-

Six regional banks have reported their stress-test results under Dodd-Frank for the first time, projecting Tier 1 common equity ratios ranging from 8.04% to 11.4% after an economic shock. However, several also projected multimillion-dollar losses during the stressful period.

June 16 -

Banks with assets totaling between $10 billion and $50 billion have begun publishing the results of their Dodd-Frank Act mandated stress tests this week and will continue to do so through the end of the month, providing a new window into the workings of regional institutions.

June 16 -

No bank has fully disclosed what it spends on the Federal Reserve's Comprehensive Capital Analysis and Review, in part because the figure is hard to isolate. It's a key piece of information missing in the debate over banks' regulatory burden.

May 18 -

The Federal Reserve and JPMorgan Chase were far apart last week in how much revenue the company would be making after the kind of economic shock envisioned in the Dodd-Frank stress test. The gap has JPM observers cautiously awaiting the results of this week's CCAR test.

March 9 -

The paper by a consultant with the Office of Financial Research said that projected losses in the 2013 and 2014 tests were "nearly perfectly correlated," suggesting that the tests have become "less informative."

March 3

Midsize banks may have gotten a little safer but not much since the financial crisis, to judge from their first round of stress tests.

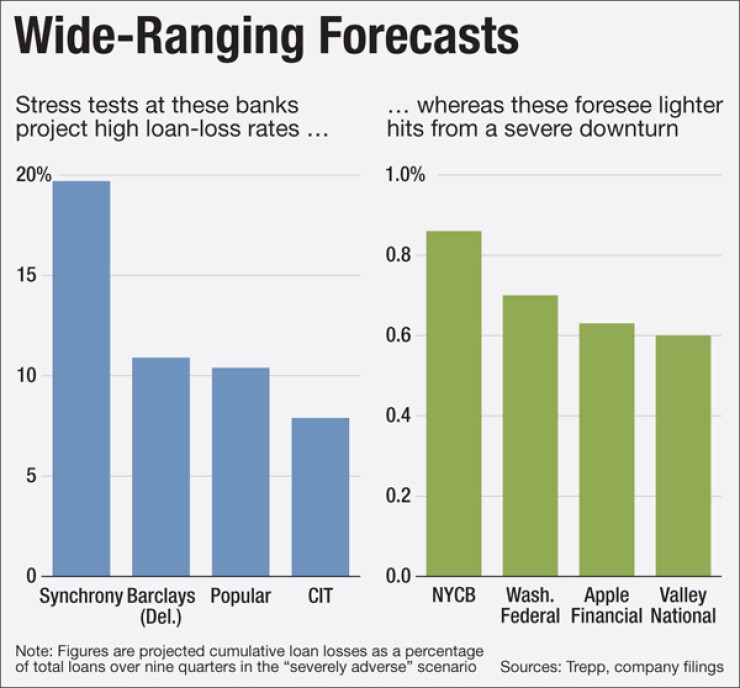

The 59 regional banks that reported their stress-test results for the first time this June showed a wide range of risk profiles, from a handful that said a severe recession would produce hardly any loan losses to some that forecast losses in the double digits.

Taken as a whole, though, the results line up very closely with what happened the last time the economy tanked.

The average projected loan losses in case of a severe downturn were 2.6% of total loans, according to the consultancy Trepp.

That was compared to losses of 2.7% of total loans during the last downturn, according to Trepp, which got that figure using the worst nine-quarter stretch of losses from 2008 through 2012 for each bank between $10 billion and $50 billion in assets.

In the test, the Federal Reserve asks banks to tally projected losses over nine quarters in what it calls the "severely adverse scenario," which mirrors the Great Recession.

Though all of the banks that filed in June projected enough capital to weather a downturn, their loss estimates may have been a bit low, said Trepp managing director Matthew Anderson. His consultancy's own estimate for regionals' average loan losses was 4.1% of total loans.

For banks just starting to conduct stress tests, "there's an inclination to focus on the results themselves and to be concerned about having the strongest possible capital ratios that they could have," he said.

Over time, that focus is likely to change, he said.

"I would not be surprised to see some movement toward higher projected losses" as banks refine their models, he said. "Banks with more experience or maturity in the process use it to think about risk exposures up and down the bank" rather than worrying about projected losses, Anderson said.

Stress testing at regional banks is still in its infancy, and the results show it, experts say. This year was the first that banks with assets between $10 billion and $50 billion were subject to the Dodd-Frank Act Stress Tests, or DFAST, process.

The reports showed wide differences in every aspect including thoroughness of the reports, which risks were tested, the depth of supplementary disclosures, and the results themselves.

Estimated losses at midsize banks ranged from Valley National Bancorp's 0.60% of total loans to Synchrony Bank's 19.70%, according to Trepp.

The estimates followed familiar patterns. Banks with high concentrations of consumer loans fared the worst in the tests, with average losses of 10.90%. Banks with residential mortgage concentrations showed the lowest losses, at 1.2%, and those with commercial concentrations had average losses of 2.5%, Trepp said.

However, observers warn against attaching too much importance to the specific loss estimates. There was no uniform process for these stress tests, so the reports show little about banks' riskiness relative to one another, said Anna Krayn, head of stress testing for Moody's Analytics.

"The results are not really comparable from bank to bank," she said. "From the way the banks interpret the Fed's scenarios for their specific portfolios to the way they model, there are dramatic differences."

This diversity is not a flaw the Fed set up the regionals' stress-testing regime that way on purpose. Unlike the stress-testing process for the biggest banks, midsize banks run their own tests, using their own methodologies tailored to their particular risks. The idea was not to overburden these smaller banks and to account for the fact that their operations differ quite a bit from each other's.

The Fed does not approve those models, beyond a relatively limited set of requirements. In a June press release, the regulator said the results "are not intended to be forecasts or expected outcomes."

Also, banks cannot fail the DFAST tests. Banks above $50 billion have to run in-house tests but are also subject to much tougher exams, with serious consequences for failing.

It is typical for tests run by banks themselves to produce stronger results than tests run outside the bank, Anderson said. Banks subject to the Fed's Comprehensive Capital Analysis and Review process estimated average losses of 3.9% in a downturn, while the Fed estimated losses of 5%, Trepp said.

In this first round of testing, banks can benefit from looking at which factors other lenders considered in their reports, Anderson said.

All of the regional banks discussed credit risk and there the unanimity ended. A majority looked at operations, liquidity, market and interest rate risks, Trepp said. A small bunch of thorough stress-testers also discussed their legal, compliance and reputational risks.

Regional banks "tend to be operating in a vacuum" when it comes to preparing their stress tests, and the reports let them see how other banks are doing it, Anderson said.

"I think this is a very valuable exercise to see what other banks are reporting, especially other banks that they consider a peer," he said.

The range of stresses considered suggests that, in these early stages, banks get out of the process what they put into it, Krayn said. Some banks may be tempted to treat DFAST as simply a regulatory box to check, or an opportunity to tout their resiliency with less-than-rigorous loss models.

But the banks that fully commit themselves to the project have benefited, Krayn said. "We're seeing an elevation of the risk-management conversation at the smaller banks," she said.

The tests do not yet give us a broad, rigorous picture of regionals' risk profiles, but that is far too much to ask for the first go-round, she said. The reports may be a hodgepodge now, but they will likely improve, just like they did at the largest banks.

"I think it's too early to criticize. We're in the nascent stages of stress testing for the industry, even for the larger banks," Krayn said. "For the smaller banks, the infrastructure is still so young that it's hard to see fruits of the labor just yet."