-

H&R Block said it received regulatory approval to sell its bank unit to BofI Federal Bank and expects to exit Federal Reserve oversight.

August 5 -

Federal Deposit Insurance Corp. Vice Chairman Thomas Hoenig on Tuesday reiterated his plan for banks that stick to "traditional" banking models and maintain high capital ratios to receive eased regulatory requirements, but added an extra incentive to the mix.

August 4 -

NCR Corp. said the U.S. Securities and Exchange Commission doesn't intend to recommend enforcement action against the company over 2012 allegations of foreign business violations.

August 4 -

Disclosure of confidential client information by the lead counsel for a group of merchants "fatally tainted" a 2013 settlement with American Express, a federal judge ruled Tuesday, auguring poorly for a similar settlement with Visa and MasterCard.

August 4 -

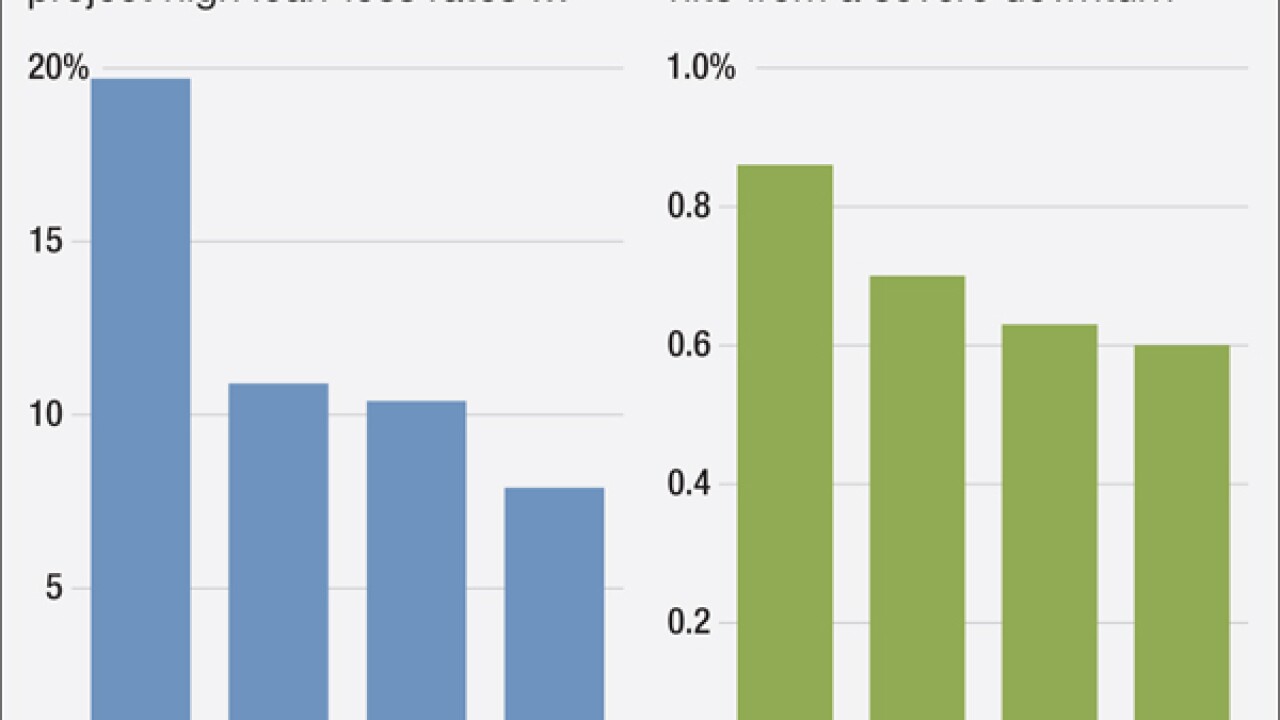

The first stress tests for regional banks show loan losses closely in line with the postcrisis period. However, an independent analysis suggests losses likely would be even higher.

August 4 -

JPMorgan Chase is the bank most integral to the stability of the global financial system, followed by HSBC and Citigroup, according to a U.S. study.

August 4 -

The Consumer Financial Protection Bureau has filed a lawsuit in federal court against a web of payday lending companies, alleging that they collected money that consumers did not owe and falsely threatened consumers with lawsuits and imprisonment.

August 4 -

Four Oaks Bank & Trust in Four Oaks, N.C., said its May 2011 enforcement action has been replaced with a more lenient agreement that requires it to address governance issues and other matters.

August 4 -

It's been nearly a century since reformers and lenders agreed on 36% as a small-dollar loan ceiling. Inflation has since swelled production costs, and lending under this cap is no longer profitable. The result: fewer options for consumers.

August 4

-

Many online small-business lenders worry that future regulations could stymie innovation in this fast-growing industry. But well-designed requirements would simply ensure that online lenders can offer adequate borrower protections without giving up market share.

August 4