-

It’s the company’s responsibility to come forward with the information about how an algorithm that could be discriminating against women borrowers was designed and the exact impact of it, she said.

November 14 -

A similar bill was introduced into the House earlier this year and both pieces of legislation have have bipartisan support.

November 13 -

And the government-sponsored enterprises could hold initial public offerings in 2021 or 2022 to ensure they hold adequate capital, FHFA Director Mark Calabria said.

November 13 -

After others have hinted the three bank regulators may part ways on a Community Reinvestment Act proposal, Federal Reserve Chairman Jerome Powell told lawmakers a “common answer” is the ideal outcome.

November 13 -

The three federal bank regulators usually try to issue rules jointly, but Comptroller of the Currency Joseph Otting on Tuesday pointed to areas where the agencies may move on separate paths.

November 12 -

The Veterans and Consumers Fair Credit Act would extend Military Lending Act protections to all consumers.

November 12 -

Fannie Mae and Freddie Mac’s exemption from the Qualified Mortgage rule is on borrowed time, but a House bill would allow lenders to use the mortgage giants’ guidelines for documenting borrower income.

November 12 -

Many in the industry have cheered regulators’ interest in improving the supervisory rating system, but they may shy from commenting publicly about their experiences in a confidential process.

November 11 -

Unlike previous central bank chiefs, Powell’s chances of being renominated by either the current president or many of the Democratic contenders are slim.

November 10 -

Readers react to Sen. Warren's call for banks to fund her Medicare plan, a proposal requiring big-bank CEOs to testify before Congress, federal regulators lacking Trump appointees on their board and more.

November 7 -

A proposal to revise how the agency calculates the restrictions for less than well-capitalized banks relies on faulty methodology and ignores competition from fintechs and credit unions, according to the industry.

November 7 -

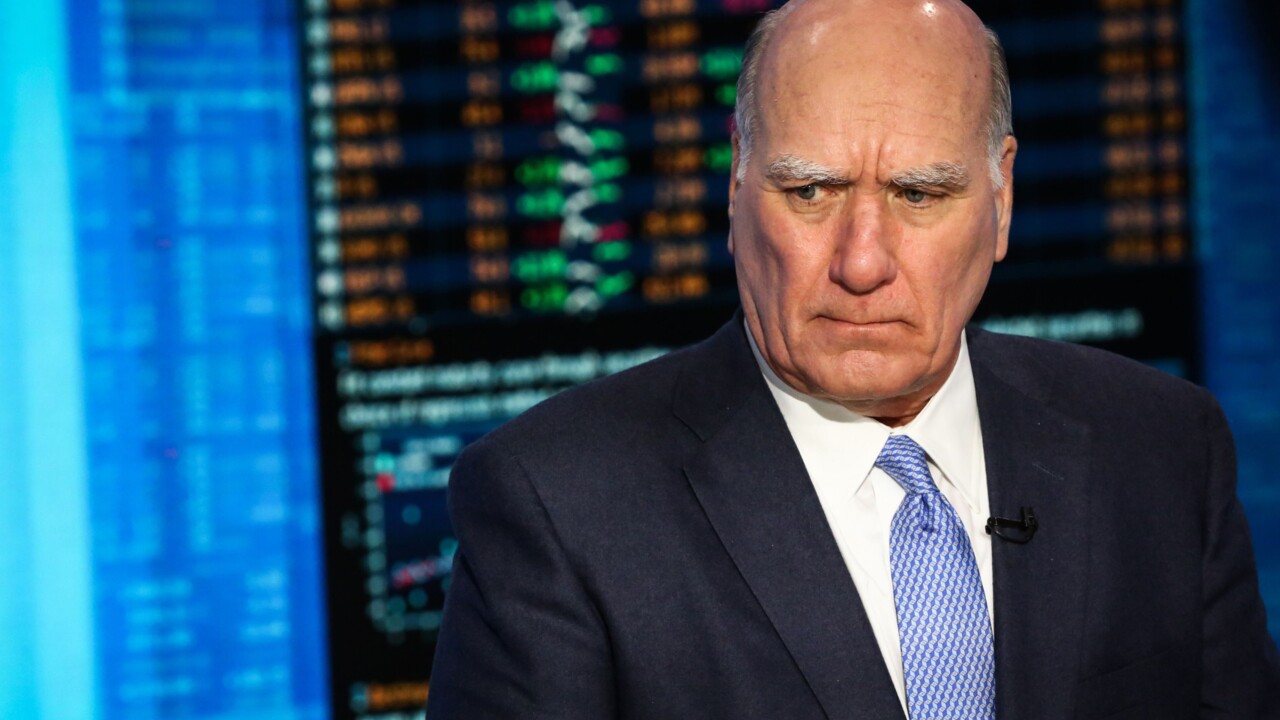

Chief Executive Officer Charlie Scharf plans to name Bill Daley, the former White House chief of staff, to a senior post to improve relations with authorities in Washington, according to people with knowledge of the plan.

November 7 -

At a forum convened by the CFPB, several bank and fintech executives argued that long-delayed rules required under the Dodd-Frank Act can help fight discrimination and shine a light on unsavory practices in the market for small-business credit.

November 6 -

JPMorgan Chase Chief Executive Jamie Dimon said presidential hopeful Elizabeth Warren's rhetoric sounds like an attack on wealthier Americans.

November 6 -

Service would help with compliance; JPM CEO sees more short-term lending rate spikes if no long-term solution implemented.

November 6 -

Top officials at Bank of America and Wells Fargo said that commercial loan demand is weak, even as U.S. consumers show strength. Their comments echo recent findings by the Federal Reserve.

November 5 -

The CFPB, OCC and FDIC are signaling a renewed focus on the sector after regulation of it fell more to the states in recent years.

November 5 -

Financial regulators have been put on notice about the risk of an economically damaging cash crunch in the home mortgage market. Behind the concern: the rapid growth of shadow banks in the origination and servicing of home loans.

November 5 -

The Supreme Court is ready to weigh in on the CFPB’s leadership structure, but both agencies are facing similar constitutional challenges, suggesting a broader impact of any decision.

November 4 -

If elected president, Sen. Elizabeth Warren would charge large banks a fee to help pay for her Medicare-for-all plan.

November 4 American Banker

American Banker