-

The Dallas regional is placing deposits in several minority depository institutions, providing each with low-cost funds that can be redeployed in underserved communities.

August 19 -

The company has now filed three lawsuits in its bid to recoup nearly $900 million it inadvertently sent to the cosmetic company's creditors.

August 19 -

The Office of the Comptroller of the Currency is overstepping its authority in granting charters to fintechs and other companies that don’t take deposits.

August 19 Conference of State Bank Supervisors

Conference of State Bank Supervisors -

With big banks largely shunning the program, small banks see an opening to grab more market share in commercial lending.

August 19 -

The Consumer Financial Protection Bureau says the proposal would increase access to credit, but consumer groups argue that it will encourage lenders to make high-cost loans while protecting them from legal liability.

August 19 -

The Japanese conglomerate first applied for deposit insurance in July 2019 and again in May 2020.

August 18 -

The Consumer Financial Protection Bureau says the proposal would increase access to credit, but consumer groups argue that it will encourage lenders to make high-cost loans while protecting them from legal liability.

August 18 -

Under the agreement, fintechs and their bank partners will have a safe legal harbor to offer loans, as long as their interest rates do not exceed 36% and they meet various other standards.

August 18 -

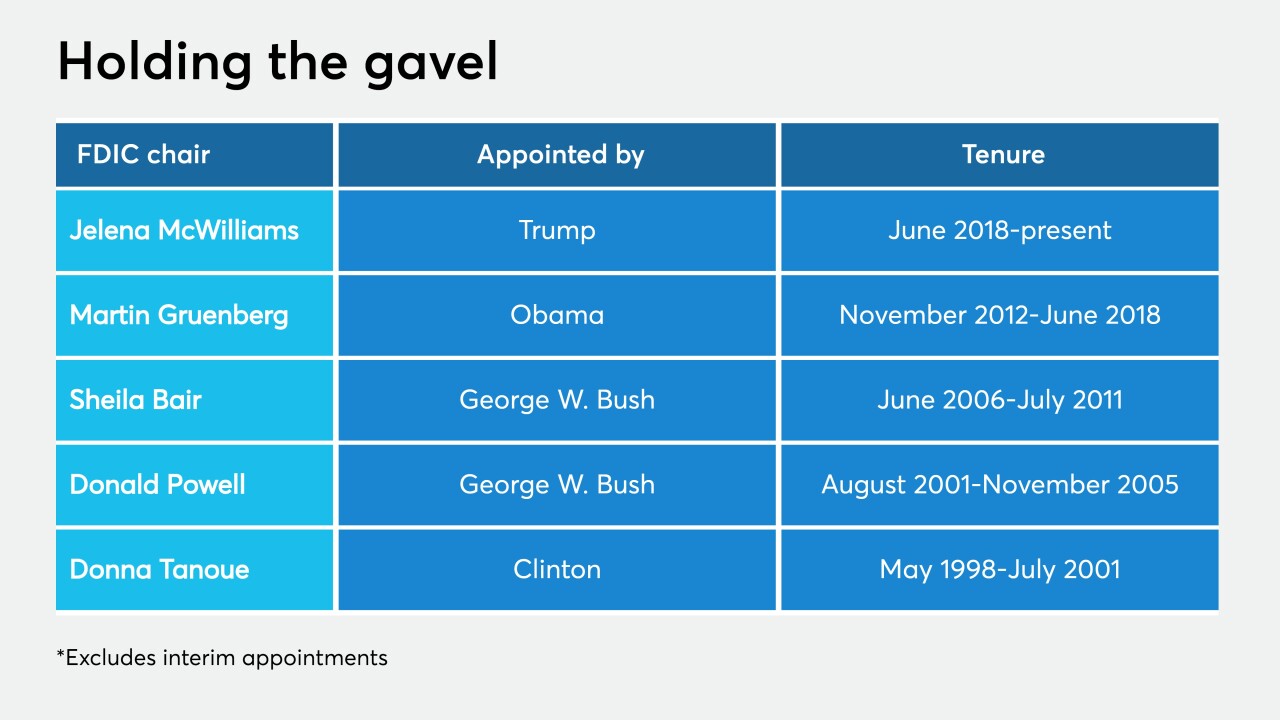

Jelena McWilliams's term as FDIC chair expires in 2023, and she cannot be removed by an incoming president. But if Joe Biden prevails, he may ask her to stay — and if she does, governing a Democratic-majority board would be a very different proposition.

August 18 -

A proposal to expand consumer protections in the state was added to a budget bill after being dropped in June. Financial institutions say the measure conflicts with federal law and are working behind the scenes to stop it.

August 18