-

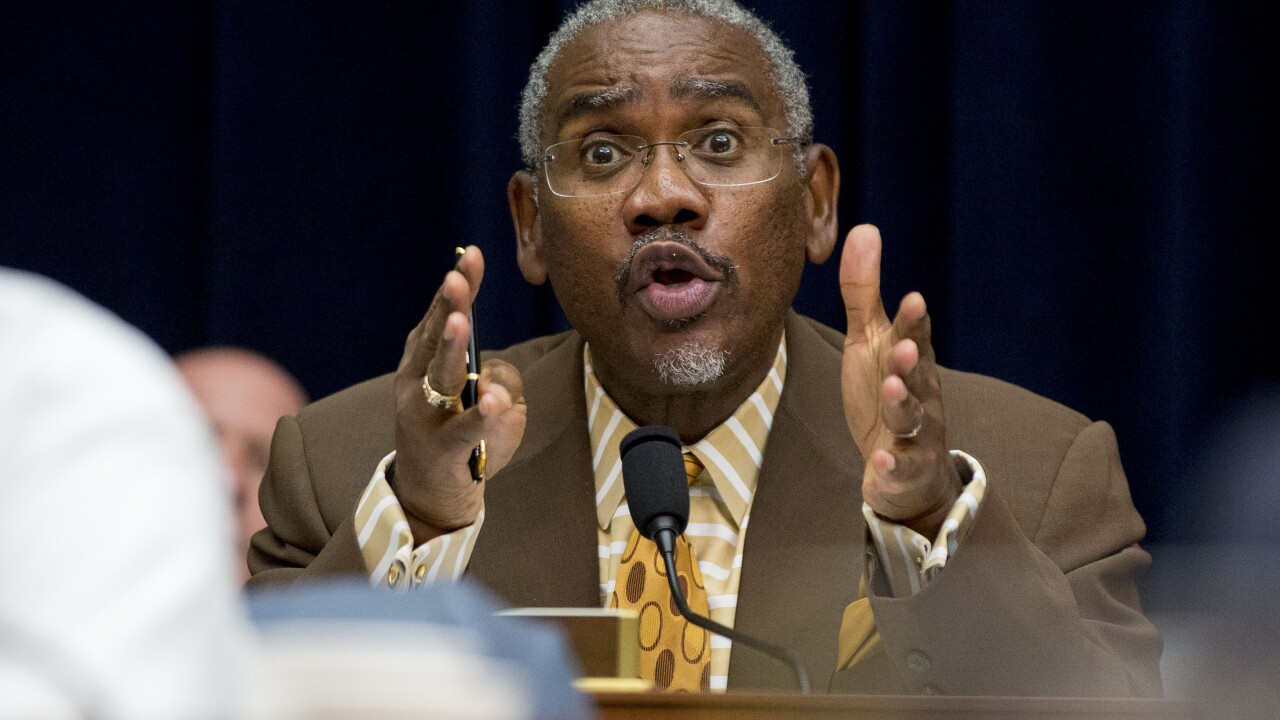

In his first of two Capitol Hill hearings this week, Democrats hammered the acting director of the Consumer Financial Protection Bureau for ignoring what they view as the agency's core purpose.

April 11 -

House Speaker Paul Ryan's decision not to seek re-election is another sign of the difficulties Republicans will likely face in holding the chamber in November, heightening pressure to move a pending regulatory relief bill as soon as possible.

April 11 -

House Speaker Paul Ryan's decision not to seek re-election is another sign of the difficulties Republicans will likely face holding the chamber in November, heightening pressure to move a pending regulatory relief bill as soon as possible.

April 11 -

Critics argue that Community Reinvestment Act standards need to be more transparent, but creating more objective measures would require regulators to favor some types of loans over others.

April 11

-

After FinCEN issued its final BSA rule, the NCUA plans to address requirements about ongoing customer due diligence.

April 11 -

The Consumer Financial Protection Bureau on Wednesday asked for public input on the way it receives and processes complaints from consumers in what the agency said was a preliminary step toward making improvements.

April 11 -

The Seattle bank's improved loan yields offset higher expenses tied to Bank Secrecy Act remediation. Washington Federal had to delay a pending acquisition after issues emerged with its anti-money-laundering compliance.

April 11 -

The acting director wants to gut the agency, which would harm both consumers and entrepreneurs.

April 11 Small Business Majority

Small Business Majority -

Both national credit union trade associations submitted letters in advance of CFPB acting director Mick Mulvaney's House Financial Services Committee hearing.

April 11 -

Proposal would lower capital requirements for some, raise them for others; Mulvaney says enforcement division will continue to police lending discrimination.

April 11