-

While the New York bank has a handle on deposit pricing, Joseph DePaolo said a new accounting standard will play tricks with how it addresses credit quality.

January 21 -

The OCC said Citigroup's main bank subsidiary violated the Flood Disaster Protection Act by not ensuring that borrowers with homes in flood hazard areas had insurance coverage.

January 21 -

Director Kathy Kraninger has told lawmakers that the agency will delay the expiration of the so-called QM patch, now set for January 2021.

January 21 -

The body will include the Bank of England, Bank of Canada, the Bank of Japan and the European Central Bank, but not the Federal Reserve or the People's Bank of China.

January 21 -

Banks in the U.S. should take note of these requirements before opening their systems to third-party developers.

January 21 Regions Bank

Regions Bank -

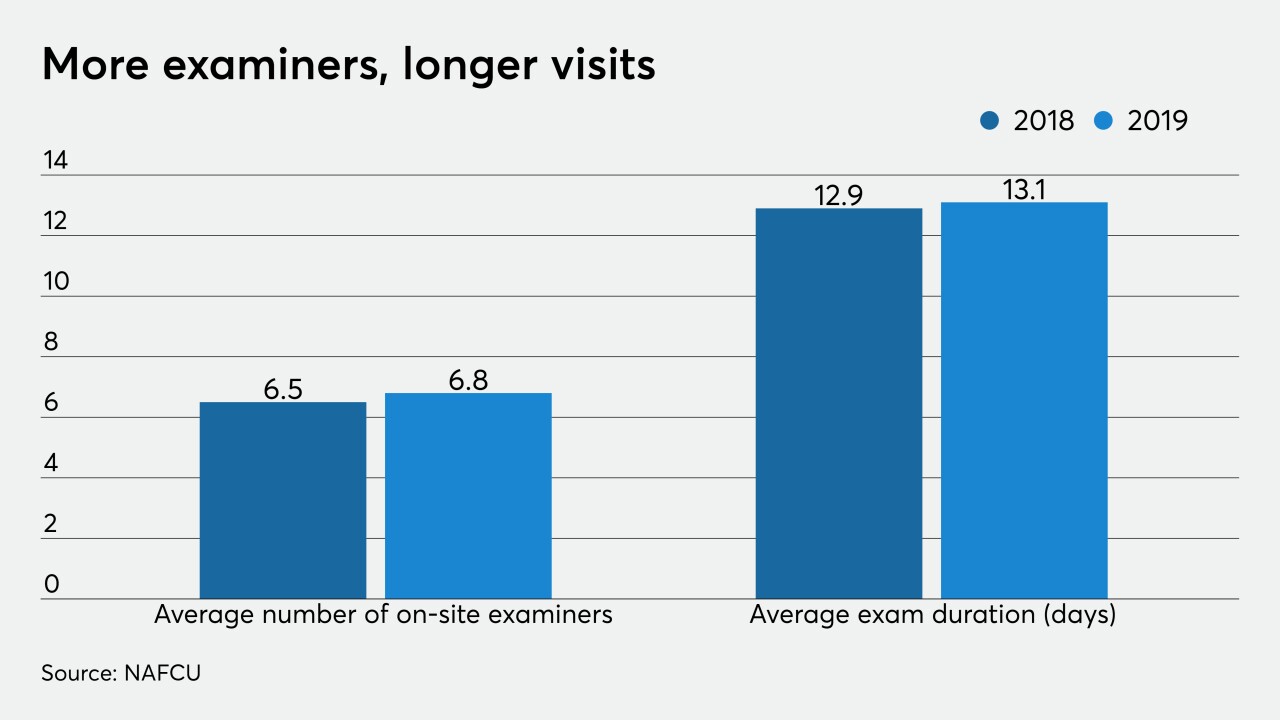

The National Credit Union Administration promised qualified credit unions under $1 billion in assets would be on an 18-month exam timeline by the end of 2019. A recent report says that hasn't happened.

January 21 -

Last week, Indian regulators ordered an antitrust probe of Walmart and Amazon while Jeff Bezos and other Amazon execs traveled to New Delhi to tout a $1 billion investment to digitize local businesses. The message is U.S. investment is welcome, as long as U.S.-driven data mining is kept at bay.

January 20 -

Truist emphasizes high-touch, high-tech focus with new logo; Wells Fargo loses another patent lawsuit to USAA; what the Visa-Plaid merger means for banks, fintechs; and more from this week's most-read stories.

January 17 -

The central bank’s top regulatory official laid out a comprehensive set of proposals to update how the agency supervises banks — particularly large institutions — with an eye toward improving transparency.

January 17 -

The agency issued a fair housing proposal last month that would perpetuate segregation and make it harder to detect discrimination.

January 17 George Washington University

George Washington University