-

Regulators globally are using "tech sprints" to test new anti-money-laundering solutions. More can be done, but it's a good start.

November 4 Alliance for Innovative Regulation

Alliance for Innovative Regulation -

Senate leaders say they're ready to consider appointees to fill vacancies at the two regulatory agencies, if only the White House would send over their names.

November 3 -

A group of 64 House lawmakers is pushing congressional leadership to incorporate premium caps and address a new methodology for assessing risk in flood insurance reform legislation.

November 1 -

It's time to establish a fintech commission.

November 1

-

Readers react to Sen. Warren's plan to weed out Washington corruption, Facebook CEO Mark Zuckerberg's testimony before Congress, restricting the Federal Reserve's proposed real-time payments system and more.

October 31 -

Recent Fannie Mae and Freddie Mac activities are “not the kind of day-to-day behavior that you would expect from companies” under federal control, the head of the Federal Housing Finance Agency said.

October 31 -

A remark by Director Kathy Kraninger during a congressional hearing has renewed a fierce debate over how the agency uses academic studies to support rulemakings.

October 30 -

Federal Reserve Chairman Jerome Powell said Wednesday that he does not think revamping capital or liquidity requirements is necessary despite recent volatility in the repurchase markets.

October 30 -

Nearly two dozen Senate Democrats say the CFPB should "immediately" open up an enforcement investigation into the Pennsylvania Higher Education Assistance Agency’s loan forgiveness program for alleged mismanagement.

October 30 -

The restriction on how often a borrower’s account is debited was supposed to be relatively straightforward, but one lender is trying to fight that provision.

October 29 -

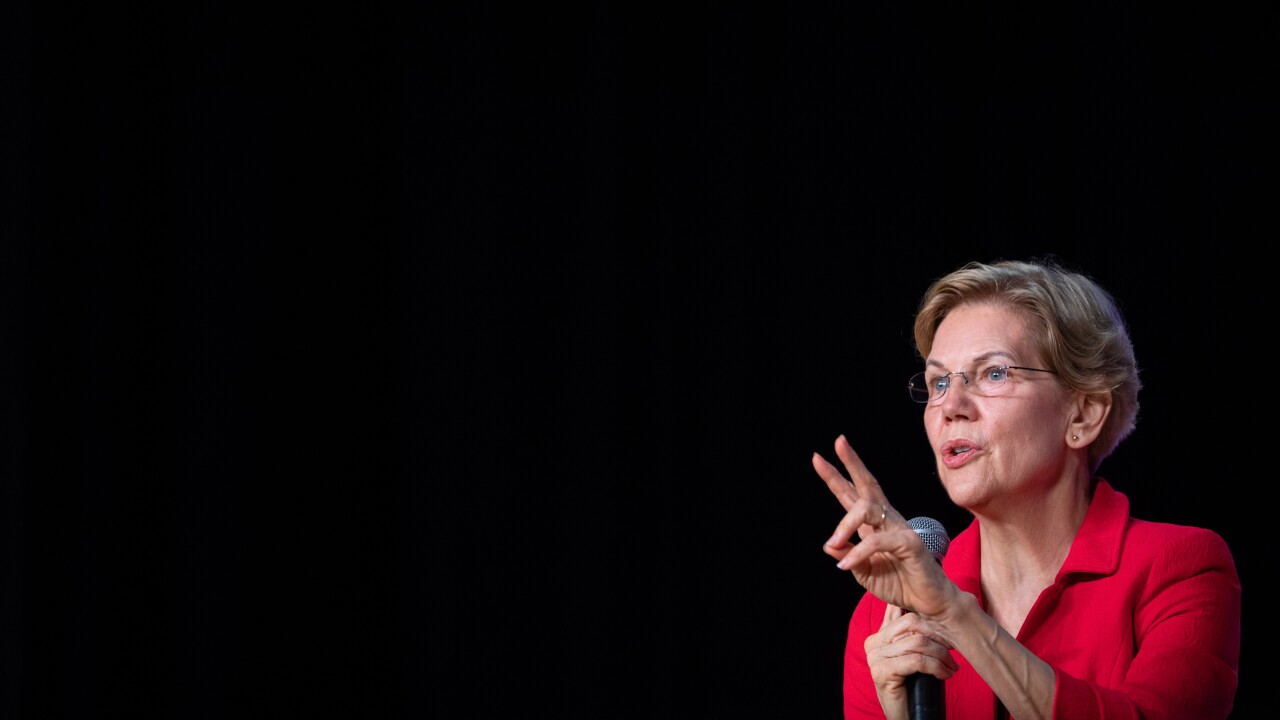

Sen. Elizabeth Warren stepped up her criticism of some of the largest U.S. corporations and singled out senior-level government officials who accepted jobs at Citibank, Wells Fargo, Facebook and Walmart after working for the federal government.

October 29 -

The government has used the law to bring fraud claims against Federal Housing Administration lenders, but the new steps respond to criticism that minor offenders were also getting punished.

October 28 -

As the Federal Reserve prepares for its October meeting, many institutions are waiting to see how the board's actions might impact the ongoing war for deposits.

October 28 -

The regulator of Fannie Mae and Freddie Mac discussed steps the companies have already taken to limit their risk, as well as efforts to prevent housing market “overlap” with the FHA.

October 28 -

Executives are deciding what roles could be relocated to lower-cost hubs such as Plano, Texas; Columbus, Ohio; and Wilmington, Del.

October 28 -

Regulators globally are using "tech sprints" to test new anti-money-laundering solutions. More can be done, but it's a good start.

October 28 Alliance for Innovative Regulation

Alliance for Innovative Regulation -

Concerns over banks’ level of preparation have led to worries about disruptions in the lending market, and some financial institutions warn that a new interest rate benchmark could cause lenders to pull back on credit.

October 27 -

It's time to establish a fintech commission.

October 25

-

The Rakuten application has opened another front in the battle over nonfinancial companies' ownership of banks.

October 24 -

Citigroup promoted Jane Fraser to president, its second-highest post, making her a likely candidate to succeed CEO Michael Corbat and someday become the first woman to run one of the largest U.S. banks.

October 24