-

The vote Friday was a victory for consumer advocacy groups that have been pushing for years to rein in lenders that charge triple-digit rates.

September 13 -

The Banking Committee chairman's comments have advanced legislative efforts, but questions remain about where he'll take the issue.

September 13 -

The FDIC's latest report on deposit market share shows the nation's seven biggest banks flexing their muscles, while smaller banks' market share gets smaller.

September 13 -

The Pittsburgh company is not interested in bank acquisitions, CEO Demchak says; why Citi, Wells, JPMorgan are seeing a spike in API calls; FHFA's Mark Calabria details next steps on GSE reform; and more from this week's most-read stories.

September 13 -

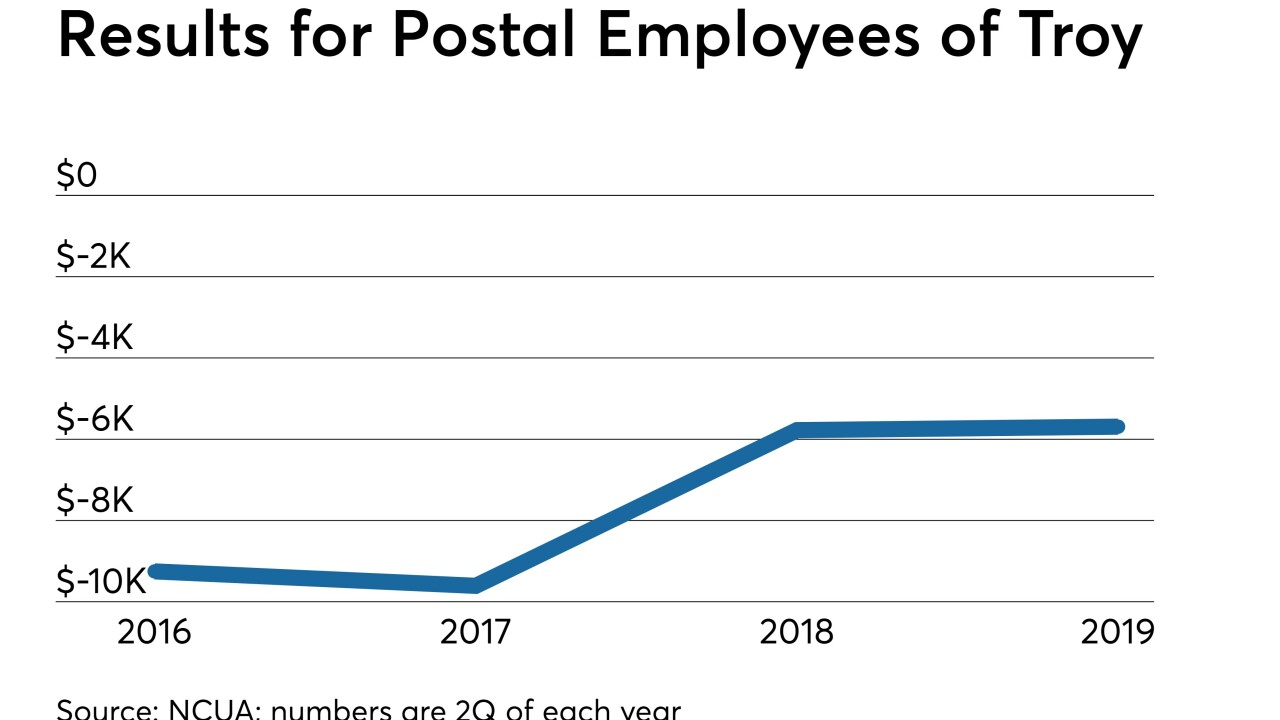

Members of Postal Employees of Troy, N.Y. Federal Credit Union approved the transaction earlier this week.

September 13 -

The Federal Housing Finance Agency is revising the multifamily loan purchase caps for the mortgage giants Fannie Mae and Freddie Mac to increase affordable housing.

September 13 -

From marijuana to member business lending, a look at policymakers and others' perspectives on key issues affecting the industry.

September 13 -

Readers react to the Trump administration's release of a housing finance reform plan, a proposal by HUD to redefine "disparate impact" and a challenger bank's claims that it can end bank fees for good.

September 12 -

The CEOs of Sallie Mae and Discover Financial Services were largely dismissive this week of the threat posed by the two Democratic presidential candidates, though their optimism seemed to be rooted in an assumption that the more sweeping proposals will never become law.

September 12 -

The lawmakers, including Sens. Sherrod Brown and Elizabeth Warren, sent the bank a letter focusing on customers' difficulty enrolling in credit monitoring and identity protection services.

September 12