-

The agency rolled out nearly a dozen policy changes, proposals and requests for comment, including an advance notice of proposed rulemaking on brokered funding.

December 18 -

The move is sure to draw criticism from bankers because it would allow credit unions to compete for backing from private investors.

December 18 -

A U.S. District judge in Scranton denied the student lender's motion to dismiss the suit.

December 18 -

A former senior staffer at the Federal Deposit Insurance Corp. was found guilty of embezzling confidential information about banks from the agency before she left her post, and could face up to 20 years in prison.

December 18 -

The objectives of a Financial Crimes Enforcement Network rule requiring financial institutions to collect “beneficial ownership” details are laudable, but the regulation can be subverted by unscrupulous customers.

December 18

-

The two institutions had to change their names after a law passed in the Hawkeye State that forbid CUs from using a state university in their names.

December 18 -

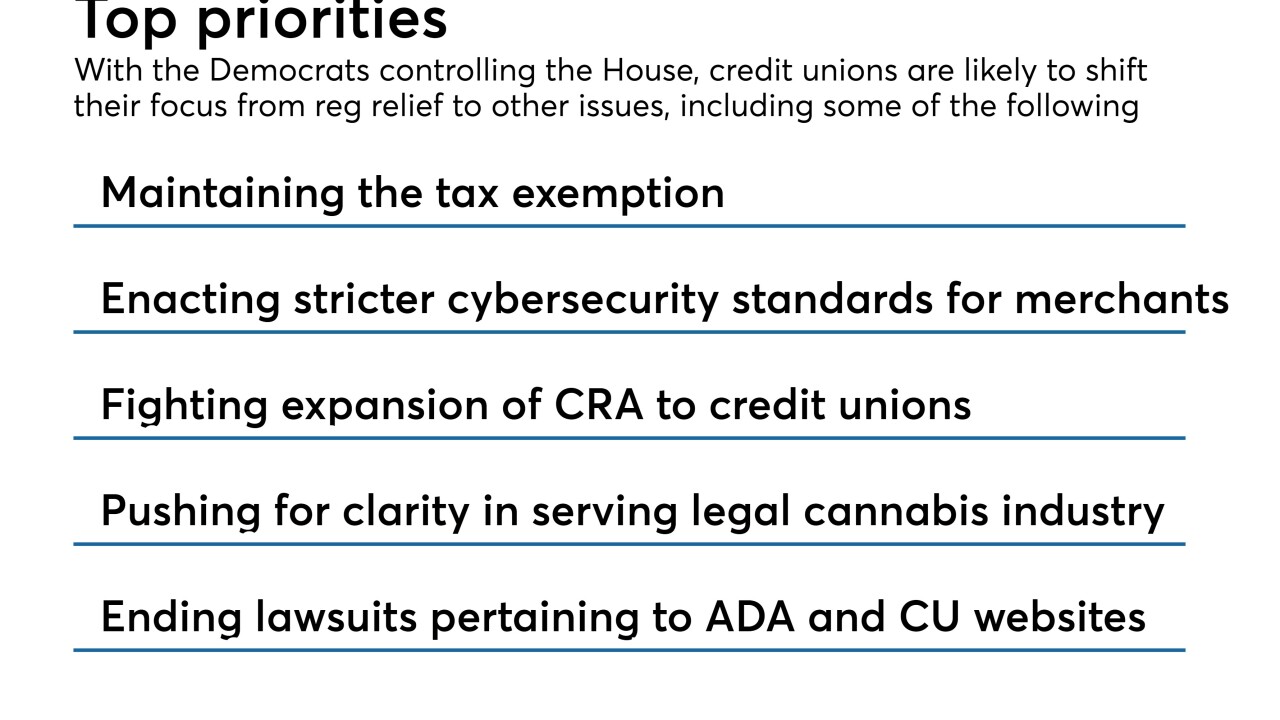

With control of the House changing hands in January, credit unions are set to shift their focus from regulatory relief to cybersecurity and fighting CRA.

December 18 -

A proposal allowing more lenders to skip outside appraisals could remove a hurdle to quick closings, but appraisers say they could be collateral damage.

December 17 -

The tech giants, along with Apple, PayPal and others, are calling on the Federal Reserve to build a backbone for real-time payments, rejecting large banks’ claims that the task is best left to the private sector.

December 17 -

The current deputy secretary of the Department of Housing and Urban Development, Pam Patenaude, will step down in January.

December 17