-

Comments by JPMorgan Chase's Jamie Dimon have added fuel to the long-discussed idea of a national database that would make it easier for banks to vet customers for anti-money-laundering and other risks.

June 3 -

American Banker readers share their views on the most pressing banking topics of the week. Comments are excerpted from reader response sections of AmericanBanker.com articles and our social media platforms.

June 3 -

The Consumer Financial Protection Bureau's complex payday lending proposal is sparking concerns that state legislatures will try to repeal existing usury laws and allow a parade of pro-payday-lending bills to move forward.

June 2 -

A lack of liquidity wasn't what caused most of the largest U.S. banks to fail their living wills test, a Federal Deposit Insurance Corp. official said Thursday.

June 2 -

The Federal Reserve has announced the schedule for releasing the results of the 2016 stress tests of the largest U.S. banks.

June 2 -

The National Retail Federation wants the Federal Trade Commission to do more than merely check up on the companies that routinely assess merchants for compliance with the Payment Card Industry Data Security Standards (PCI DSS).

June 2 -

The Consumer Financial Protection Bureau proposal could have included flexibility for banks to offer payday loan alternatives, but the plan misses the mark.

June 2

-

Federal Reserve Govs. Jerome Powell and Daniel Tarullo Thursday said they expect banks to have to meet significantly higher capital minimums after the central bank applies its capital surcharge rule for large globally risky banks to its stress test. That difference could significantly cost banks.

June 2 -

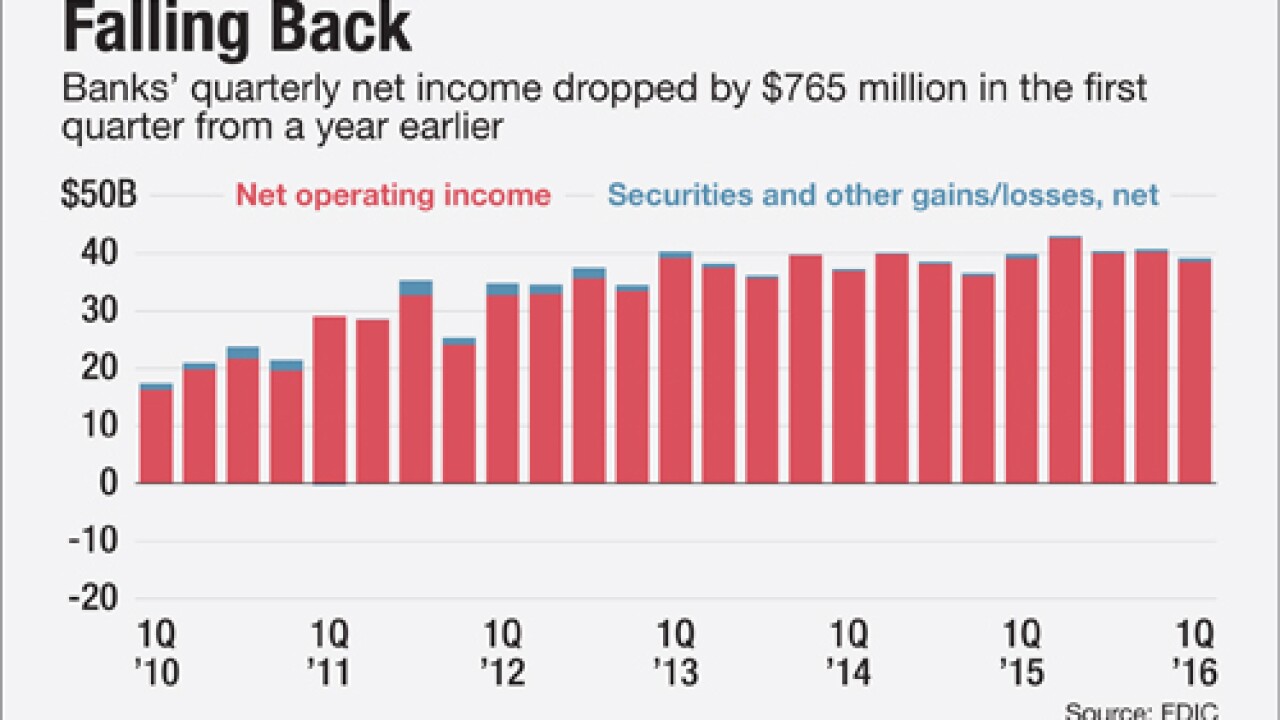

Bank earnings fell by 2% in the first quarter, mostly due to higher loan loss provisions because of troubles in the energy sector. But there were other alarming signs and some positive ones in the FDIC's Quarterly Banking Profile report. Following are the most significant:

June 2 -

The Federal Deposit Insurance Corp. has reached a $190 million settlement with eight large financial institutions over residential mortgage-backed securities claims as the receiver of five banks that failed during the crisis.

June 2