-

JPMorgan would consider buying other businesses; collectors would be allowed to pursue debt past the statute of limitations, if they warn borrowers.

February 26 -

The regulator completed a thorough process, which included ensuring investors would treat borrowers well, before settling on a buyer.

February 25 -

Deputy Director Brian Johnson spent more than two years serving under two separate CFPB directors. He will become a partner at Alston & Bird LLP next month.

February 25 -

The agency's director said both steps will come as part of an ongoing review of agency rules and show her "commitment under the law to be effective and evidence based” in providing clarity to stakeholders.

February 25 -

Jennifer Piepszak, JPMorgan's chief financial officer, said the largest U.S. bank planned to borrow funds through the Federal Reserve's emergency lending facility in an exercise designed to break the stigma attached to that program.

February 25 -

NCUA board member Mark McWatters defended the agency's position on credit union-bank purchases and called out the ongoing sniping on both sides of the argument.

February 25 -

The Credit Union National Association is submitting a FOIA request to get more information about the National Credit Union Administration's recent portfolio sale, but further action could be necessary if those answers aren't satisfactory.

February 24 -

The agency plans to conduct a review of how it regulates the 11 Federal Home Loan banks amid concerns that some companies are inappropriately seeking a back door into the Home Loan Bank System.

February 24 -

The deal, which could be announced Monday, would push the TurboTax maker into consumer finance; the bank would follow U.S. rival Goldman Sachs into the British market.

February 24 -

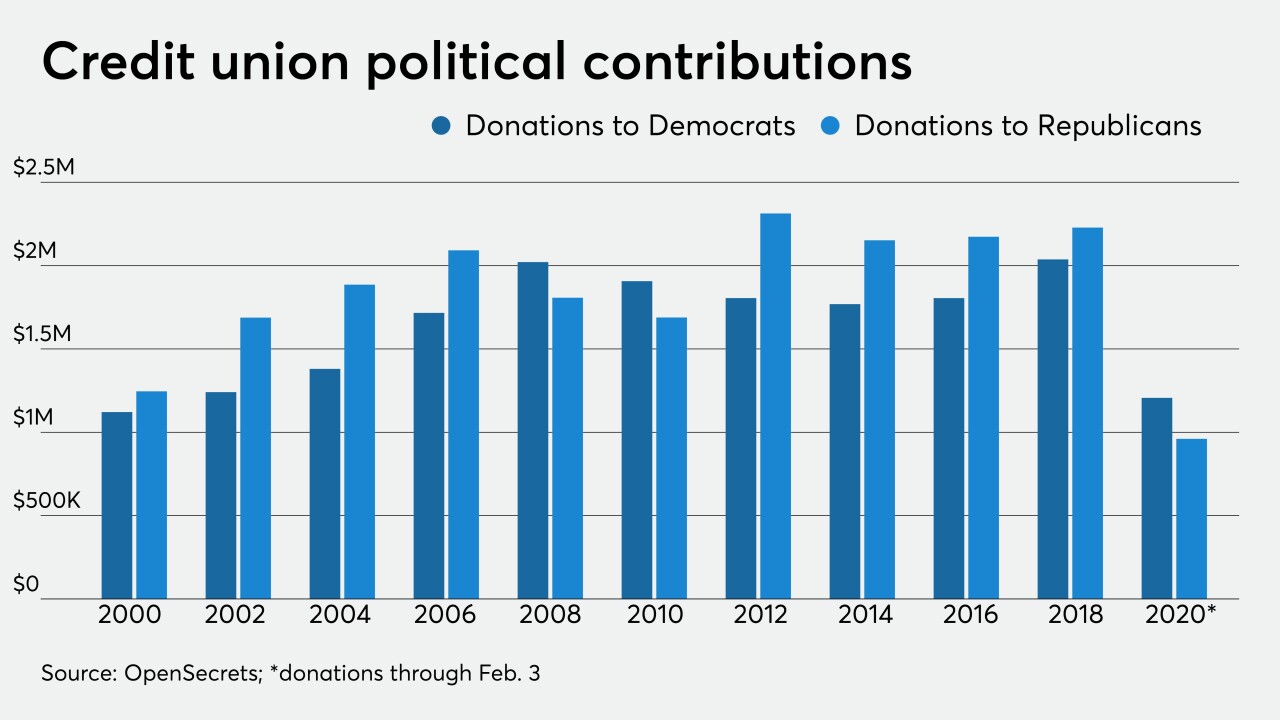

The industry loves to tout its bipartisanship, but it has very publicly embraced the Trump administration at times.

February 24 -

Bernie Sanders’ rise to front-runner status for the Democratic nomination worries many bankers, but their opinions diverge on his electoral chances and whether a Sanders presidency would pose a direct threat.

February 23 -

The 10-digit penalty marks an important milestone for the bank, but individual ex-bankers may still be at risk and grueling hearings lie ahead for current leadership.

February 21 -

The hearing will be one of three held by the House Financial Services Committee to scrutinize the bank next month.

February 21 -

Fannie Mae and Freddie Mac are expected to retain “limited and tailored government support” after they are released from U.S. control, Treasury Secretary Steven Mnuchin said in a letter to lawmakers.

February 21 -

The Wall Street giant will inherit some $56 billion of low-cost deposits that will allow it to offer more traditional banking products to its wealth management clients.

February 20 -

The all-stock takeover would add E-Trade’s $360 billion of client assets to Morgan Stanley’s $2.7 trillion.

February 20 -

Goldman Sachs pledged in late 2019 to stop financing projects in coal and Arctic oil exploration. Activist groups and Democratic senators say other large institutions should do the same given the economic and environmental risks from climate change.

February 19 -

In a sudden reversal, the OCC and FDIC said they would push back the deadline to April for groups to weigh in on the proposal to modernize the Community Reinvestment Act.

February 19 -

Years after criticizing the Dodd-Frank Act, the Democratic presidential candidate and former New York City Mayor Michael Bloomberg is now taking a page from the Elizabeth Warren playbook.

February 18 -

Compared with incendiary fights elsewhere in the capital, deliberations among the banking agencies tend to be more banal. But on issues from the Volcker Rule to CRA reform, disagreements lately between officials have grown sharper.

February 16