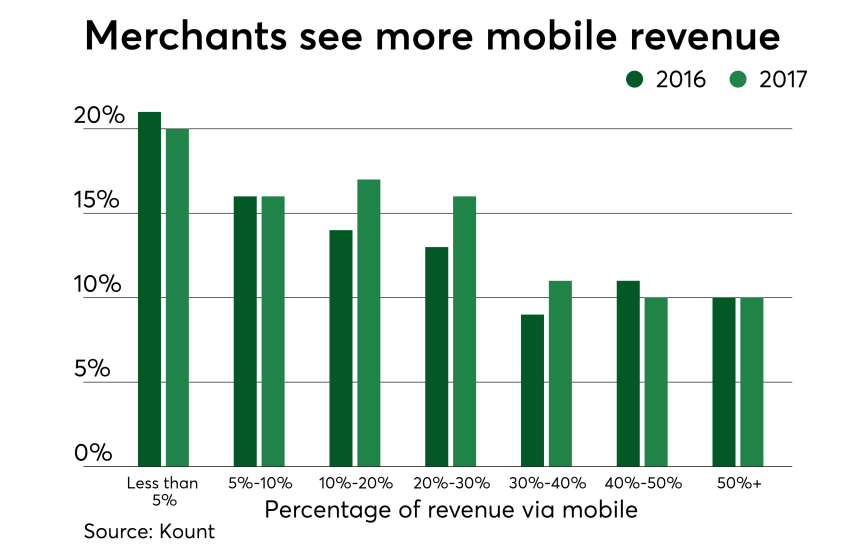

The same survey highlights that fraud over mobile is also shifting and that the most vulnerable areas were the browser and mobile app. Nearly 60% of online retailers considered the mobile browser to be the most vulnerable area for attack and nearly a quarter considered mobile apps to be a vulnerable channel.

Consequently, many of the tools being used to combat mobile payment fraud have some pedigree in the online payments realm.

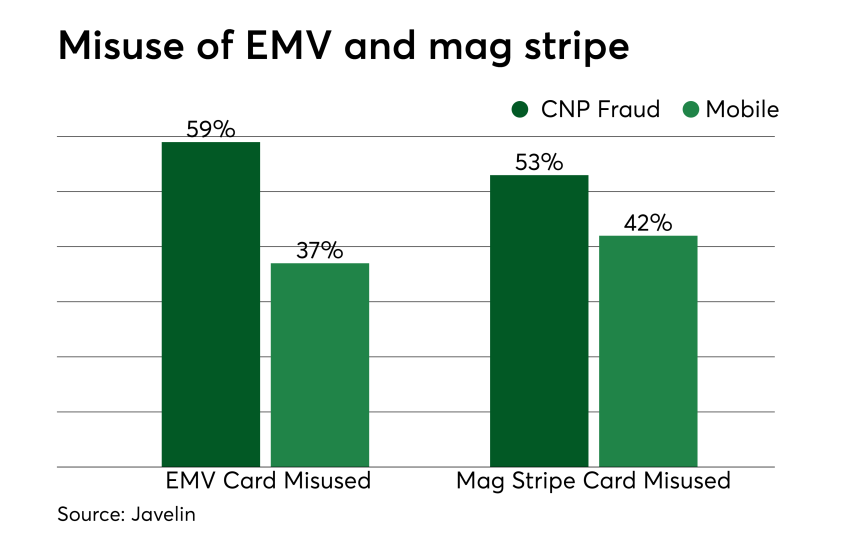

But, back to the core question — did EMV cause the CNP fraud spike?

“Consumers who had an EMV card misused were considerably more likely to be victims of CNP fraud, but in an even bigger issue did not necessarily experience that much lower a rate of POS fraud,” says Al Pascual, senior vice president and research director at Javelin.

So it's not a simple cause-and-effect of EMV leading to more fraud on CNP channels. With consumer habits shifting online, the evidence points to CNP fraud occurring irrespective of EMV, not because of it.

According to a fraud expert who requested to remain anonymous, fraud has shifted in-channel, with Mobile Wallets, Account Takeover and Fraud Apps being the channels to watch for growth.

“In terms of CNP/mobile fraud, we do see a ton of fraud there. Most of it is new (it simply didn’t exist previously) and it frequently aligns with the changing shopping habits of consumers, and this is often attributable to Account Takeover, First Party and growth in various mobile wallets. Did EMV influence that? No, there are no signals that EMV has suffocated counterfeit, it only changed which players are now exposed, both on the compromised merchants and the banks who are still issuing mag-only cards.”

Even the largest card network agrees with the EMV shift not being causal in CNP fraud rates.

“It’s true that fraud dollars from CNP are growing, but it’s not increasing as a percent of total sales,” said Stephanie Ericksen, vice president of risk products at Visa, in a panel discussion at SourceMedia's 2017 Card Forum.